Digest 21 Mar 2022 - 27 Mar 2022

Project Events

GameStop Marketplace

GameStop Marketplace launches NFT Marketplace powered by Loopring L2.

The Balancer

The Balancer protocol introduces a new veBPT token model that will allow users to earn additional profits and vote for different pools to distribute rewards in BAL tokens.

Ellipsis Finance

Ellipsis Finance is preparing to launch the 2 version of the protocol.

Matcha

DEX aggregator Matcha is blocking transactions from Russia.

SushiDAO

SushiDAO is planning to create an association or foundation to mitigate future regulatory risks. In doing so, the SushiDAO will provide legal clarity regarding the rights and obligations of token holders and contributors, limit the liability of token holders and contributors, and create an apparatus to handle administrative matters for the SushiDAO.

Parallel Finance

Parallel Finance launches DeFi "Super app" for the Polkadot crypto ecosystem.

The lending protocol with $500 million in TVL is planning to dominate the market.

$ETH

This week $ETH had $81 million in revenue, and the network is preparing to merge with PoS.

Vitalik Buterin

Vitalik Buterin makes it to the cover of TIME Magazine.

Elon Musk

Elon Musk says: I still own and won't sell my ETH.

SithSwap

SithSwap announces next-generation AMM on StarkNet.

zksync

zksync announces new "bug bounty" program on immuenfi.

BAYC

BAYC issued an APE token and dropped a portion of the tokens to all holders, and the value of the tokens was about $40,000 for each NFT holder.

Highlights of the week

Events for the coming week

Funding

- Bored Apes creator Yuga Labs raises $450 million in a round led by a16z.

- Ribbon announced the closing of an $8.75M Series A+ funding round led by Paradigm.

- Polychain Capital leads $22M investment in NFT appraisal protocol Upshot, which seeks to bridge the worlds of DeFi and NFT.

- Web 3 gaming platform on Terra blockchain raises $25M in token sale. FTX Ventures, Jump Crypto and Animoca Brands were among the purchasers in the sale that values C2X, a Hashed-advised gaming platform, at $500 million.

- Coinbooks raises $3.2 million to build accounting software for DAOs.

- The Mina ecosystem raised $92 million in a funding round led by @FTX_Official and Three Arrows Capital to support the growth of developers in the community.

- Today, Lava Labs, a game development studio, announced that it has raised $10 million to further develop its debut title AFAR, a third-person, hero-based arcade platform that includes a series of games.

Metrics

10 effective coins of the week

Assessment combines altcoin price performance relative to bitcoin and social performance.

.png)

