Digest (17 Jan 2022 - 23 Jan 2022)

Project events

Copper and Olympus

Copper and Olympus strengthen relationship: Copper is the first platform to add $OHM as collateral

OpenSea

OpenSea has confirmed the purchase of Dharma Labs

Dharma app will be shut down, but its technology features will be able to help with the transition to fiat and boost the performance of OpenSea's core offering

Polygon

London EIP-1559 updates are taking effect on Polygon's core network

Platypus Finance

Platypus Finance launched Stableswap protocol on Avalanche

Beta Finance

Beta Finance will complete the migration the Avalanche network today

Optimism

Curve, Set Protocol, TornadoCash and Matcha.xyz are now live on Optimism.

Arbitrum

RariCapital is coming to Arbitrum

Orbiter Finance

Orbiter Finance can now make cross-rollups transfers between ETH mainnet, Arb1, and ZkSync.

Solana

Solana launches developer engagement program and kicks off Solana Hacker House world tour

Zeta Markets

Zeta Markets network has been launched

XDEFI_wallet

THORChain-based cross-chain swaps now available in XDEFI_wallet

Adidas and Prada

Adidas and Prada are teaming up for an NFT collaboration.

Adidas Originals' first NFT launch, titled ''Into the Metaverse,'' will give NFT holders access to special Adidas Originals services and products, including digital attire and accessories for the gaming world known as The Sandbox.

Highlights of the week

Events of the coming week

Funding

- PlotX, the GameFi ecosystem project, secures $5 million in funding and grant led by Polygon, Hashed

- Mechanism Capital launches $100 million fund focused on P2E games

- The new fund will be called Mechanism Play and will focus entirely on gaming investments and direct partnerships with studios to develop new games, the company said in a statement

- Allbridge_io has raised $2 million to expand its cross-chain token bridge, which has nearly $475 million in tokens locked in the protocol's contracts.

- NEAR, a development platform that runs on its Sharded PoS L1 blockchain, raised $150 million from high-profile investors.

- Entropy, a decentralized asset custody protocol, raised $1.95 million in funding.

- Secret Network announces $400 million ecosystem funding and reveals new investors

- Cryptocurrency exchange FTX is launching a $2 billion venture capital fund

Metrics

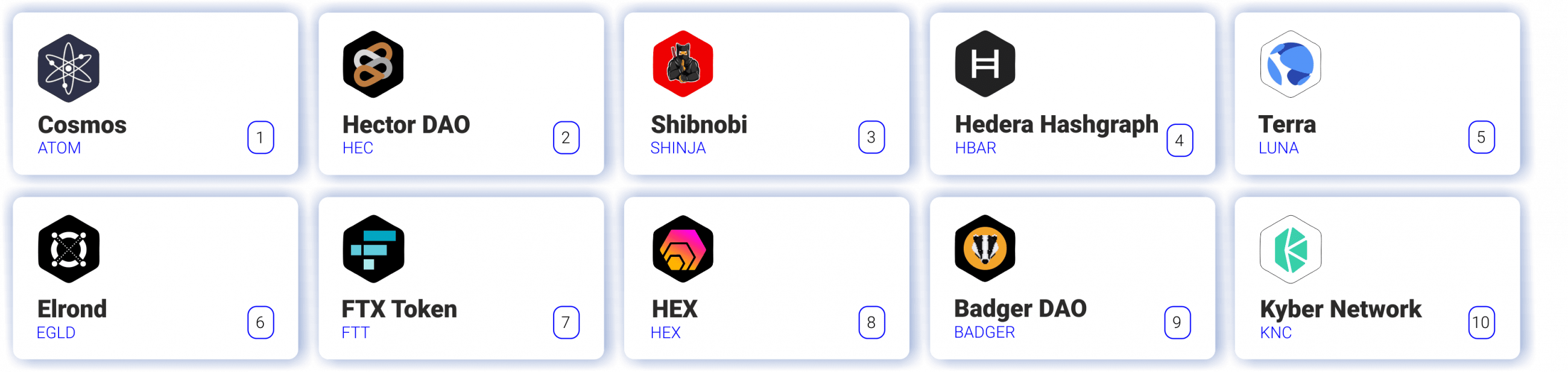

10 effective coins of the week

Assessment combines altcoin price performance relative to bitcoin and social performance

