Digest 07 july 2022 – 14 july 2022

Project Events

ЗАС

The 3AC fund filed for bankruptcy and dragged the Voyager fund, which also went bankrupt after a 90% drop in assets under management.

Celsius

Celsius, which was also under market pressure and was on the verge of liquidation in the MakerDAO credit protocol, started to repay its debt and thus reduced the risk of liquidation of funds under management.

Alameda

These events brought some positivity to the market, and the Alameda fund stopped its pressure by sinking several competitors. Nevertheless, their goal is to monopolize the overall market as much as possible, and we believe there will be several more market shocks ahead of us, therefore we shouldn't let our guard down.

Sango Coin

Central African Republic launches a national cryptocurrency "Sango Coin".

Alchemix

Alchemix introduces new tokenomics to project with DAO management elements.

Uniswap

Uniswap token holders are figuring out how to take control of the protocol to improve it and reduce dependence on the Uniswap Labs team.

DyDx

DyDx launches trading competition with cash prizes for best revenue performance.

Polygon

Polygon network partners with phone maker HTC to integrate blockchain technology into mobile phones. This has the potential to be a new round of development and mass adoption by new users.

ShellProtocol

ShellProtocol updated their roadmap a few days ago: a Governance Token will be created.

OpenSea

OpenSea has experienced major data breach. If you receive emails from suspicious senders, it''s better not to interact with them.

Edverse

Edverse, the educational metaverse, has released its pre-alpha version this week to revolutionize education through its first of its kind immersive and interactive platform.

ZigZag

Trading platform ZigZag has been working on a Level 3 ZK rollup for private transactions on StarkNet as a possible addition to ZigZag Exchange and has named it InvisibL3.

Hidden orders would prevent tracking of addresses (creator and receiver) and sums, and allow users to hide the origin of their funds when switching to another wallet.

InvisibL3

InvisibL3 will be a viable alternative to the existing privacy solutions on Ethereum.

RTFKT

Nike-owned RTFKT will grant commercial rights to CloneX NFT owners, which will allow owners to create derivative projects, print fan art, and produce and sell merchandise with their avatar image.

Uber Eats и DoorDash

Uber Eats and DoorDash recently partnered with BitPay to facilitate crypto payments for food orders.

Highlights of the week

Events for the coming week

Funding

-

Bitmark raises $5.6M, launches interoperable NFT wallet called Autonomy.

-

Klang Games raises $41M to build Seed virtual world with AI and user-development capabilities.

-

Rubix Blockchain Pte Ltd (Rubix) announced it has secured a $100M investment from LDA Capital Ltd to grow global operations, support the transition to Web3, and expand its green blockchain community.

-

Enjinstarter, a launchpad for Enjin and other metaverse and blockchain gaming projects, has raised $5M in Series A funding from True Global Ventures (TGV).

