Digest (10 Jan 2022 - 16 Jan 2022)

Project events

Synthetix

Synthetix joins the cross-chain protocol race and plans to become the first synthetic asset bridge.

Gnosis Protocol

Gnosis Protocol произвел ребрендинг в CoW Protocol.

Terra и Sol Invictus

Terra and Sol Invictus join forces for new bond offering.

Invictus is excited to offer UST bonds as part of a new partnership between Invictus DAO and Terraform Labs. Through this partnership, Invictus DAO can begin shifting treasury toward high-quality stable assets and away from centralized stablecoins like USDC and USDT.

Moreover, with the addition of high-quality treasury assets such as UST, Invictus DAO will be able to accept higher-risk assets into its treasury and begin to accumulate key parts of Solana's decentralized financial infrastructure.

Zerion

Zerion launches a movrnetwork-based multi-chain bridge.

dYdX

dYdX is preparing to release the new version of the protocol, V4, in 2022.

The main goals of the protocol are as follows :

- dYdX V4 will be fully decentralized, controlled by the community, and will have no central components;

- No central party will receive trading commissions on dYdX V4.

Solana

Solana's Zeta Markets derivatives platform is launched on the Mainnet.

We believe ETH will dominate in 2022**. That's why we recommend taking a closer look at all ZK solutions. For example, Starknet.

Yearn

Andre Cronje (founder of Yearn) is planning to launch a new protocol associated with a new kind of DEX.

Yearn launches 7 new vaults on Ethereum + 7 new vaults on Fantom.

Celer Network

Celer Network launches Inter-chain Message Framework: it fundamentally changes the way dApps are created and used on multiple blockchains. Instead of deploying multiple isolated copies of smart contracts on different blockchains, developers can now build inter-chain native dApps with efficient use of the liquidity.

Aurory

Seed investors and the Aurory game studio project team on the blockchain have decided to extend their cliffs.

Highlights of the week

.png)

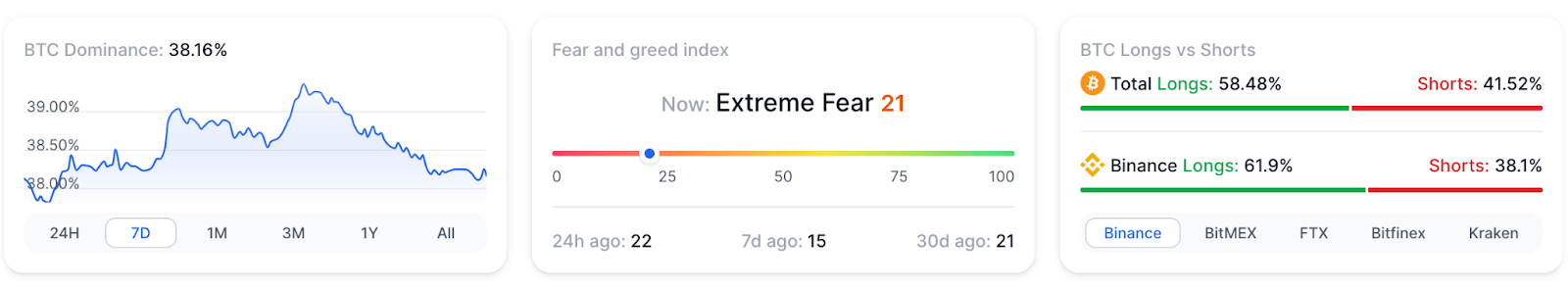

Events of the coming week

.png)

.png)

Funding

- Bribe is a protocol to tackle low participation and voter apathy in DeFi governance with transparent markets for DAO solutions. It closed a $4m seed round.

- Web3Auth a simple auth infrastructure for Web3 apps and wallets, formerly known as Torus. It raised $13 million in a Series A funding round led by Sequoia Capital

- Citadel Securities, a leading global market maker, announced today that Sequoia and Paradigm have made a $1.15 billion minority investment in the company.

- NFT aggregator Flip raises $6.5 million in seed funding

- xBacked, Algorand's decentralized stablecoin, has raised a $1.5 million seed round from investors.

