Bitcoin Cryptocurrency review

Bitcoin is the first cryptocurrency that became "digital gold". It's a payment system that operates independently of neither its creator, nor states, or global corporations. While making transfers in Bitcoin, you can remain anonymous. The system is supported by thousands of computers in different countries, which makes it reliable and secure.

After reading the article, you will learn the history of Bitcoin and understand what its advantages are. Also, the article considers the prospects of the main cryptocurrency and describes a convenient way to buy it which is available even for the beginners in the market.

The history of Bitcoin

In 2008, a text file was published, which described the principles of decentralized protocol that could become a reliable and independent payment system, independent of anyone. The author of the text was named Satoshi Nakamoto. So far, nobody knows who was hiding under this pseudonym. Perhaps it was one person, or maybe it was a whole team of experienced and skilled programmers.

His profile states that Satoshi Nakamoto was born on April 5, 1975, and resides in Japan. However, Bitcoin-related documents are written in professional English. Therefore, researchers believe that the creator of the protocol lived most of his life in an English-speaking country.

Further events turned out as follows:

- The Bitcoin network was launched on January 3, 2009;

- On January 9, 2009, Bitcoin Core program was released - it could be used to mine BTC coins and send them to the other users;

- The first-ever cryptocurrency transaction was carried out on January 12, 2009 - Satoshi Nakamoto sent 10 Bitcoins to the address of one of the developers helping him;

- On October 5, 2009, the first website for exchanging BTC into common money was launched, and the rate was so low, that you could buy about 1600 BTC for $1 (now the amount of those coins is worth of $64 000 000);

- The first purchase with the use of Bitcoins was made on May 22, 2010 - a programmer from America bought a pizza for 10,000 BTC, and the seller agreed to accept the cryptocurrency as a payment;

- On December 16, 2010, Bitcoin creator Satoshi Nakamoto made the last changes to the code of his brainchild, and disappeared forever.

By the time he left, Satoshi Nakamoto had managed to mine 1 million Bitcoins. To this day, however, crypto enthusiasts send their coins to his address to express their gratitude for creating the protocol.

Where do new Bitcoins come from?

The process of extracting cryptocurrency is called mining. It involves running a special program on computer hardware that performs the calculations necessary for the entire network to function. People who mine Bitcoins or other cryptocurrency are called miners.

The protocol is designed so that anyone can take part in supporting its work. You can install the appropriate program on almost any computer. After that, it will become a "node" in the network. Thanks to the ease of connection to the network, its functionality is now supported by tens of thousands of computers around the world. This ensures the reliability of the entire system.

Miners that connect to the network receive rewards in Bitcoins. This is built into the code of the protocol. There is no other way to "print" new coins. The only way to get them is by mining.

Unfortunately, anyone can no longer make money by mining. The more computing power connected to the network - the fewer asiBitcoins each miner gets. The reason is obvious: the amount of BTC mined during a certain time interval is always equal.

That's why it became unprofitable to mine on usual computers a long time ago. ASIC mainers, also called "asics", are used nowadays for Bitcoin mining - special devices, customized for particular operations.

However, even the most effective "asics" have a payback period of months or even years. However, they cost at least 50,000 rubles per device. There is no need for a person who wishes to invest in Bitcoin to master mining, since one can simply buy the coins already mined by the miners. How to do this is described at the end of the article.

Bitcoin emission

The maximum number of Bitcoins that can exist is 21 million coins. Almost 19 million coins have been mined now. The rest will be mined in the future. When miners get the remaining 2 million coins, the creation of new Bitcoins will become impossible. However, this won't happen until the 2130s.

The fact is Bitcoin mining speed halves every 4 years. This procedure is called halving:

- since the launch of the network, every 10 minutes miners mined 50 BTC;

- in 2012, this number decreased to 25 BTC;

- since September 2016, miners were mining 12.5 BTC every 10 minutes;

- The last halving took place in 2020, and since then miners mined only 6.25 BTC every 10 minutes.

Thus, the number of new Bitcoins entering circulation regularly decreases. This makes the asset deflationary. That is, the number of available Bitcoins will only decrease over time. Some will be lost, and some will remain in the wallets of deceased people, and so on.