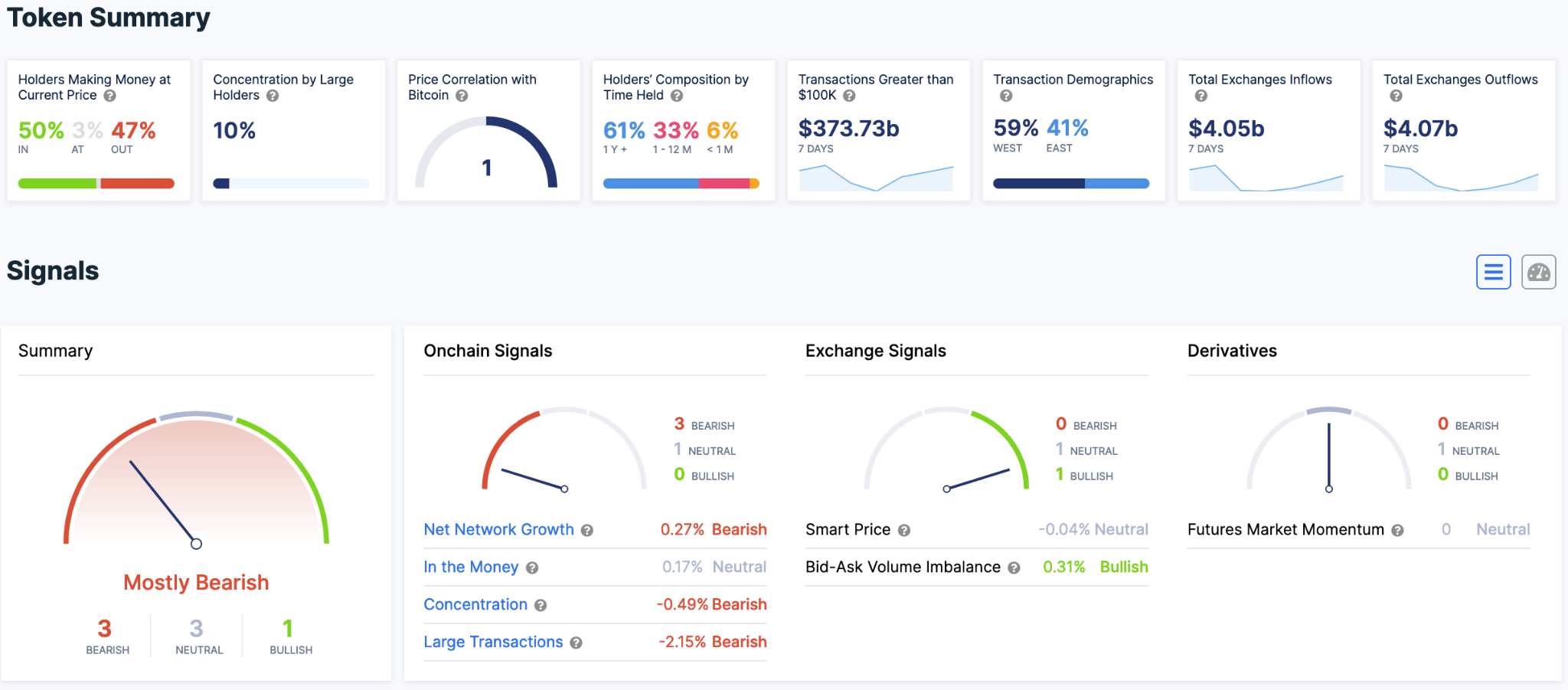

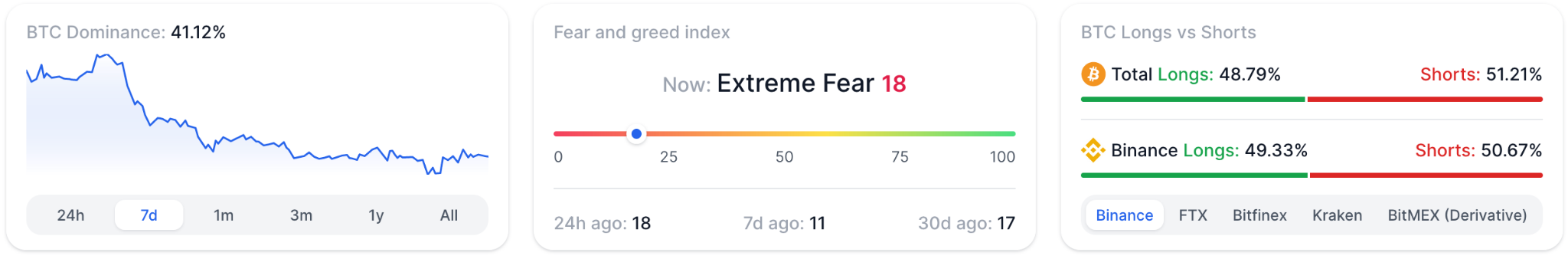

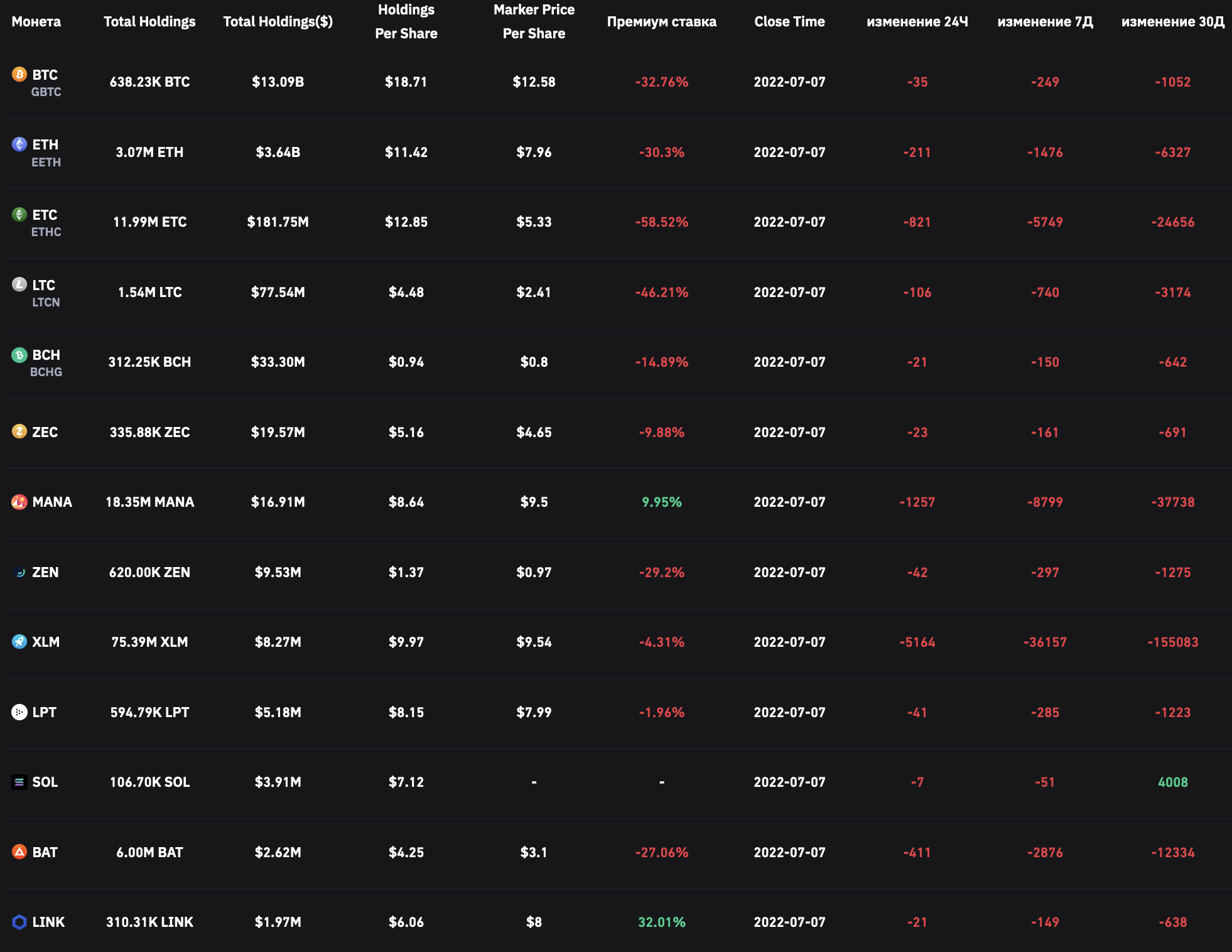

Metrics

10 effective coins of the week

Assessment combines altcoin price performance relative to bitcoin and social performance.

Grayscale fund portfolio dynamics

Bitcoin metrics

- Stock to flow

This model views Bitcoin as a commodity comparable to those like gold, silver, or platinum. These commodities are known as "stored value commodities" because they retain their value over time due to their relative scarcity.

For commodities of value, such as gold, platinum, or silver, a high ratio indicates that they are not primarily consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we are able to predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event. It's an event during which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

- BTC OnChain

Despite the panic, the number of Bitcoin addresses with a balance of more than 0.01 BTC has reached 10 million.

Funding Rates

Positive funding rates imply that speculators are bullish, and long-traders pay funds to short-traders.

