There are different ways to make money on cryptocurrencies. One popular method is trading. This refers to the process of making a large number of trades to buy and sell assets to gain profit from changes in exchange rates. For example, you can buy cryptocurrency for $15, sell it for $20, and then, when its price goes down, buy it again for $15 and sell it again when its price goes up to $20.

However, without prior preparation for trading, by forming the best crypto trading strategy, there is a high chance of losing your entire deposit. To generate profits, it is important to have a plan with instructions for all market situations. There are ready-made cryptocurrency trading strategies suitable for newbies. They allow you to get started with trading faster. We will consider the best and popular strategies in this article.

Crucial to understand

Cryptocurrency trading is a very risky business. While some users earn, others lose deposits and are left with nothing. As a trader, you are fully responsible for your actions and decisions.

If you feel that you are not ready to trade cryptocurrencies all the time, even according to ready-made strategies, but you want to invest money - just buy coins. In the long run, as history shows, the rate of classic assets ( like Bitcoin or Ethereum) always goes up. So, simply buying cryptocurrency to sell it more expensive later will minimize the risk of losing money.

Where to buy cryptocurrencies securely for long-term storage is described at the end of the article.

Fundamental and technical analyses

Cryptocurrency exchange trading strategies are based on either fundamental or technical analysis. Or both at once. Let's look into these terms.

Fundamental analysis

It is based on an in-depth study of information about a cryptocurrency. For example, you can select a specific project, and analyze:

- whether the development team is strong;

- whether the project is useful to the market;

- whether the asset has real applications.

And then decide whether the asset is overvalued or undervalued. If it becomes clear that the price is unfairly low and should grow in the future - then the cryptocurrency should be bought. And after the rise to the expected price - sell.

Thus, fundamental analysis is simply the study of information, almost without taking into account what is happening on the charts.

Technical analysis

Technical analysis is the process where a trader predicts future price movements by looking at how it has changed in the past. To do this, a cryptocurrency chart is examined. For example:

- you notice that every time the price of a cryptocurrency falls by 10%, after that there is a slight rise of 2%;

- the next time the situation repeats, you buy the cryptocurrency after a 10% drop, and sell after a 2% rise.

In this case, you have formed a cryptocurrency trading strategy based on technical analysis. It doesn't take into account the news background, the specifics of the project, and what is going on in its development. Only "dry" indicators are important in technical analysis, the vast majority of which are visible on the chart.

Below we will consider two of the best crypto trading strategies based on technical analysis.

Trading by trend

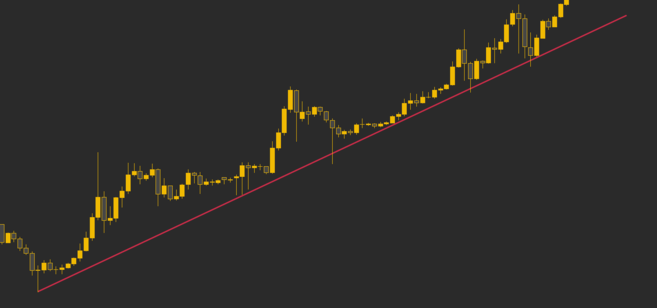

In trend trading, the most important thing is to identify the trend. It can be upward or downward. If a trader wishes to make a short-term trade of an hour or two, he will use the 15-minute or hourly chart (when each bar on the chart represents the change in price over 15 minutes or an hour).

To determine a trend, one must analyze local lows (values below which the price did not fall after the next small decline) and local highs (values above which the price did not rise after the next small rise).

If the local lows and highs are higher than the previous ones, as shown in the screenshot below, the trend is upward. If they go down, the trend is downward.

For example, in the case of an uptrend:

- you need to draw a line through the local lows (as in the screenshot above);

- when the price goes down to the line, buy the cryptocurrency;

- sell when the price goes up.