This is why Bitcoin is compared to gold. The reserves of this metal on the planet are limited, and there is no way to get more gold than is hidden in the Earth's depths. It's the same with Bitcoins - there won't be more than 21 million coins.

We can also draw an analogy with classic fiat currencies - that's what the rubles, dollars, euros and other currencies issued by the states are called. They can be printed as much as you want, which makes the asset inflationary. That is, the value (purchasing power) of each particular dollar is constantly falling over time. Bitcoin, on the other hand, only grows in value as there are fewer coins, not more.

How Bitcoin is built

Bitcoin is a distributed data ledger. It's based on a chain of blocks. Every 10 minutes, a new block is attached to the chain, which contains information about all the transactions made during those 10 minutes. Once a block is added to the chain, its contents cannot be changed.

Thus, all transactions performed on the network are irreversible. You can't interfere with the system and make changes to the chain retroactively. And the chain of Bitcoin blocks is called a blockchain.

All transactions can be reviewed by anyone - this is open information that cannot be hidden. However, the only things you can see in the blockchain are:

- the sender's wallet address;

- the transfer amount;

- the recipient's wallet address.

Wallet addresses are not tied to identities, so you can only find out who owns the address if the owner of the address publishes the relevant information himself, or in case the owner is careless enough to make it clear that the wallet belongs to him.

Bitcoin development

It's wrong to think that the Bitcoin protocol is not changing and being updated. Satoshi Nakamoto left it up to independent developers to supplement and improve the blockchain. Since Bitcoin's source code is open and freely available, anyone can make improvements to it.

Bitcoin updates are called hard forks. To modify the code, you need to:

- enlist the support of the community - tell about your development in advance on thematic forums, where crypto enthusiasts interact;

- propose the update for adoption, in other words - put it to a vote;

- to get approval of at least 50.1% of miners.

Voting for acceptance or rejection of the update can be done by users whose capacities support the network. When more than half of the miners show their willingness to accept the update, it will be automatically incorporated into the code.

Due to the complexity of the procedure, the protocol is updated very rarely. Maybe it's for the best, though - only truly useful innovations that improve the network's performance are implemented.

Bitcoin Forks

In addition to Bitcoin itself, there are other cryptocurrencies based on it. They are called forks. Anyone can create their own fork by taking the source code of Bitcoin and launching a new cryptocurrency based on it. However, its value will be zero without community support, so simply launching a new coin will be pointless.

However, there are successful forks that are valuable and popular, for example:

- Bitcoin Cash (BCH);

- Bitcoin Gold (BTG);

- Bitcoin Diamond (BCD).

Some forks like Bitcoin Cash emerged as a result of the Bitcoin enthusiast community splitting into two camps. During the regular update, some of the miners decided to separate from the majority and continued to support the old version of the blockchain. As a result, there was an updated Bitcoin, and its fork without the implemented Bitcoin Cash update.

For newcomers to the market, experts recommend paying attention only to the original Bitcoin. It's the main cryptocurrency asset, which is "digital gold," and which will be valued for years to come. But the future of forks is more difficult to predict, so the beginners should not invest in them.

Benefits of Bitcoin

The main purpose of Bitcoin, according to its creator Satoshi Nakamoto, is to provide absolutely everyone with the ability to freely use the new payment system. It seems to be fulfilled - just like a decade ago, you can send and receive Bitcoins, remaining anonymous and located anywhere in the world.

The advantages of Bitcoin are:

- Reliability. Each computer involved in the blockchain stores a full hollow copy of the entire blockchain. And there are tens of thousands, if not hundreds, of such computers. To break into the network, you have to hack all of these computers at once to make changes to them in sync. It's impossible, as Bitcoin's history proves. The protocol has never been hacked since 2009.

- Ease of use. Anyone can install a wallet on their smartphone or PC to receive or send transfers. BTC is divided up to 8 digits after the decimal point. I.e. transaction amount is not necessary to be in whole Bitcoins - you can transfer from 0.00000001 BTC.

- Low commission. It doesn't depend on transaction amount, but depends on network load at the moment. For example, it's possible to send $1,000,000 in Bitcoins to someone from another country, paying just $20 for that (commission will also be charged in Bitcoins and will be sent to wallets of miners, whose computing power is used to confirm your transfer). Moreover, if you need to perform the transaction as soon as possible - you can increase the amount of commission for miners, so that the priority of your transfer will increase, and then it will "overtake" other transactions in the queue.