Negative funding rates mean that speculators are bearish, and short-traders pay funds to long-traders.

P.S. Funding rates (0.01%) - black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) - red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

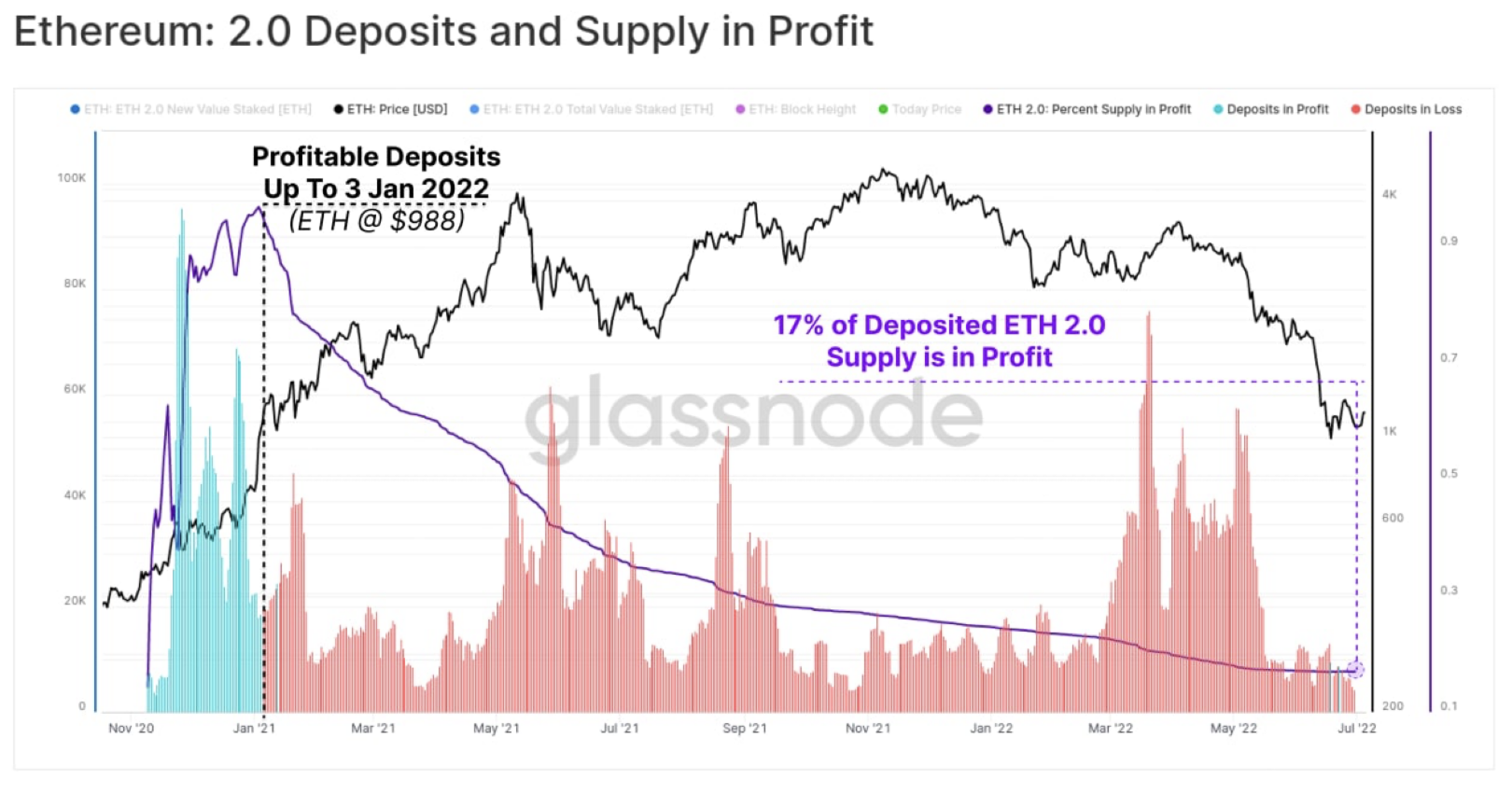

Off chain data