- Solana-based DeFi banking startup Exotic Markets raises $5 million in its latest funding round

- Serum community fund raises $75 million in token sale from Tiger Global and others

- Web 3 developer platform Pocket Network raises $10 million to expand adoption and node coverage in Asia

- Goldfinch raises $25M led by Andreessen Horowitz

Metrics

10 effective coins of the week

Assessment combines altcoin price performance relative to bitcoin and social performance

.png)

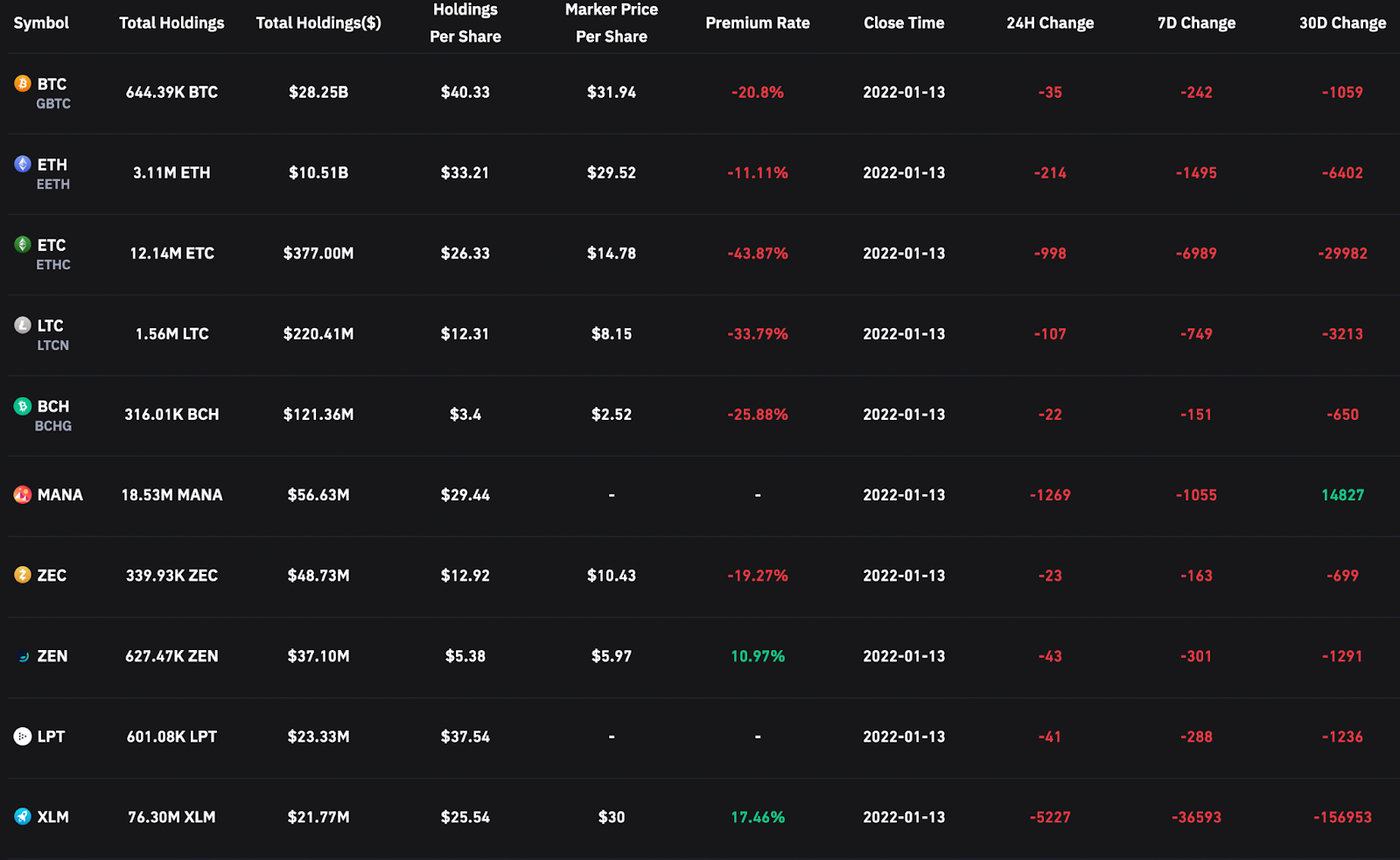

Grayscale Fund Portfolio Dynamics

Bitcoin Metrics

- Stock to flow

This model views bitcoin as a commodity comparable to commodities such as gold, silver, or platinum. These commodities are known as "stored value commodities" as they retain their value over time due to their relative scarcity.

