Digest (24 Jan 2022 - 30 Jan 2022)

Project events

Twitter launches NFT profile picture verification

Big Daddy Ape Club

Solana NFT project Big Daddy Ape Club rug-pulls investors of $1.3, despite the fact that its developers were purportedly fully verified through the “Verified by Civic Pass” program.

Aave

Aave recently announced a V3 for its platform with free voting, SnapshotX integration

Fantom

Fantom became the third-largest DeFi protocol by total value locked The value of DeFi-centric projects built on Fantom surged 52% in the past week.

As interest in the Fantom blockchain grows, 0xDAO has asserted itself, aiming to become the DAO ecosystem for Fantom.

Walmart

Walmart is about to enter the metaverse trend, planning to roll out its own cryptocurrency as well as collection of NFTs.

Solidly

Andre Cronje launches new Solidly protocol

web3

Hundreds of Y Combinator alumni join cryptocurrency collective to support web3 startups

The group, called Orange DAO, is an effort to build out a venture structure which can scout out and back young crypto startups.

dYdX

dYdX introduces Hedgies, a collection of 4,200 unique collectible avatars that will be distributed to its community. Bastion is algorithmic, DeFi lending protocol based on Aurora, NEAR's gasless EVM layer.

Fuse

The Fuse protocol is now officially deployed on Arbitrum

Highlights of the week

Next week’s events

.png)

Funding

- Metaplex, the creator of the NFT marketplace on Solana, has raised $46M, with the project looking to expand upon release in 2021.

- POAP inc, a project focused on preserving memories as digital records, which are minted as ERC-721 tokens, has raised $10M in funding.

- The Graph, the "Google of Blockchains," raises $50 million in a round led by Tiger Global

- The protocol indexes data across 26 blockchains.

- The collective of crypto artists PleasrDAO raises $69 million

- BreederDAO just raised funding from a16z and others to generate NFTs at a large scale

- While some tech titans debate how decentralized "web3" will differ from their unscrupulously centralized predecessors, an ecosystem of companies connected to each other is quickly forming, including support from the same investors. Consider that late last summer, Andreessen Horowitz (a16z) invested in Yield Guild Games [...].

- HAL secured seed funding of $3 million and integration with DeFi platform Aave

- HAL has received backing from investors to the tune of $3 million amid a recent integration with DeFi lending platform Aave.

- Animoca Brands leads $6.5 million round for decentralized exchange Soma.Finance

- Soma aims to become a fully interoperable digital asset exchange for both institutional and retail investors.

Metrics

10 effective coins of the week.

Assessment combines altcoin price performance relative to bitcoin and social performance

Grayscale fund portfolio dynamics

Bitcoin metrics

- Stock to flow

This model views Bitcoin as a commodity comparable to those like gold, silver, or platinum. These commodities are known as "stored value commodities" because they retain their value over time due to their relative scarcity.

For commodities of value, such as gold, platinum, or silver, a high ratio indicates that they are not primarily consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we are able to predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event. It's an event during which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

BTC OnChain

Bitcoin is reaching a macro bottom.

The number of short-term holders is at historic lows - an opportunity that occurs infrequently.

Funding Rates

Positive funding rates imply that speculators are bullish, and long-traders pay funds to short-traders. Negative funding rates mean that speculators are bearish, and short-traders pay funds to long-traders.

P.S. Funding rates (0.01%) - black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) - red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