- High speed. Bitcoin transactions are faster than international interbank SWIFT transfers. The standard waiting time to complete a transfer is about 20 minutes.

- Independence. Bitcoin's blockchain is truly independent. Neither major corporations nor state governments can disrupt its operation. The network exists everywhere at once, and nowhere in particular. Even if some country bans cryptocurrency, and users living there disconnect from the network - the blockchain's functionality will not be affected, and people's wallets and the cryptocurrency in them will not disappear.

- Total freedom. An advantage derived from the previous point. No one can control your funds. Only you decide where, to whom, and when to send them. Once you start using cryptocurrencies, you will be able to refuse the services of banking institutions.

At the same time, Bitcoin has high liquidity, i.e. it can be easily exchanged for fiat currencies, be it rubles or dollars. In case cryptocurrency is completely banned in your country, there is nothing to stop you from going to another country and exchanging it for fiat currency there. You can also simply give access to your wallet to a trusted person who is abroad, so that he can do the necessary operations for you.

How Bitcoin is used

Cryptocurrency is an alternative means of payment. Suitable for those who cannot use traditional banking systems, or are unwilling to contact them for any reason. Common ways to use Bitcoin are:

- Sending funds to other people. The purpose can be anything, like transferring coins as a gift.

- Transferring funds to another country. Sending money using cryptocurrency is usually easier, faster, and cheaper than using the services of banks.

- Payment for goods and services. In Russia, it is prohibited to pay with cryptocurrencies (you can only exchange them and make gifts). However, in many other countries Bitcoins are used to pay in stores and restaurants, up to the outlets of big brands like KFC or Starbucks. Over time, the number of goods and services that can be purchased with cryptocurrency is constantly growing.

- Savings. As stated above, Bitcoin is a deflationary asset, the amount of which will decrease over time. Consequently, its value is expected to grow. So, it's suitable for savings.

- Investing to make a profit. Many market participants buy Bitcoins in order to sell them at a higher price.

Thus, Bitcoin is an alternative to traditional banking systems, and surpasses them in many ways. Significant disadvantages include only the throughput of the first cryptocurrency. Right now, it is 3 to 6 transactions per second, which is nothing compared to the throughput of systems like Visa, which may process tens of thousands of transactions per second. However, Bitcoin developers are creating various solutions to this problem, so we can expect it to be eliminated in the future.

Bitcoin is convenient both for ordinary people and for entrepreneurs. Today, they can settle accounts with suppliers from other countries almost instantly and independently of banks. Moreover, a transaction in BTC is irreversible, so businessmen are protected from the risk of fraudulent chargebacks that exist with traditional financial systems.

How to store Bitcoins

Many wallets have been developed for Bitcoin for different systems. Here are some of them:

- For Windows - Wasabi, BitPay;

- For MacOS - Knots;

- For Linux - Bitcoin Core, Electrum;

- for Android - Trust Walet, Bither;

- for PC browser - MetaMask.

Additionally, there are hardware wallets that are considered more reliable than software wallets. For example, Ledger or Trezor. They look like a flash drive, and are connected to the owner's device and the Internet only when any cryptocurrency transaction needs to be made.

You don't have to understand how wallets work, though. You can use a solution like Broex. In this case, the company will be responsible for storing your cryptocurrencies, and you will have access to them through your personal account. For beginners who are afraid of making a mistake and losing money, this option will be optimal. Read more about Broex wallet at the end of the article.

How Bitcoin price changed

Initially the price of BTC was measured in 10 thousandths of dollars. But in 2010 the price of 1 BTC reached $0.5, and in 2011 it was $10. Later the price seemed to grow almost every year. Even if the value was falling after a strong peak, sooner or later the price not only returned to its previous value, but even surpassed it.

For example, the lucky people who managed to invest in Bitcoin in 2018 at $3600 per coin could sell it for over $60,000 just 3 years later. In this case, they would increase their investment by 16 times or more.

Everyone who is willing to wait for the next cryptocurrency price peak will have an opportunity to increase their deposit. However, the further it goes, the slower the value will grow. If now we can still count on a 10-fold increase in price, then, for example, in 10 years, the value growth potential will be much less.