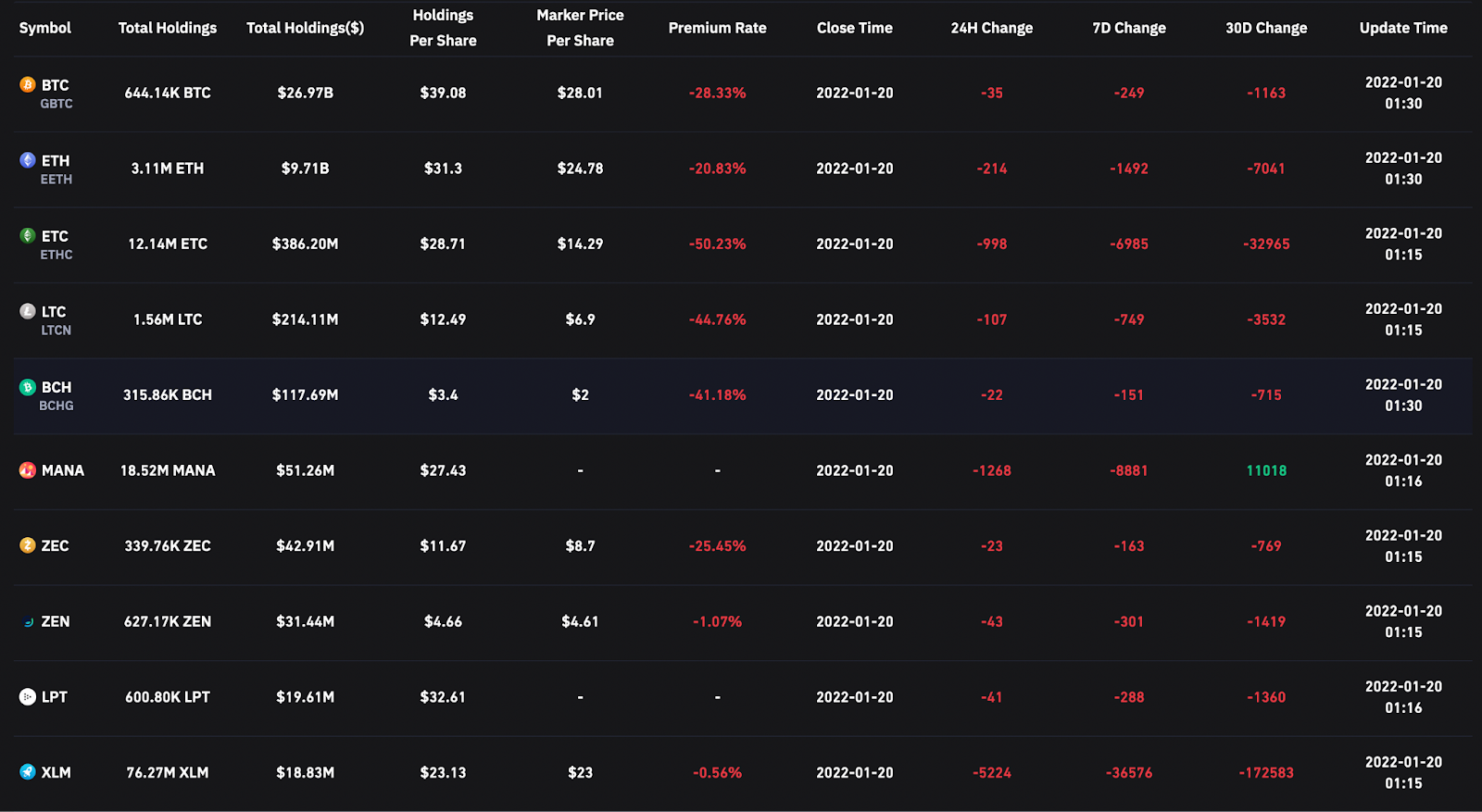

Grayscale Fund Portfolio Dynamics

Bitcoin Metrics

- Stock to flow

This model views bitcoin as a commodity comparable to commodities such as gold, silver, or platinum. These commodities are known as "stored value commodities" as they retain their value over time due to their relative scarcity.