For commodities of value like gold, platinum, or silver, the high ratio indicates that they are not mostly consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we are able to predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event. It's an event during which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

BTC OnChain.

Bitcoin enters the Buy Zone when its value is compared to the level of consumption and wastage of fiat currencies.

The bottom signal has only flashed 5 times in Bitcoin's history.

Funding Rates

Positive funding rates imply that speculators are bullish and long-traders pay funds to short-traders.

Negative funding rates mean that speculators are bearish and short-traders pay funds to long-traders.

.png)

P.S. Funding rates (0.01%) - black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) - red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

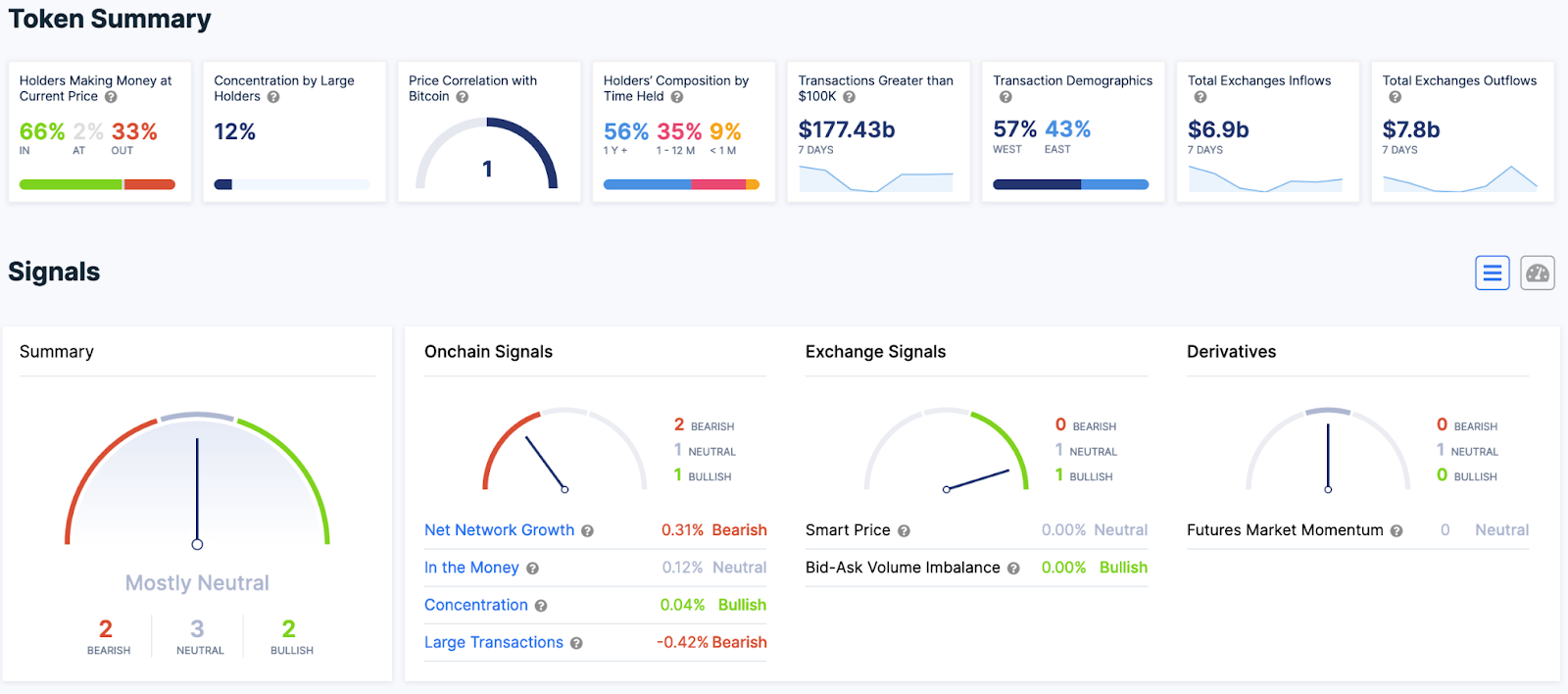

Off chain data