Digest (31 Jan 2022 - 06 Feb 2022)

Project events

ConsenSys

The Ethereum software development company ConsenSys, known for its MetaMask and Infura products, is about to acquire wallet manager MyCrypto.

0x

0x introduces its 4th version of the protocol

This upgrade combines creator-centric features with gas efficiency, making NFT swaps on Ethereum and 6 other EVM chains and L2 networks more affordable than ever

Solana

Solana network faced multiple issues between Jan. 21 and 22, caused by bots spamming the network with transactions to win liquidations and arbitrage deals.

Solidly

Solidly, a new project by Andre Cronje (founder of Yearn) that facilitates transactions with minimal slippage and gas costs, was rolled out on the Fantom network.

Cryptocurrency

Cryptocurrency has become legal in India!

The Indian government has passed a law to tax crypto-assets

TOKE

TOKE issues its own bonds

FTX

FTX acquires Liquid, a Japanese crypto exchange

Coachella music festival to launch NFT Solana in deal with FTX

Fuse - Algorand - NEAR

FUSE - Algorand - NEAR networks have reported an increase in activity

Paraswap

ParaSwap launched on Fantom network

Bobanetwork

Bobanetwork token can now be staked and traded on Bancor

Wormhole

Solana Wormhole bridge has been hacked for $200m

Highlights of the week

.jpg)

.jpg)

.jpg)

.jpg)

Next week’s events

.png)

Funding

- Solana-centric crypto wallet Phantom has raised $109 million, bringing its valuation to $1.2 billion - Decrypt

- Solana-centric cryptocurrency wallet Phantom has raised $109 million in a Series B funding round led by Paradigm, earning the project unicorn status.

- FTX raises $400 million in Series C round, valued at $32 billion.

- Temasek, Paradigm, + Ontario Teachers' Pension Plan Board participated along with other companies.

- OptyFi, a DeFi asset optimizer has closed a $2.4mn seed round

- Superdao has raised $10.5 million at $160 million valuation to make it absurdly easy to build and operate DAOs.

- MyCointainer, a platform for easy staking, announced it had raised $6 million in a seed funding round.

Metrics

10 effective coins of the week.

Assessment combines altcoin price performance relative to bitcoin and social performance

.png)

Grayscale fund portfolio dynamics

Bitcoin metrics

- Stock to flow

This model views Bitcoin as a commodity comparable to those like gold, silver, or platinum. These commodities are known as "stored value commodities" because they retain their value over time due to their relative scarcity.

For commodities of value, such as gold, platinum, or silver, a high ratio indicates that they are not primarily consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we are able to predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event. It's an event during which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

BTC OnChain

Bitcoin is reaching a macro bottom.

The number of short-term holders is at historic lows - an opportunity that occurs infrequently.

Funding Rates

Positive funding rates imply that speculators are bullish, and long-traders pay funds to short-traders. Negative funding rates mean that speculators are bearish, and short-traders pay funds to long-traders.

P.S. Funding rates (0.01%) - black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) - red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

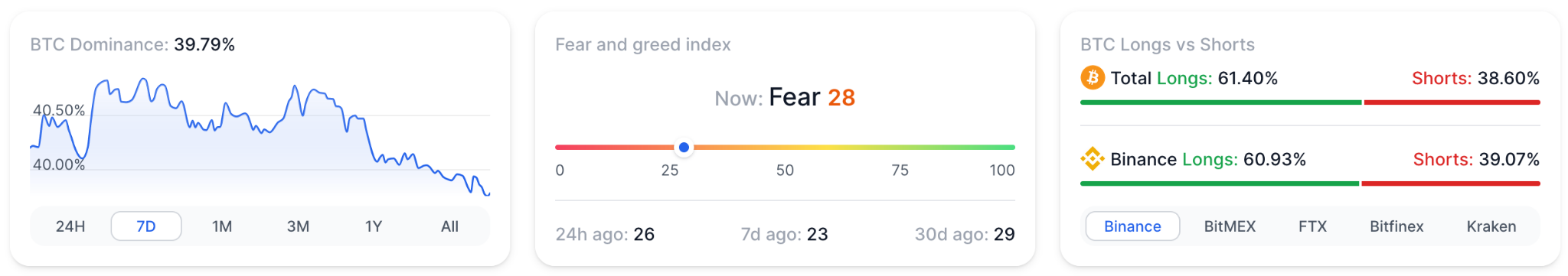

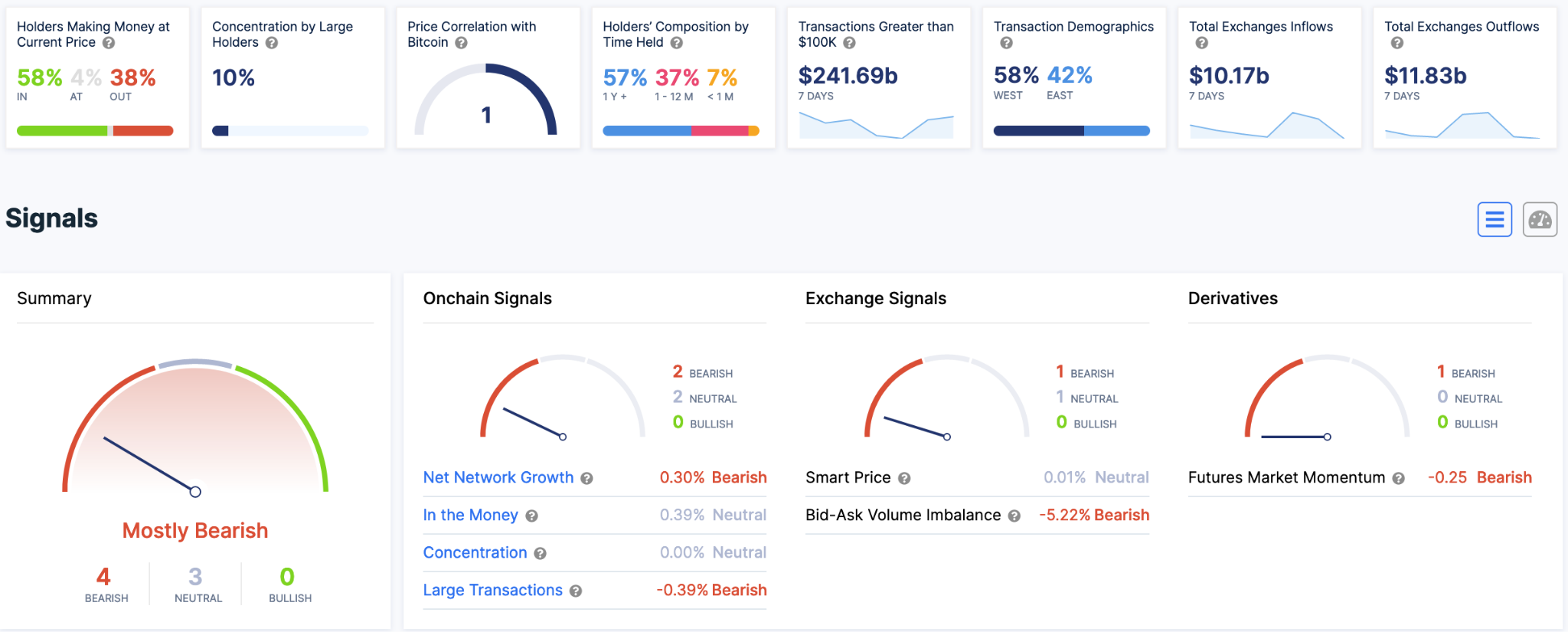

Off chain data