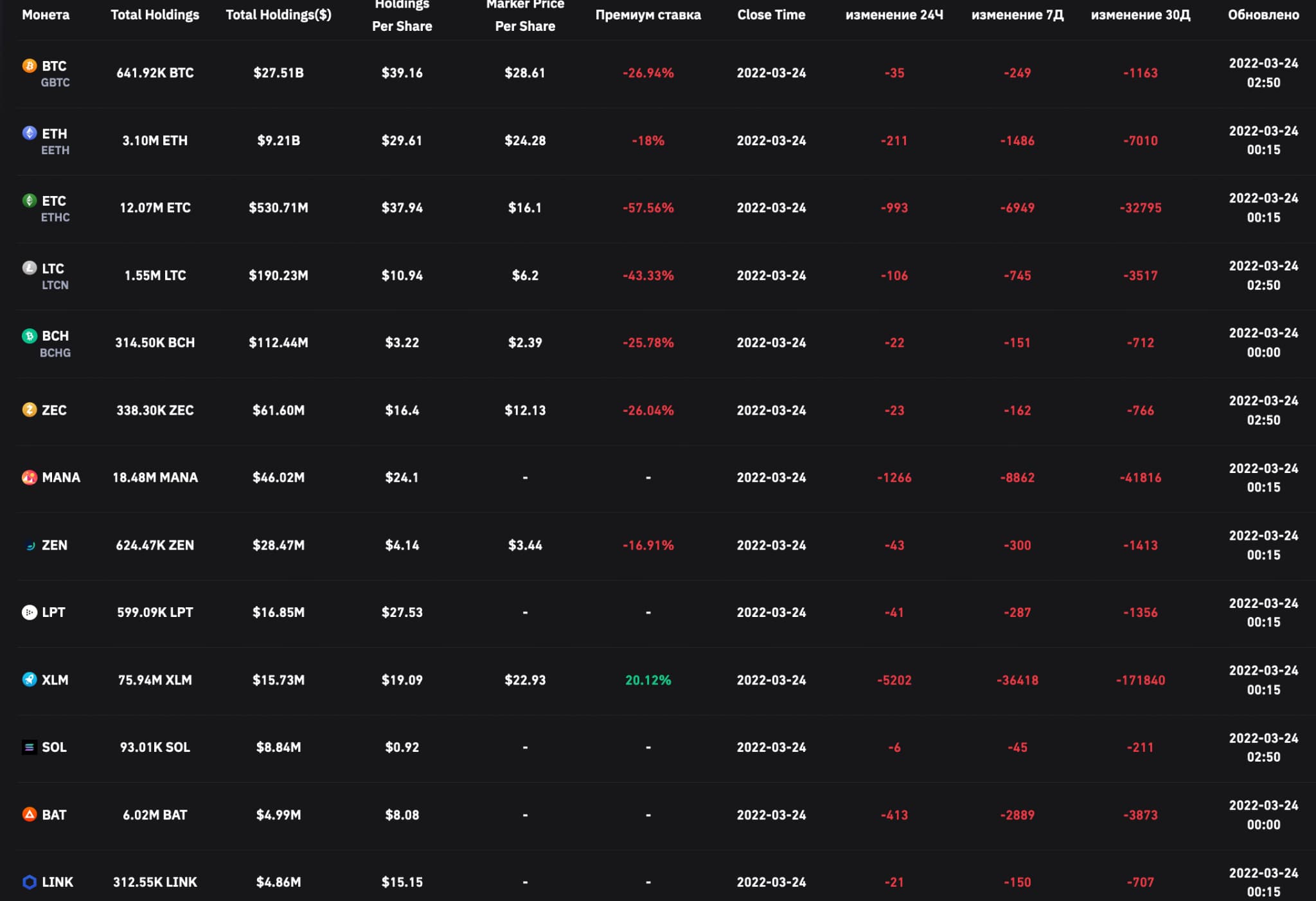

Grayscale fund portfolio dynamics

Bitcoin metrics

- Stock to flow

This model views Bitcoin as a commodity comparable to those like gold, silver, or platinum. These commodities are known as "stored value commodities" because they retain their value over time due to their relative scarcity.

For commodities of value, such as gold, platinum, or silver, a high ratio indicates that they are not primarily consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we are able to predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event. It's an event during which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