For commodities of value like gold, platinum, or silver, the high ratio indicates that they are not mostly consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we are able to predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event. It's an event during which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

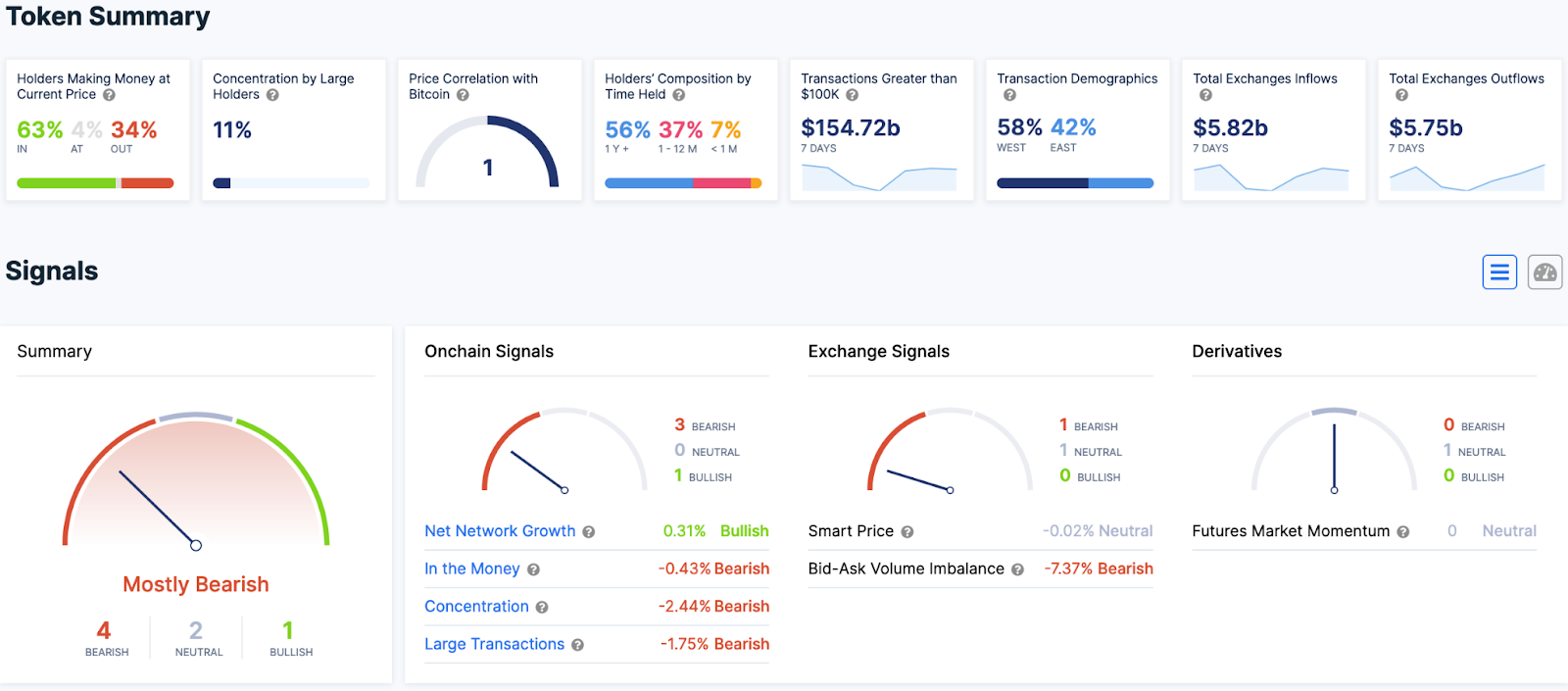

BTC OnChain.

Bitcoin enters the Buy Zone when its value is compared to the level of consumption and wastage of fiat currencies.

The bottom signal has only flashed 5 times in Bitcoin's history.

.png)

