Digest 28 April 2022 — 04 May 2022

Project Events

Kadena Network

Kadena Network launched a $100 million grant program to inspire developers to innovate on the Kadena Network.

FutureSwap

Decentralized margin trading protocol FutureSwap updated to v4, in which it added new DEX for trading, optimized gas costs, and updated the oracle checking system.

Polygon

Polygon launched Supernet chains (contiguous networks to increase the capacity of the core network), pledging to invest $100 million in the development of customizable networks.

Abracadabra

Abracadabra introduced Cauldrons V3, a new credit mechanic that allows users to borrow MIM using another asset as collateral.

USDD

Justin Sun to launch USDD algorithmic stablecoin on Tron, with $10 billion to be used as collateral, which will be used for dividends for investors with a risk-free rate of 30% APY.

OpenSea

OpenSea acquires aggregator NFT Gem.

Optimism

Optimism released its token, conducted a decent retrodrop for its users, and announced a new management mechanic for Optimism. Collective is a massive experiment in digital democratic governance, designed for the rapid and sustainable growth of a decentralized ecosystem and managed by the newly created Optimism Foundation.

MakerDAO

MakerDAO is integrating StarkNet's L2 solution.

JPEG'd protoco

JPEG'd protocol recently launched, enabling loans secured by NFTs

BTC

Fidelity Investments announced its plan to offer BTC as a 401(k) investment option for employee contributions. If a full bear crisis strikes and we have to look for a job again, at least this time we will have a tax-deferred option to average the value of BTC.

Orca Protocol

Orca Protocol is launching concentrated liquidity pools that can improve the capital efficiency of liquidity providers ( the analog of Uniswap V3).

Highlights of the week

.jpg)

Events for the coming week

.jpg)

Funding

- LimeWire, a marketplace for digital collections, has raised $10M in a private token sale led by Kraken, Arrington, GSM funds.

- Dragonfly Venture Fund is closing a new $650 million round of startup funding for Fund III.

- Coinbase partner NFT 0x Labs raises $70M from Greylock Partners, Jump Crypto, and Jared Leto.

- DeFi Data Shop Nansen makes its first venture investment in gaming analytics firm ZeroDrop.

- Founders from a16z, Solana and more back new billion-dollar crypto fund.

Metrics

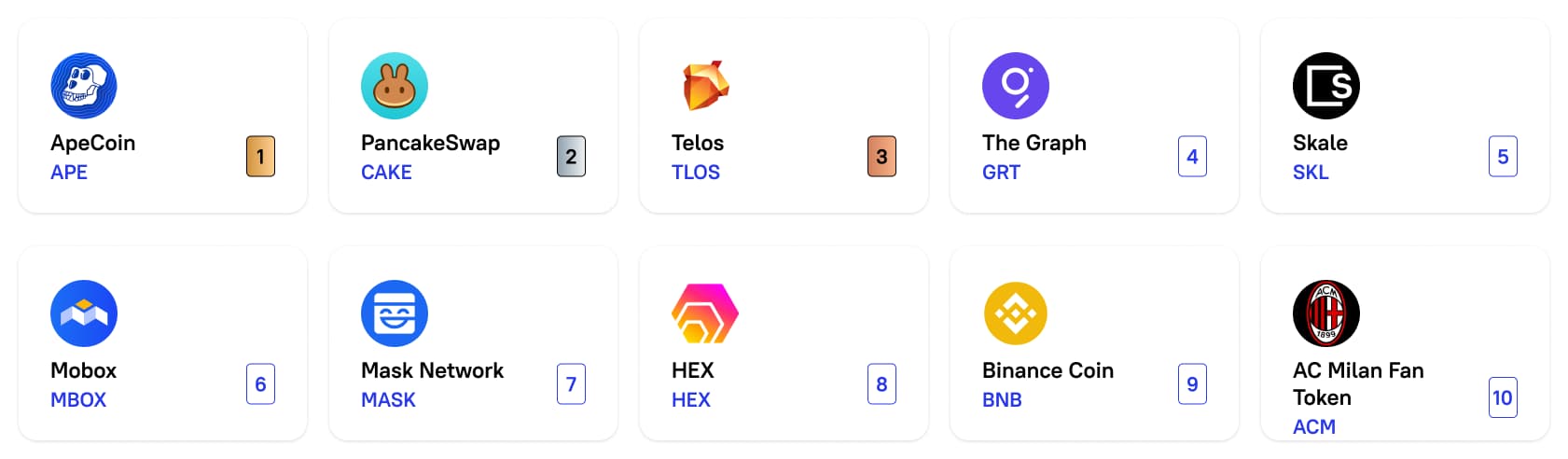

10 effective coins of the week

Assessment combines altcoin price performance relative to bitcoin and social performance.