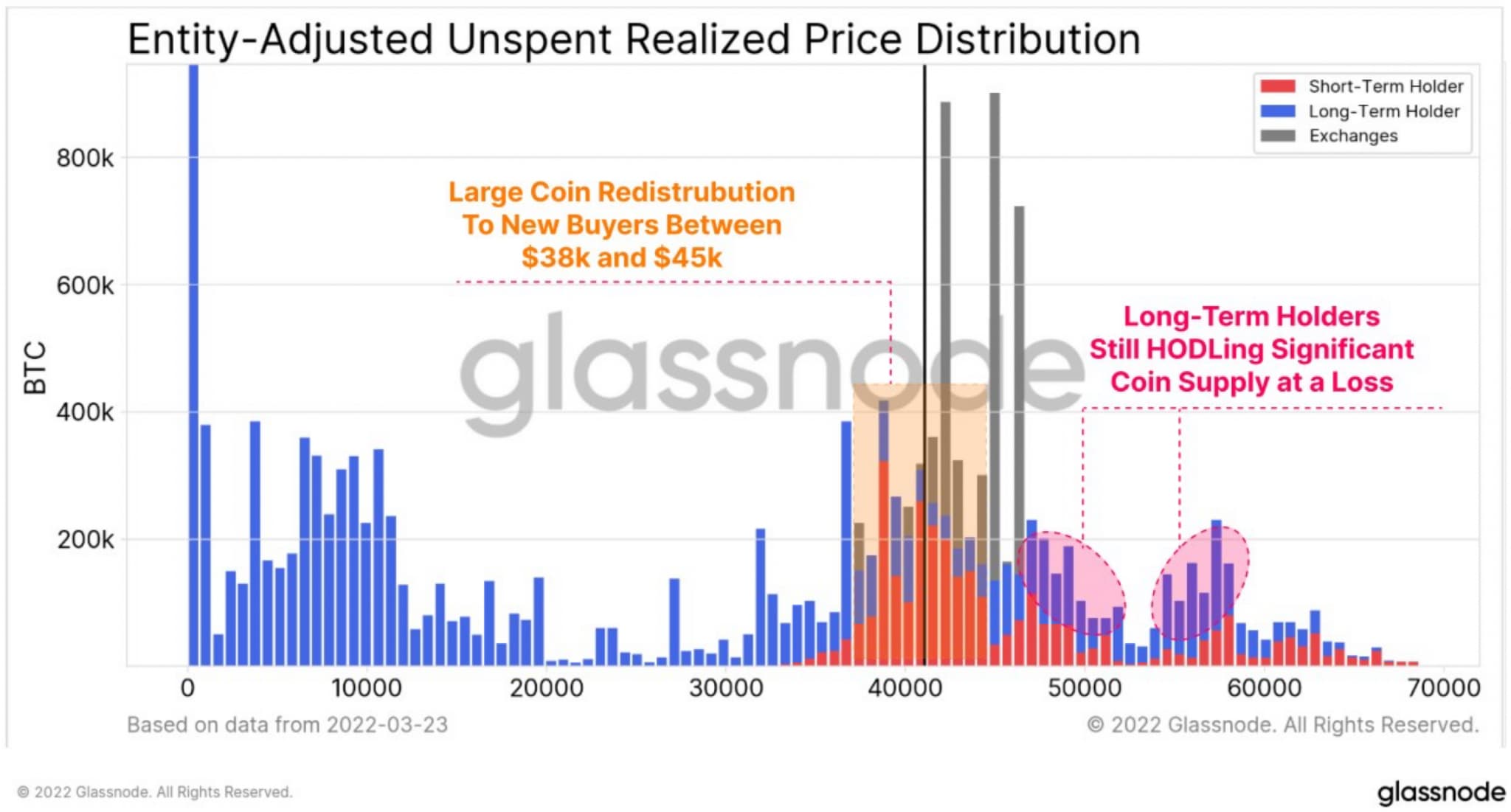

- BTC OnChain

Glassnode records a large withdrawal of BTC from exchanges. This kind of event often led to the growth of BTC.

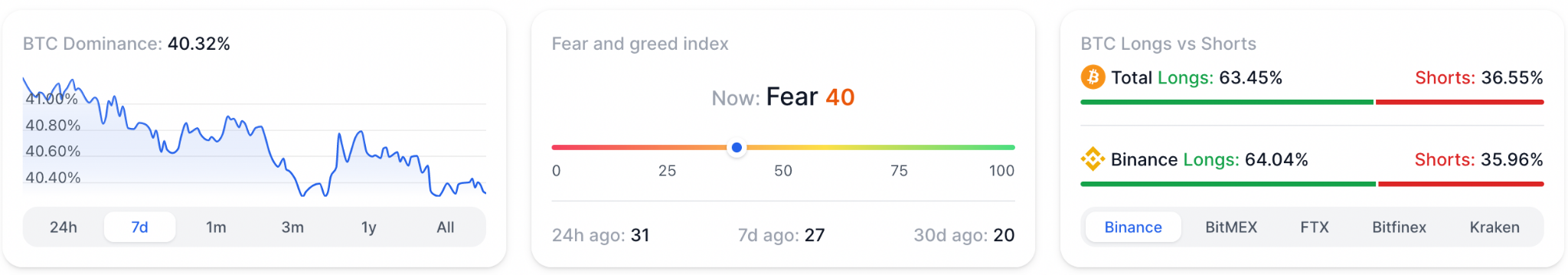

Funding Rates

Positive funding rates imply that speculators are bullish, and long-traders pay funds to short-traders.

