Digest 02 june 2022 — 09 june 2022

Project Events

Uniswap

Uniswap exceeds $1T in trade volume, yet 3.9M addresses have utilized it.

Zcash

Zcash's NU5 goes live, which means that transactions are now shielded by default. Privacy is one of the most important missing elements in most public blockchains. Since this trend has not yet fully played itself out, it is worth keeping an eye on the Secret Network, Obscuro, Zcash and Monero privacy coins.

Optimism

Optimism, an Ethereum scaling solution, has launched the first set of airdrops to its community. The protocol faced an overload in the first hours, but after that everyone was able to get their tokens. So far, only 40% of all available addresses have picked up their rewards, and the protocol is in the process of deciding how to penalize those who sold this reward immediately and proposes to delist them for the next giveaways.

Ropsten

Reorganization of 7 blocks, which took place last week on Ethereum's testnet, called Ropsten, did undermine investors' sentiment and trust. For now, however, the problem has been revealed and resolved, making a smooth transition of Ethereum to a Proof-of-Stake model much more likely in August.

Ethereum 2.0

The total number of ETH put on the Ethereum 2.0 contract keeps growing. Over 12,764M ETH has been staked by 398,000 unique validators. That's 10.73% of the circulating supply.

Goldman Sachs

A recent Goldman Sachs annual survey includes cryptocurrency for the first time and reveals that insurance companies are warming to crypto investments.

Gitcoin

The new round of Gitcoin grants runs from June 8 to June 23. Donations to projects submitted for the grant are frequently rewarded with tokens.

Solana

Solana's blockchain suffers a new network outage. This is becoming a hallmark of this blockchain. Is it a bug or a feature?

pSTAKE

pSTAKE has launched a liquid ETH staking. Users can now stake coins and receive stkETH, which can be used in other DeFi apps.

Terra

The new Terra network launched on May 28 and distributed the new LUNA token to coin holders of the old network. The token is currently traded at $6.32.

Move-to-earn game STEPN

Move-to-earn game STEPN announced users in China would effectively be barred from using it starting July 15. STEPN's in-game assets have plummeted hard in the wake of this news.

OpenSea

Former product manager at OpenSea indicted after insider trading scandal.

Highlights of the week

Events for the coming week

.jpg)

Funding

-

Venture fund a16z has raised $4.5B to invest in GameFi and metaverse projects.

-

Protocol to coordinate work tasks in the web3 Dework ecosystem has closed a $5M seed round.

-

Binance raises $500M for crypto investments.

-

Investment capital is coming in, indicating strong demand among large investors. A bear market is the best time for long-term investments.

