Digest 12 May 2022 — 19 May 2022

Project Events

Juno

Juno developers mistakenly burned nearly $36 million in crypto, but after a new vote, funds were recovered.

The Tron

The Tron network has released an algorithmic stablecoin called USDD. Justin Sun, the founder of the project, has already spoken out his fears about possible attacks on the security of this asset.

Coinbase

Coinbase reported a net loss of $430 million in the first quarter of 2022.

LUNA

The highlight of the week - Top 10 project Terra and its LUNA coin dropped 98% in a week. The UST stablecoin lost its peg to the dollar and is currently worth $0.6. The Luna Foundation Guard seeks more than $1 billion to shore up UST. Many protocols and exchanges stop dealing with these assets.

Compound Treasury

Compound Treasury received S&P credit rating, which is the first of its kind in the crypto industry.

The SEC

The SEC has added 20 more positions to its cryptocurrency enforcement division. So, we see that the U.S. is getting serious about regulating the industry.

U.S. Treasury Department

The U.S. Treasury Department has imposed its first-ever sanctions against a cryptocurrency mixer.

Gnosis

Gnosis has announced the establishment of Safe Guardians, groups of people who will actively and positively contribute to the ecosystem.

Maple

Maple recently shared information about its growth and announced upcoming changes to tokenomics.

Bancor

Bancor has announced the official release of its new version of the protocol, Bancor 3.

Instagram will support NFTs from Ethereum, Polygon, Solana, and Flow.

ETH

Depositing small (≤ 0.5) amounts of ETH to Optimism became ~5x cheaper and ~15x faster with the introduction of the new Warp Speed bridge.

Highlights of the week

Events for the coming week

Funding

- Chainflip Labs secured $10 million for cross-chain DEX.

- Katie Haun's new firm, Haun Ventures, has led its first deal in the NFT startup Zora Labs. The $50 million funding round values the company at $600 million.

- Dapper Labs launches $725 million ecosystem fund for Flow blockchain.

- Binance Labs makes strategic investment in pSTAKE, a liquid staking protocol.

- Haun Ventures leads $11 million round for Highlight, a platform focused on community building tools in the web3 ecosystem.

