The peculiarity of Aave is to grow after bitcoin and major altcoins (any coin from TOP-100, except BTC), as well as independently of them during the stagnation of the cryptocurrency market. Due to this dynamic, the Aave token is among the mandatory set of digital assets that should be purchased and held to earn double income.

The easiest and fastest way to become the owner of the asset is to buy Aave on the popular licensed platform broex.io in 1 click. Read in the review what is the value of this crypto token, how beginners can earn on it and how to use Broex service.

Aave: what it is

Aave is the base token of the DeFi protocol (a sector of finance that works like a bank, only in a decentralized sphere).

Project milestones:

- Started in 2020 under the name ETHLend, and its own token was called Lend;

- Licensed by the FCA, the UK Financial Conduct Authority;

- Initially operated on a P2P (user-to-user, hand-to-hand) basis;

- rebranded a little later, reorganized to the P2C model (between the platform and clients directly, without intermediaries).

Lend (OLD) tokens were converted to Aave (Atoken) in a 100:1 ratio.

How Aave works

Aave's platform allows anyone to be a lender and/or a borrower. So, one can

- Place crypto assets on deposit (create liquidity) and receive interest on loan provision.

- Borrow as a debtor some cryptocurrencies secured by others, paying a lending interest.

An example of capitalization of monetary assets and rates.

.png)

The loan can be taken for various periods of time, starting from a few minutes/hours to be used at one's discretion without any conditions. The option of depositing funds for safekeeping at interest is present on the Aave platform itself, other trading platforms - the DeFi projects sector or with multifunctional capabilities, like Binance.

Aave characteristics

The work of the project is the same as in a traditional bank with the difference that the transactions are not managed by employees, but by the Ethereum network smart contracts protocol:

- Transactions, regardless of size, are instantaneous, and with no paperwork.

- The return exceeds the possibilities of deposits in fiat (real currencies - ₽, EUR, USD).

- The feature of instant loans without collateral, which are made within 1 block, deserves special attention.

Obviously, the platform has opened up new commercial opportunities for cryptocurrency owners.

Ways to make money with Aave

All assets are accounted for in internal Atoken. There are several ways of earning income:

- Passive – receiving interest for providing liquidity.

- Combined - from placing the sum under the interest, lending for the same amount with the further repetition of the scheme up to 3-4 and more rounds and reaching an annual percentage of 35-50, not counting the potential income from the growth of the collateral assets themselves.

- From arbitrage transactions, for which the loan is taken within 1 block without collateral and payment of transaction fees.

- From economy on fees at rebalancing of portfolio (periodic adjustment of the proportions of the set of assets to a certain index), when many operations are carried out within 1 transaction.

The combined method requires a deposit equivalent to 3-5 thousand USD or more to minimize the impact of the cost of transactions in the ETH network on the final profit.

Aave Prospects

Great opportunities have attracted a lot of users to the project. Aave is in the top 10 tokens of DeFi direction. Due to the fact that cryptocurrencies are converted into Atoken for further transactions on the platform, the demand for Aave and its market rate is growing:

- In 2020, the price was in the 30-40 USD range;

- in the spring of 2021, the cost reached a maximum of 632 USD;

- today, for the 4th quarter of 2021, the price is at about 320 USD, which corresponds to a 50% correction and is considered a successful entry level;

- the chart of the coin has been in an upward trend since the start.

.png)

A feature of DeFi assets is the ability to grow not only along with bitcoin and major altcoins, but also during a period of stagnation in the crypto market, like the summer of 2020.

Therefore, the Aave token, which has managed to decentralize credit services, is recommended to be included in the set of cryptocurrencies for hold in order to generate profit in the medium / long term.

The range of exchange rate changes of the coin on daily / weekly intervals is about 10%:

- Aave can be sold on swing highs and bought back on declines.

- You can make one deal and hold, waiting for the historical maximum to be tested or exceeded.

It is worth keeping in mind that more than 13,000,000,000 of the 16,000,000 coins planned for issuance have already been released to the market.

Going forward, Aave will become a limited deflationary resource with growing purchasing power.

How to buy Aave token

To buy a coin for Russian ruble, US dollar, other fiat currencies, create an account on the Broex.io platform. Verify yourself using the simplified scheme. Then follow the steps:

- Cpen your ‘Assets’ section.

- Select Aave.

- Click ‘Buy’.

.png)

The last step is to set the volume of the transaction, deposit money from the card to your Broex account and become the owner of a profitable cryptocurrency.

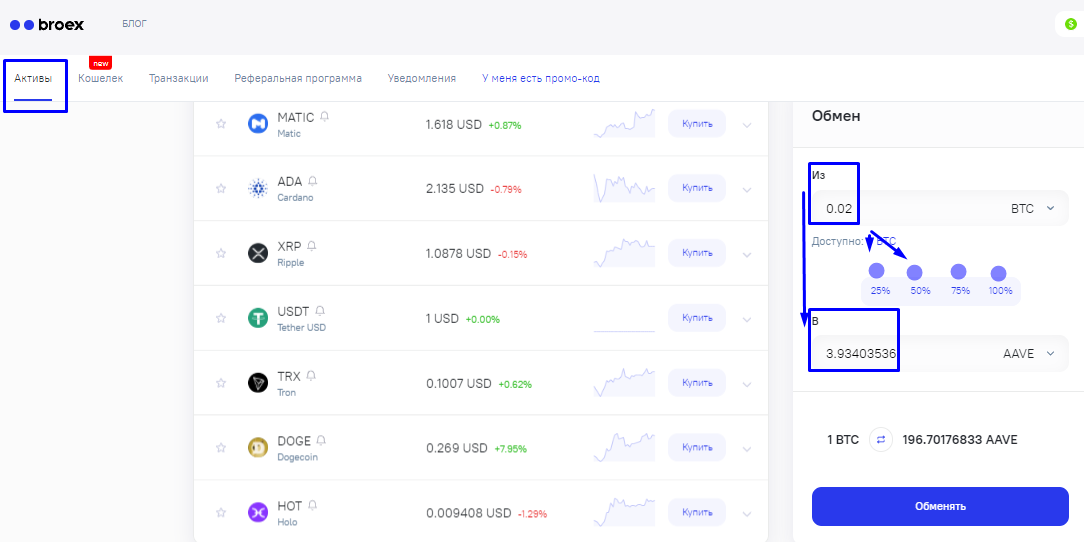

Similarly, in the Assets tab, there is an exchange for any denomination of your deposit. You can assign the number of coins or choose the option to exchange 25/50/75/100% BTC or other assets for Aave.

The Broex wallet is convenient to use as a place to store funds. From the Personal Account, you can work on drawing up a portfolio and trade. Assets are quoted at the best current prices. The rate is updated online.

All operations are automated and supplemented with pop-up tips. If you need to clarify some points, please contact Broex chat, which can be accessed on the right side of the page.

.png) The on-duty manager will answer your questions within 2 minutes.

The on-duty manager will answer your questions within 2 minutes.