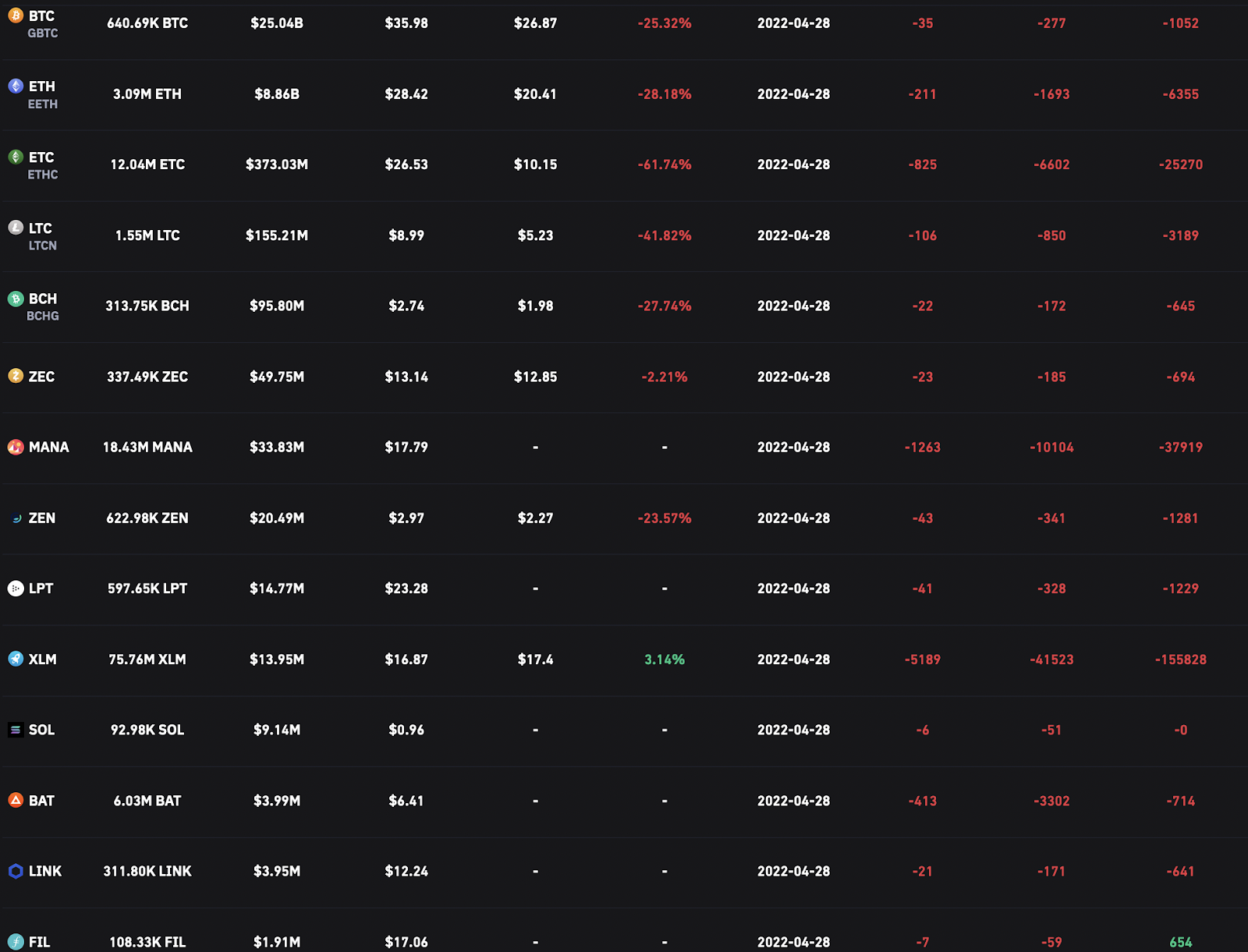

Grayscale fund portfolio dynamics

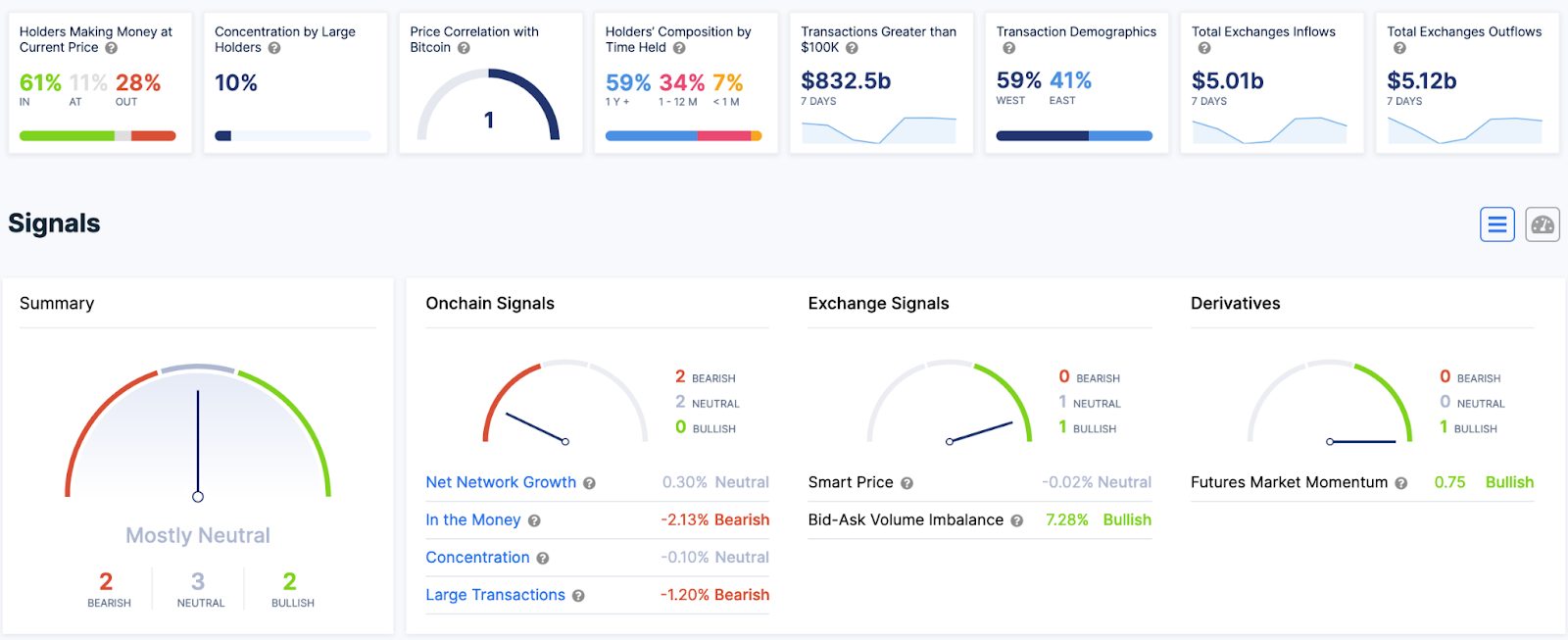

Bitcoin metrics

- Stock to flow

This model views Bitcoin as a commodity comparable to those like gold, silver, or platinum. These commodities are known as "stored value commodities" because they retain their value over time due to their relative scarcity.

For commodities of value, such as gold, platinum, or silver, a high ratio indicates that they are not primarily consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we are able to predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event. It's an event during which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

- BTC OnChain

There is a prevailing uncertainty in the market

Higher lows indicate bullish momentum is coming

Whales are piling up here.

However, there are early signs of a lower high forming, since some whales have unloaded positions at ~$43K.

The whales are basically accumulating, but some have been selling lately.

Could the higher low be revised?

Funding Rates

Positive funding rates imply that speculators are bullish, and long-traders pay funds to short-traders.

Negative funding rates mean that speculators are bearish, and short-traders pay funds to long-traders.

P.S. Funding rates (0.01%) - black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) - red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

Off chain data