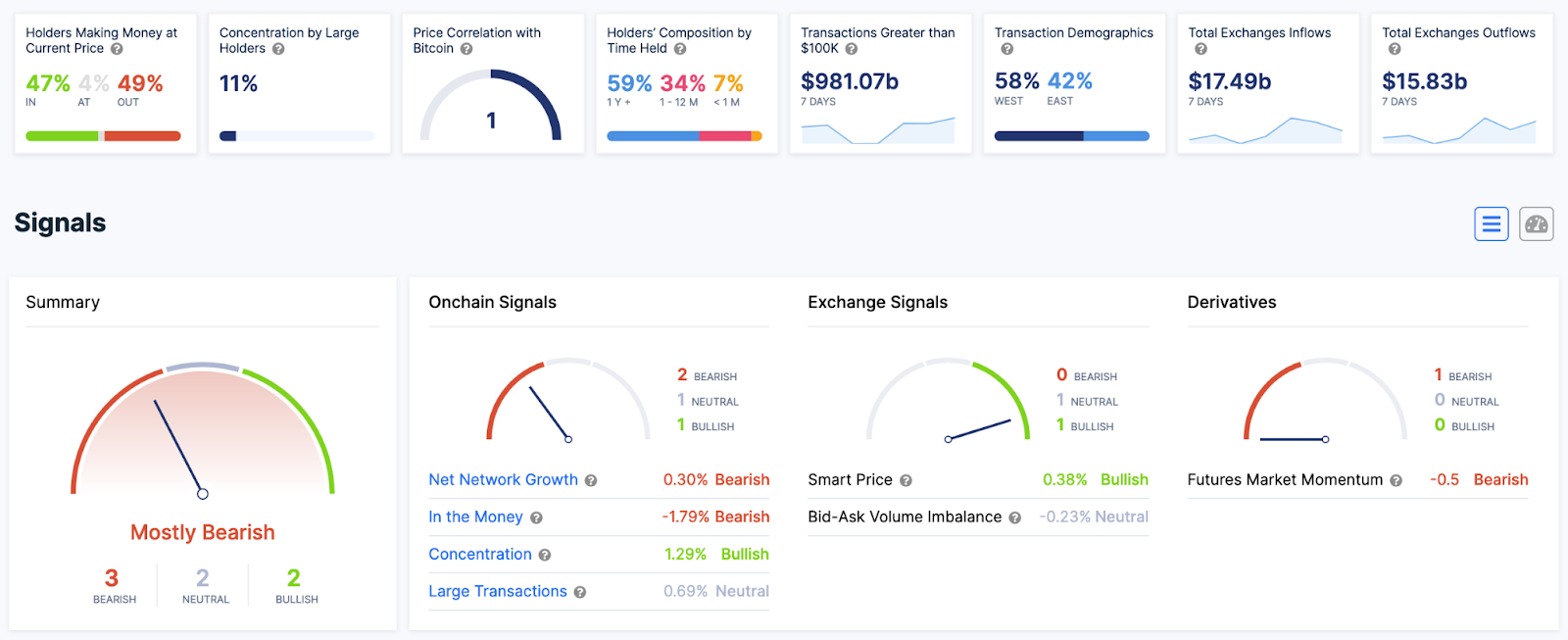

Metrics

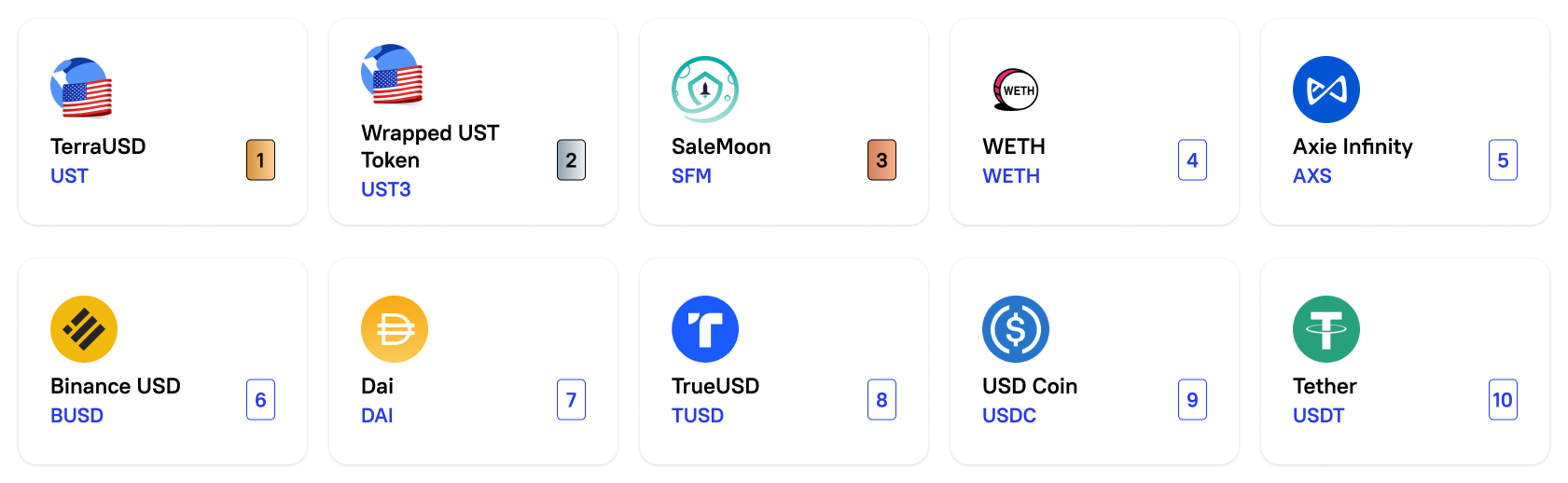

10 effective coins of the week

Assessment combines altcoin price performance relative to bitcoin and social performance.