Negative funding rates mean that speculators are bearish, and short-traders pay funds to long-traders.

P.S. Funding rates (0.01%) - black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) - red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

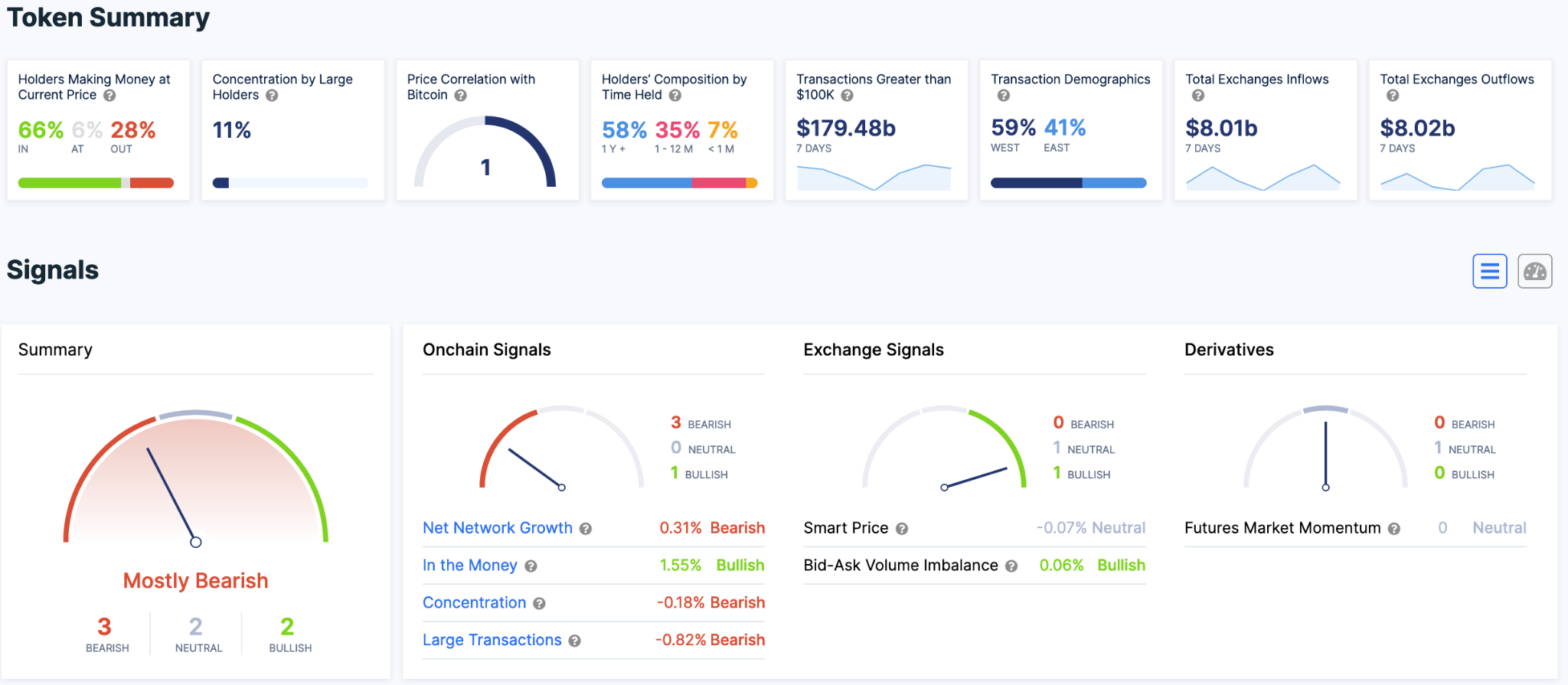

Off chain data