It's important to keep in mind that a deflationary asset like Bitcoin will always rise in value. Therefore, the main thing is not to catch a good time to buy, but to wait for a good time to sell.

Bitcoin Prospects

Just 5 years ago, Bitcoin wasn't all that popular, and fewer people were aware of it. But already now it is a full-fledged financial instrument:

- Bitcoin can be used to pay for goods and services, and it's absolutely legal ( though it depends on the country).

- El Salvador has adopted Bitcoin as its national currency. For the citizens of this country, Bitcoin is about the same as the ruble for us.

- The cryptocurrency market has become a major financial institution, existing almost on a par with the stock market.

- In the U.S. and some other countries, there are ATMs right in the streets, which are used to exchange fiat currencies for Bitcoin, and vice versa.

These are just many facts that make it clear that Bitcoin is being accepted as a convenient and useful tool by a growing number of people and states.

Besides, there are several factors proving that the Bitcoin price will grow in the long run:

- The constant inflation of fiat currencies. The more dollars are printed, the more the value of Bitcoins grows, and thus, in the long run, so does their price.

- Legalization in multiple countries. Over time, more and more countries will begin to regulate the cryptocurrency industry, which will positively affect the acceptance of Bitcoin, and help its price soar.

- Support for big business and media personalities. Celebrities like Elon Musk are talking about Bitcoin, and it's also being accepted as payment by the world's biggest brands.

Bitcoin Price Forecast for 2022-2023

At the moment, the main price point, breaking through which the participants of the crypto market expect, is $100,000 per coin. Most experts agree that this price will be reached by the end of 2022 or at the beginning of 2023.

However, not only growth to $100,000 is expected, but also the achievement of much higher price points. Some experts cite figures of around $150,000, while others say around $250,000.

One should bear in mind that it's impossible to accurately predict the price - it is influenced by a multitude of factors. However, even most public opponents of Bitcoin admit that sooner or later its price will reach $1,000,000 - the only question is when it will happen - in a couple of years, or in a decade.

Is it worth investing in Bitcoin

Unlike other cryptocurrencies, Bitcoin is considered a safe investment for a reason. The status of the main cryptocurrency was secured by the fact that Bitcoin was the first. Without it, the cryptosphere might not have started developing anytime soon. That's why a huge number of people around the world believe in Bitcoin. The more people learn about Bitcoin and invest in it, the faster it is growing in value.

Therefore, experts believe that Bitcoin will remain "digital gold" for a long time and will be valued for many years to come. So, investing in it will be the right decision for anyone who wants to multiply their funds.

An important thing to remember - there are still risks. Unlike physical gold, which has existed longer than people, Bitcoin's history is less than 15 years old. And whether it's worth investing in a new asset is up to you to decide. And our job is to help you buy Bitcoins, if you wish to do so.

How and where to buy Bitcoin

There are many ways to get your first Bitcoins. The most affordable is a simple purchase. BTC purchases are offered by:

- Large centralized platforms like Binance or Huobi. They allow you to buy and sell cryptocurrencies, and offer many additional functions and features. This is convenient for experienced market participants. However, for beginners, such platforms are not suitable. These platforms are difficult to deal with and easy to confuse, and the technical support is very reluctant to respond to user inquiries, as there are too many of them.

- Internet exchangers. There are many services, offering a convenient way to buy, exchange, or sell Bitcoins. Working with them is quite easy. The problem is that there are many fraudulent projects that deceive users. If you stumble on a fraudulent website, you are likely to lose your deposit, and will hardly be able to get it back, even through the court.

- Exchangers with a license. The best option for beginners. If the exchanger received a license, it means that it is 100% legal, and works according to the law. This makes it safe and secure.