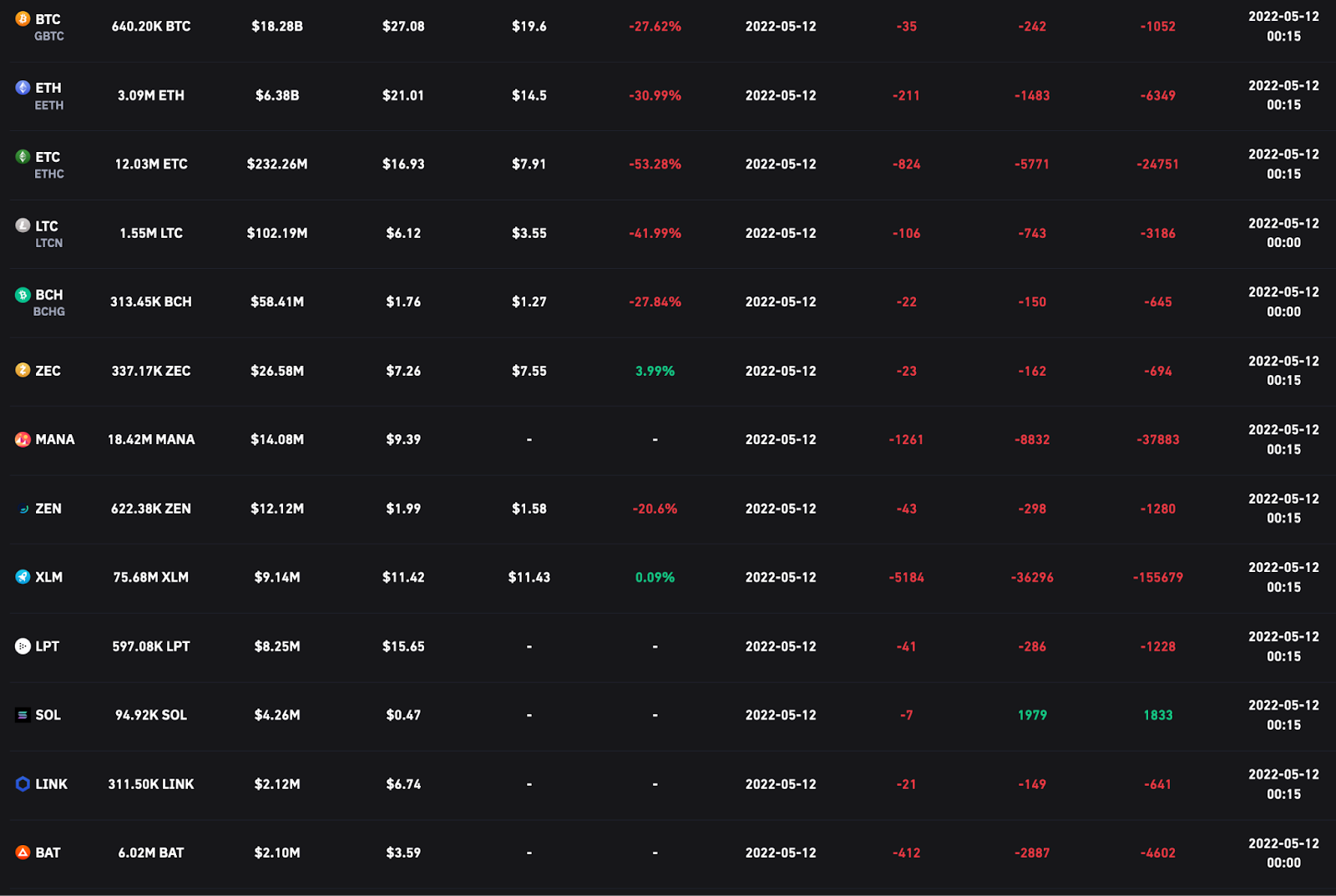

Grayscale fund portfolio dynamics

Bitcoin metrics

- Stock to flow

This model views Bitcoin as a commodity comparable to those like gold, silver, or platinum. These commodities are known as "stored value commodities" because they retain their value over time due to their relative scarcity.