To determine the moment to sell, you can draw the same line through the local highs (then, together with the line drawn through the lows, it will form a channel in which the price is moving). And then sell the cryptocurrency when the price approaches the line drawn from the local highs.

Breakouts and bounces from support level

A support level is a value that price has approached several times and has always "pulled back" from it upwards. A cryptocurrency trading strategy based on support levels is divided into 2 types:

- Bounce trading. When the price has once again "bounced" off the support level and started to rise, the trader buys the cryptocurrency. Then sells before the price drops back down to the support level.

- Breakout trading. There is a chance that when the price comes up to the support level again, it will not "bounce" from it, but "break down" the level. In this case the trader opens a short deal.

Some trading platforms allow opening short trades. In this case, the user borrows cryptocurrency from the platform and sells it for, say, $100. When the price drops, the trader buys the same amount of cryptocurrency back, say, for $95. After that, all that remains is to return the cryptocurrency back to the marketplace (and pay a small fee). And the $5 proceeds remain in the user's account as profit.

Experienced traders combine both strategies, so as not to miss out on additional opportunities. They trade both breakouts and bounces, depending on the situation.

Similarly, you can also trade breakdowns/bounces from resistance levels. A resistance level is a value that the price has approached several times and "bounced back" down.

Cryptocurrency arbitrage

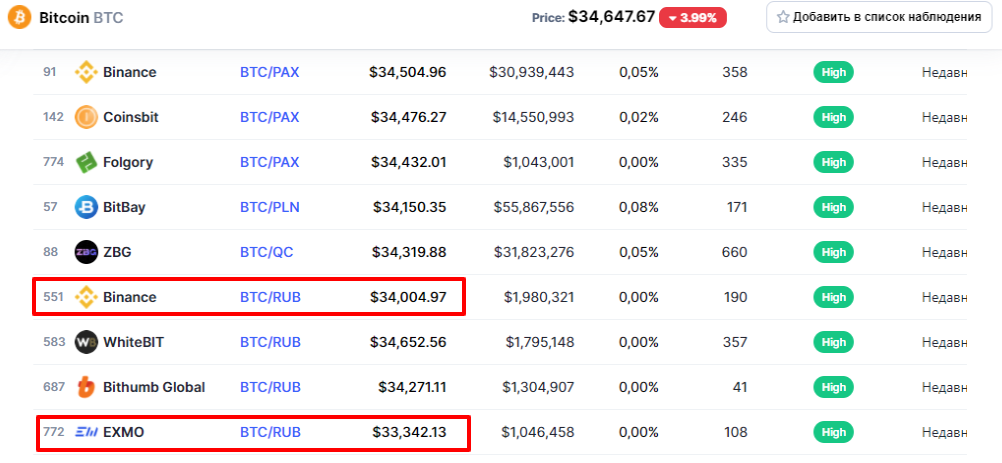

It's a type of trading that requires neither fundamental nor technical analysis. Cryptocurrency arbitrage is buying coins on one trading floor and then selling them on another, at a higher price. Look at the screenshot:

There are cases when there is a significant difference in the price of a cryptocurrency on two platforms. If you react in time, you can profit from this situation. However, before engaging in cryptocurrency arbitrage, you should:

- study the amounts of fees on both platforms;

- understand how long it takes to transfer assets from one platform to another.

In addition, the price has the potential to stabilize and equalize before you have time to sell the cryptocurrency. Then you will lose on fees. Therefore, this strategy of trading cannot be regarded as risk-free. Similarly, as with other techniques, it is possible to lose a part of the deposit.

Rules for successful trading

Even the most profitable crypto trading strategy will not be useful if you don't follow a number of rules. The main ones are listed below:

- Don't risk more than 1% of your deposit in a transaction. If you made a wrong assumption and opened a losing trade, close it before you go into deep redemption. Newbies are inclined to "wait out" the situation, hoping that the price will return to its previous values, and the deal will be possible to close without losses. In practice it often leads to even bigger losses when the price keeps moving in the "wrong" direction.