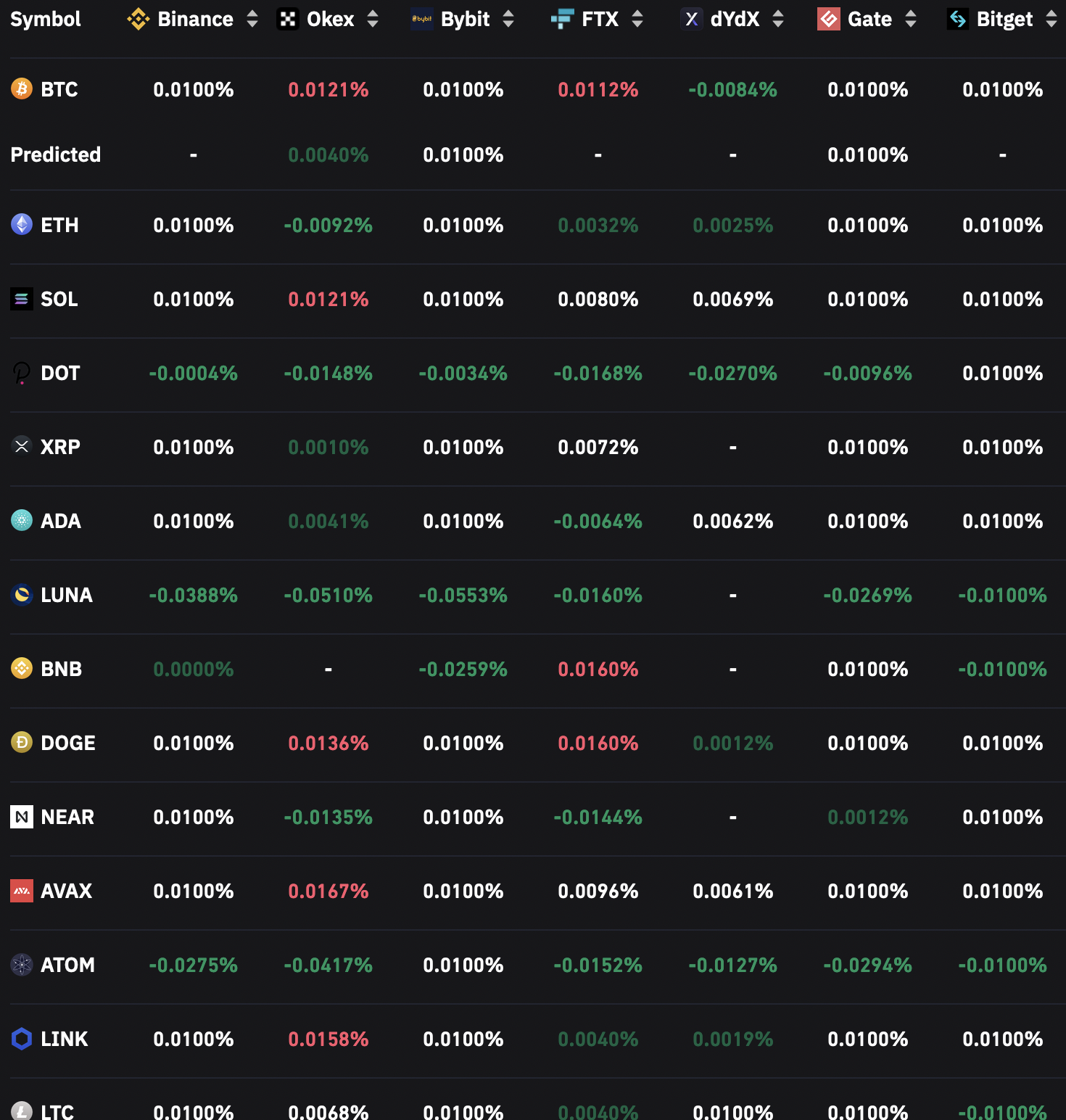

Funding Rates

Positive funding rates imply that speculators are bullish and long-traders pay funds to short-traders.

Negative funding rates mean that speculators are bearish and short-traders pay funds to long-traders.

P.S. Funding rates (0.01%) - black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) - red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

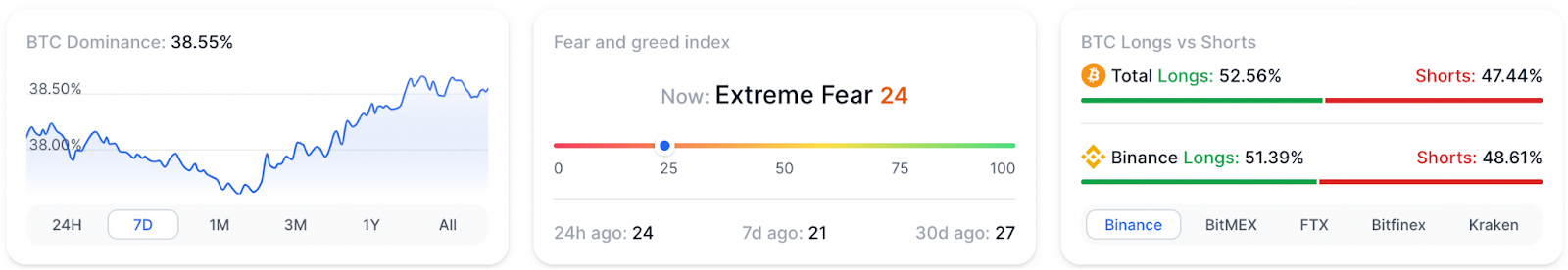

Off chain data