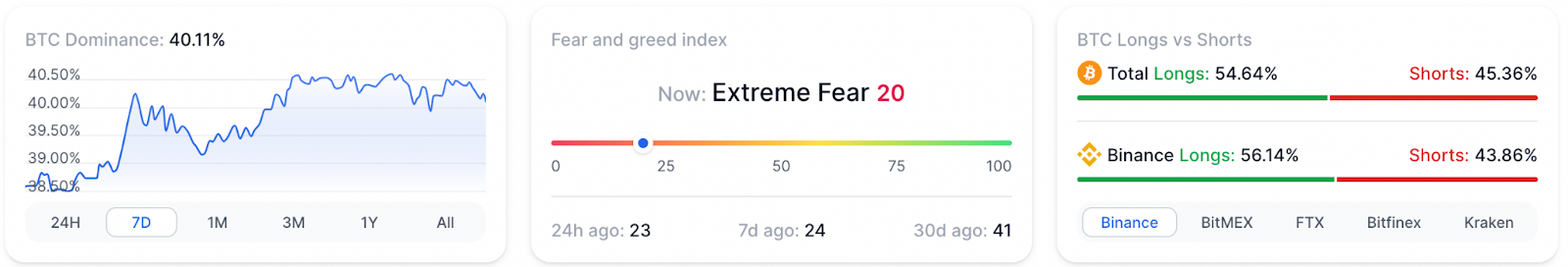

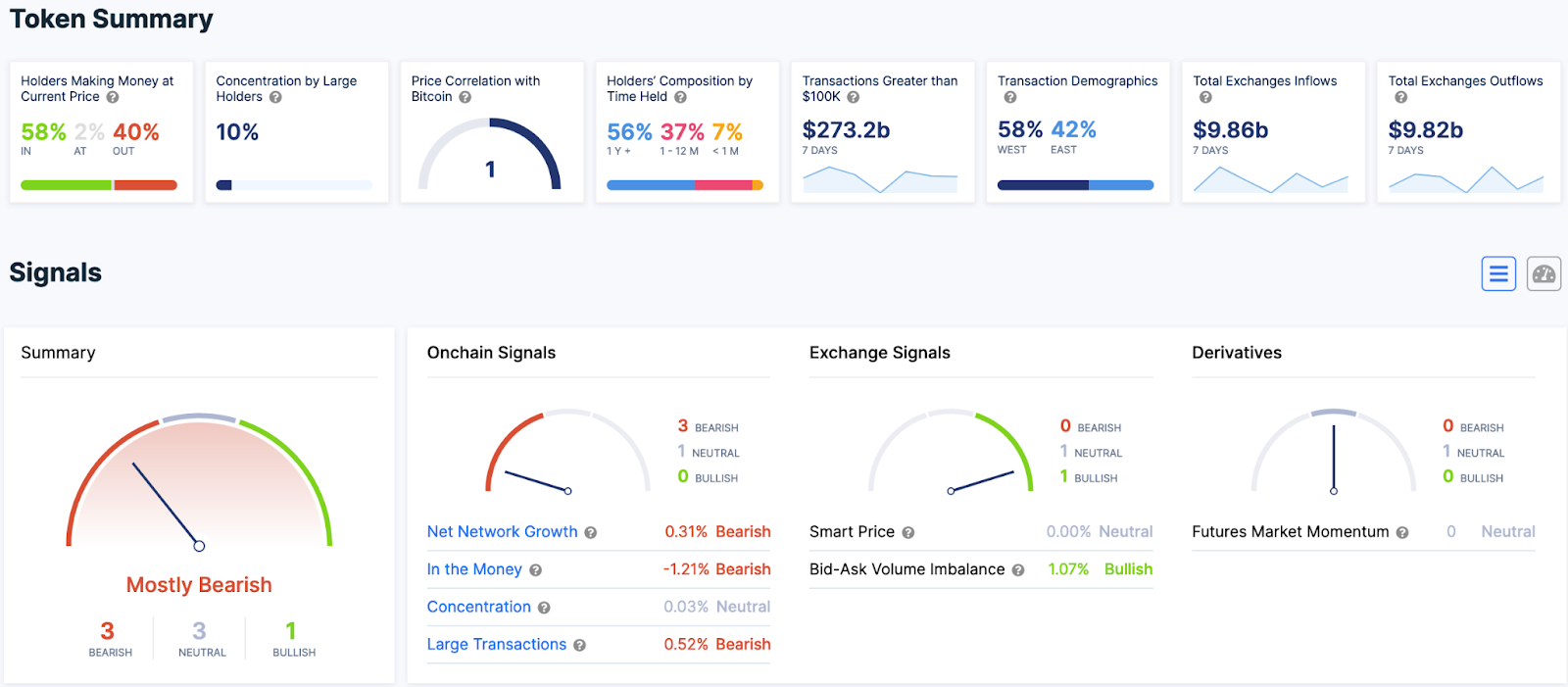

Off chain data