For commodities of value, such as gold, platinum, or silver, a high ratio indicates that they are not primarily consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we are able to predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event. It's an event during which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

- BTC OnChain

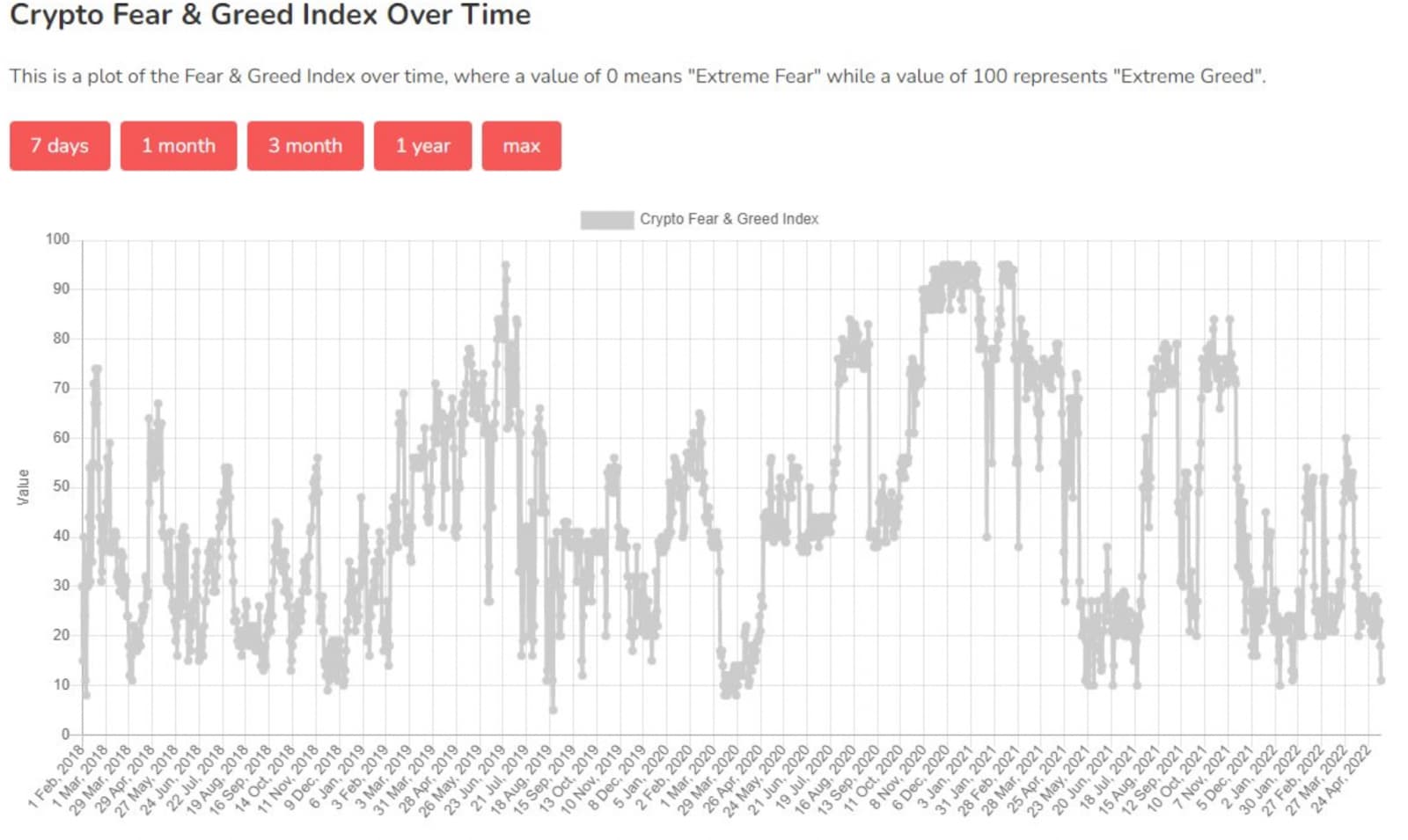

The crypto fear and greed index has dropped to 11 and plunged into ”extreme fear” territory. Typically, such moments provide good entry points into heavily discounted assets.

Funding Rates

Positive funding rates imply that speculators are bullish, and long-traders pay funds to short-traders.

Negative funding rates mean that speculators are bearish, and short-traders pay funds to long-traders.

P.S. Funding rates (0.01%) - black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) - red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

Off chain data