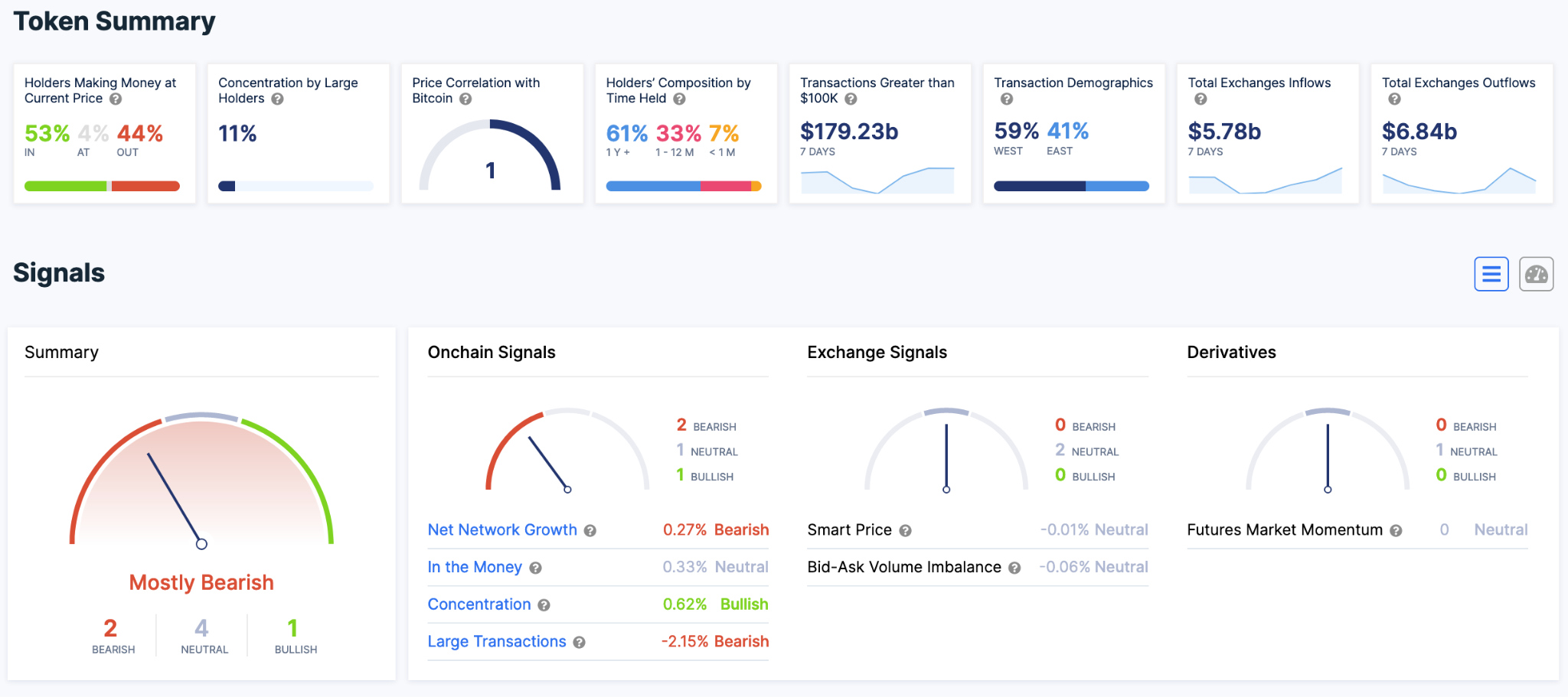

Metrics

10 effective coins of the week

Assessment combines altcoin price performance relative to bitcoin and social performance.

.jpg)