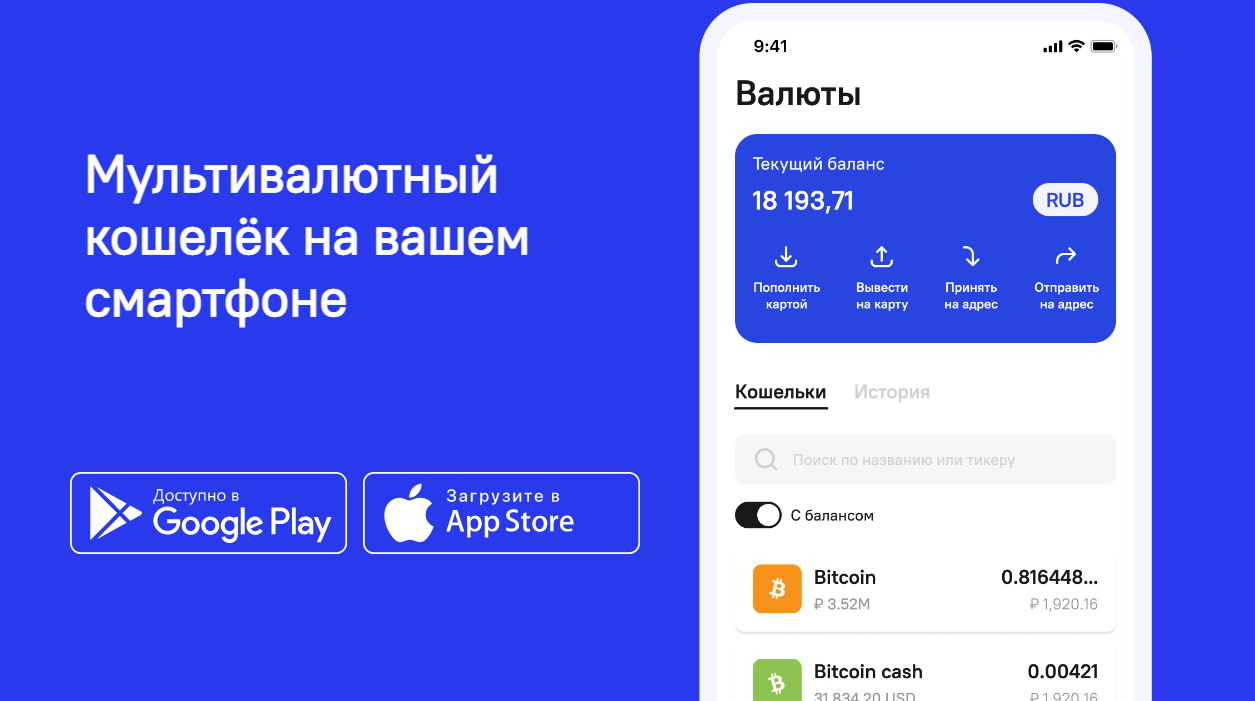

That's why Broex is recommended for beginners. The company has received an official license in Estonia, having passed all the inspections of the regulating state authorities. Therefore, it can legally provide help in buying and selling cryptocurrencies. So, when you make a deposit in your personal Broex cabinet, you won't have to worry about losing your money. Broex has many more advantages that deserve special attention.

Advantages of Broex

Broex is more than just an exchanger - it's also a custodial wallet. It means that with our help you can keep cryptocurrencies securely and easily. You don't have to download third-party wallets and figure out how to use them.

After you buy cryptocurrency, just leave it in your account. When you need to sell it or make another operation - go to the personal cabinet and make necessary actions. The decision to trust Broex with storing cryptocurrencies will save you from extra hassle, and also protect you from losing access to your assets, as it usually happens when using classic wallets.

Broex also has a mobile app for Android and iOS smartphones. Once you install it, you will be able to access your personal account from anywhere you have an internet connection.

Other advantages of the Broex exchanger and wallet include:

- Large selection of cryptocurrencies. Not only BTC, but also other popular cryptocurrencies such as ETH, XRP, DOGE are available for purchase. In total - more than 40 cryptocurrencies and more than 2000 digital tokens.

- 24/7 technical support. The team works around the clock and quickly responds to user requests. You won't have to wait long for an answer - most problems are solved in minutes. You can be confident that you'll get a consultation if there is any question.

- Low commissions. Buying and exchanging cryptocurrencies with Broex is more profitable than using many other exchangers. Commissions are from 0.1% per transaction, and in some cases there are no commissions at all.

- The minimum deposit is only 1500 rubles. This makes investing in Bitcoin and other cryptocurrencies accessible to everyone. You can start small and then buy up the assets you're interested in monthly, in installments.

- Instant deposit. You can deposit funds with a bank card or through AdvCash. The deposit will immediately show up in your personal cabinet, after which the money can be used to buy cryptocurrencies.

Register to get access to Broex exchanger and wallet. The procedure will only take a couple of minutes.