- Combine different cryptocurrency crypto trading strategies, ready-made and your own. To become a successful trader, you need to try many techniques for making deals. So you will find "your" strategy, convenient for work and bringing a stable profit.

- Start with a small deposit. If you trade successfully with small amounts, your profit will be insignificant. Nevertheless, in case of unsuccessful trading, losses will also be insignificant. For a person, starting to trade in cryptocurrencies, it's vital to gain skills and experience, rather than to make money. To work with large amounts of money is worth it, when you will find "your" strategy, and you will stably trade with a profit.

- Do not use "signals" from guru-traders. The beginners often trust the ads of people selling paid access to channels with information on deals. Guru-traders promise that the user will just have to copy trades and earn. However, after buying the access, it turns out that both profitable and unprofitable trades are published in the channel. That's why beginners just lose money following such signals and don't even get experience in return that is necessary to gain when trading independently.

- Don't trade with your last bit of money. When a person feels he/she must not lose the deposit, there is a big risk that emotions will take over. In this case, the user starts deviating from his best cryptocurrency trading strategy and opens wrong deals. After making a loss, the user tries to "win back" quickly, leading to the loss of the entire deposit. To trade, it is necessary to allocate an amount that would be unpleasant to lose, of course, but not critical.

Is it worth learning cryptocurrency trading

Experienced market participants are aware that 95% of traders lose money, not earn it. Trading with cryptocurrencies, even with well-tuned strategies, is a complicated business. You need to avoid mistakes, control your emotions, and refine your strategy with the changing market conditions. That's why trading isn't for everyone.

If you are a beginner in the market, the best strategy for trading cryptocurrencies is to simply buy the asset in order to keep it for the long term. Its advantages:

It doesn't require any time investment. You only need to buy cryptocurrency once and "forget" about it for a while.

It's available to everyone. You won't need millions to invest - you can buy Bitcoin or other coins for a couple of thousand rubles.

The only difficulty is to find a reliable exchanger where you can safely convert rubles, dollars or euros into Bitcoins and other cryptocurrencies. To avoid the risk of running into scammers, experts recommend using legal platforms with an official license. For example, the Broex exchanger, the advantages of which make it the best choice for users who are just starting to invest in cryptocurrencies.

The advantages of Broex

Broex is a cryptocurrency exchanger that operates 100% legally. The company that owns it has an official license in Estonia, which means that it has passed all the inspections of the state authorities. So, with Broex, you are protected from fraud and don't have to worry about the safety of your funds.

The exchanger was specifically designed to be convenient for beginners. That's why it has a simple interface and no unnecessary features. Anyone can master the process of buying and selling cryptocurrencies through Broex, and literally in 15 minutes.

Other advantages of the exchanger:

- Low fees. Broex charges 0.1% of the transaction amount to help you make the exchange.

- 24-hour technical support. If you need advice, you can get it literally within a couple of minutes. The operators are always ready to help and respond.

- The minimum deposit is 1500 rubles. You can start studying the cryptocurrency market even with a small amount.

- Instant replenishment with a bank card or through AdvCash. It's possible to buy cryptocurrencies immediately after making a deposit.

- Large selection of cryptocurrencies. More than 2,000 digital coins are available. You can invest in both classic assets and new promising projects that can show even more growth.

However, Broex is more than just an exchanger. It's also a custodial cryptocurrency wallet. This implies that you can entrust the storage of purchased cryptocurrencies to the company. You don't have to withdraw the assets anywhere, experiencing the hassle of having to master third-party wallets. You can simply buy cryptocurrency and leave it with Broex for safekeeping, and then sell it when the time comes.

You can access your personal account to check balances or make transactions at any time of the day or night. In addition to the website, Broex has an app for smartphones and pads. It copies the functionality of the website, so you don't need to use a PC.

Sign up to buy your first cryptocurrency with the handy and reliable Broex exchanger!