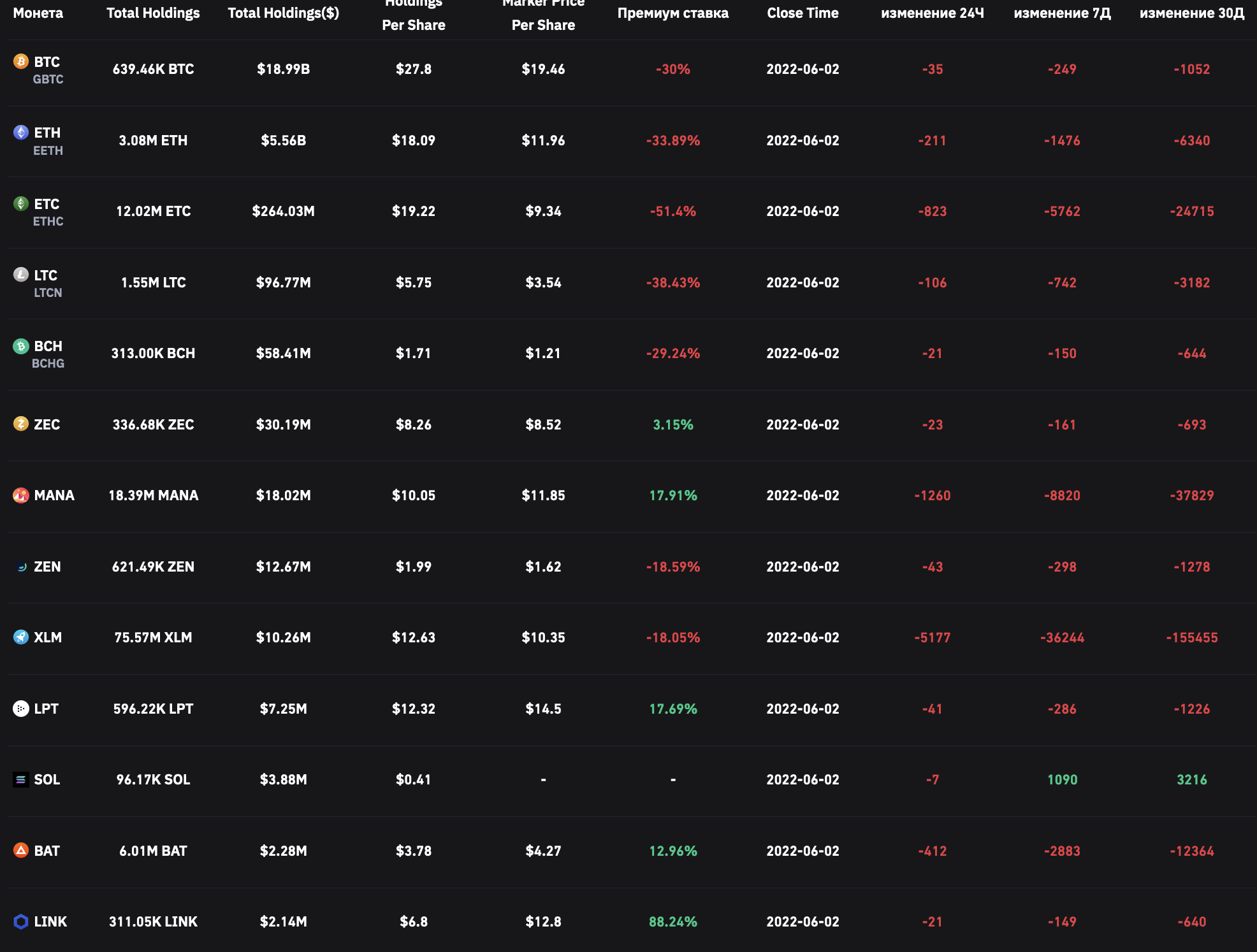

Grayscale fund portfolio dynamics

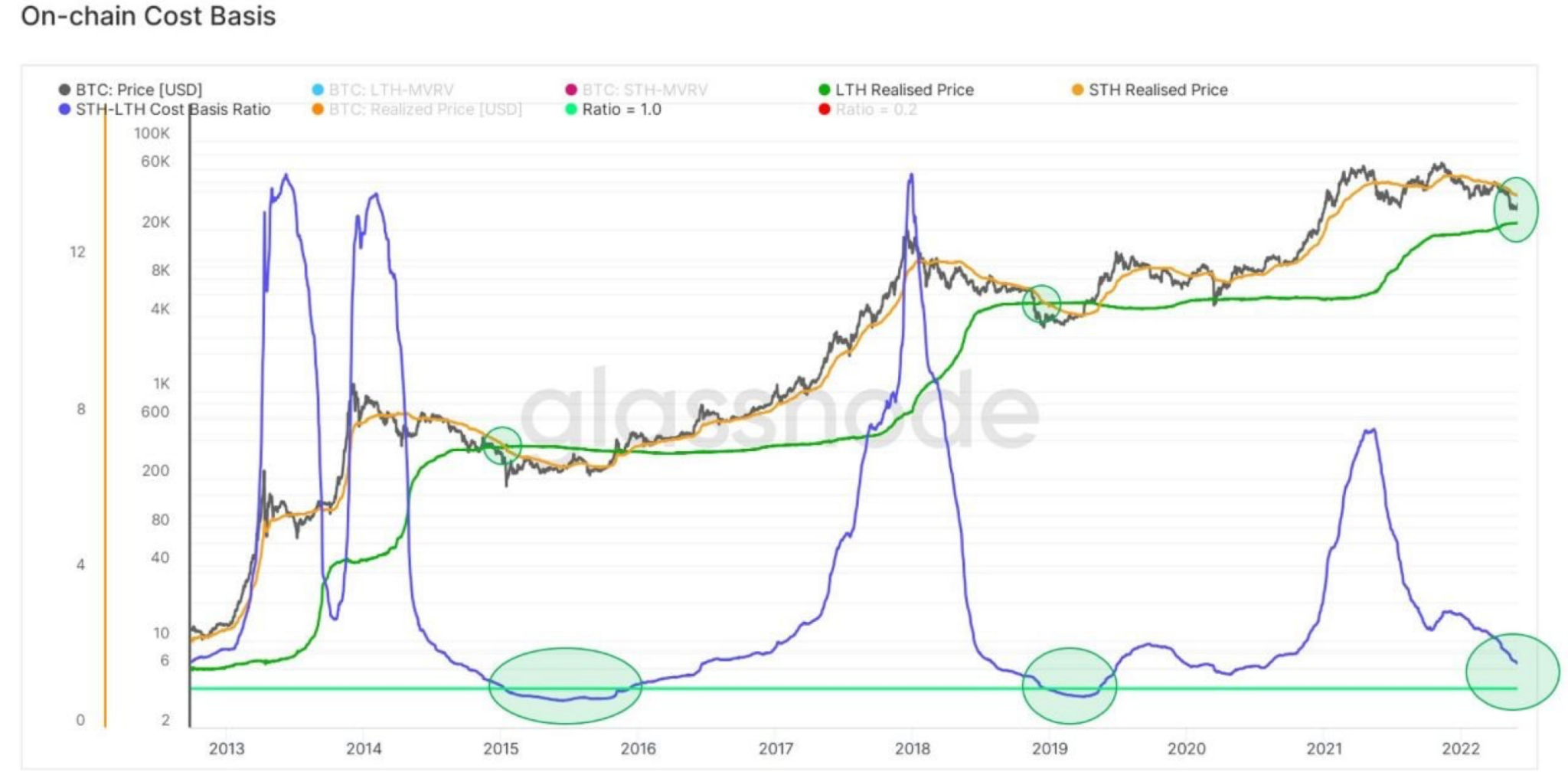

Bitcoin metrics

- Stock to flow

This model views Bitcoin as a commodity comparable to those like gold, silver, or platinum. These commodities are known as "stored value commodities" because they retain their value over time due to their relative scarcity.

For commodities of value, such as gold, platinum, or silver, a high ratio indicates that they are not primarily consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we are able to predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event. It's an event during which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

- BTC OnChain

Despite the panic, the number of Bitcoin addresses with a balance of more than 0.01 BTC has reached 10 million.

Funding Rates

Positive funding rates imply that speculators are bullish, and long-traders pay funds to short-traders.

Negative funding rates mean that speculators are bearish, and short-traders pay funds to long-traders.

P.S. Funding rates (0.01%) - black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) - red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

Off chain data