The crypto industry expands every month - new projects and entire ecosystems emerge. This trend will continue in 2022, as the sphere is still far from its final formation. Startups that enter the market attract funds from people willing to invest. The money is needed for development: paying developers, marketing campaigns, and so on.

There are different ways to raise funds. In this article we will look at the differences between STOs and ICOs. What is the difference between them, which method is more reliable, and whether you should participate in these activities, read below.

What is ICO

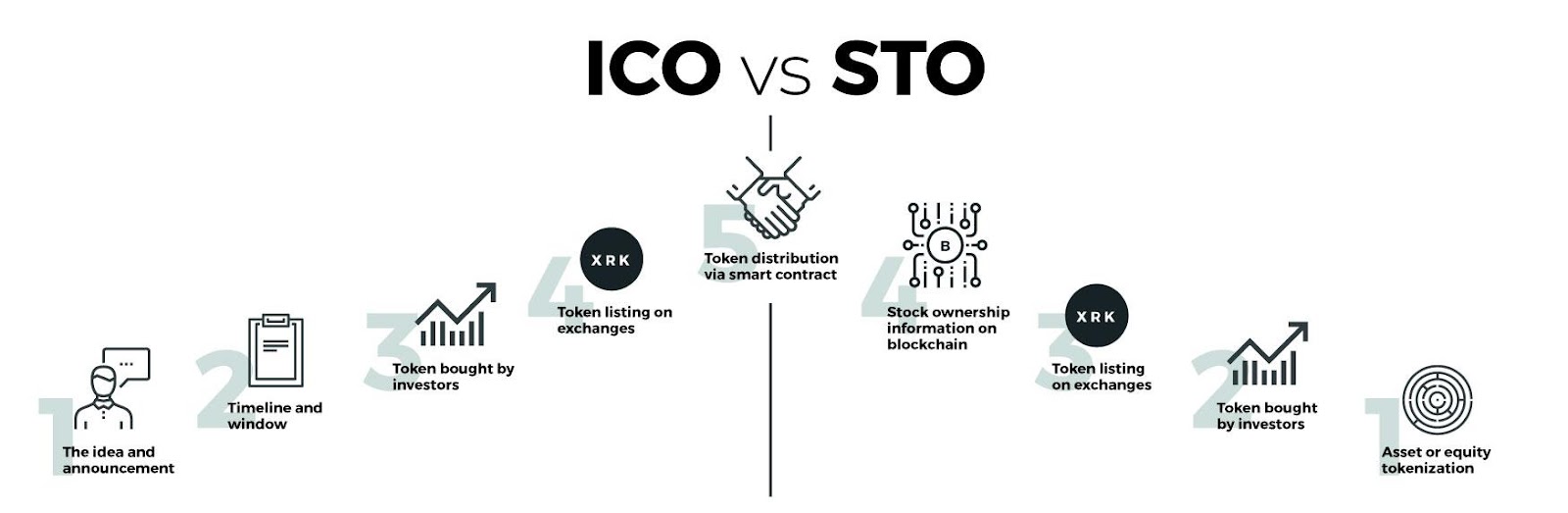

ICO stands for Initial Coin Offering. It's a way to raise funds, consisting of the following:

- the company developing the product publishes information about the ICO, and how to participate in it;

- those people who are interested in investing register according to the rules and transfer the funds to the company;

- some time later, the project tokens are automatically distributed among the users who have invested.

- At this point, the ICO is considered completed. Investors assume that the tokens of the project will grow after the project is launched in the open market or over time.

This is what attracts - you can invest $1,000, and after 2-6 months to get already $ 5,000, or even all $ 20,000.

What is STO

For the average user the difference between the ICO and STO is not significant. In fact, STO is a subtype of ICO, but with a number of features:

- the company conducting the STO must be inspected by regulators like the SEC;

- there is no risk of fraud - only trustworthy startups with a promising product are allowed to conduct STOs;

- it's difficult to invest - you need a lot of money, and in many cases - the status of a qualified user in terms of working with securities.

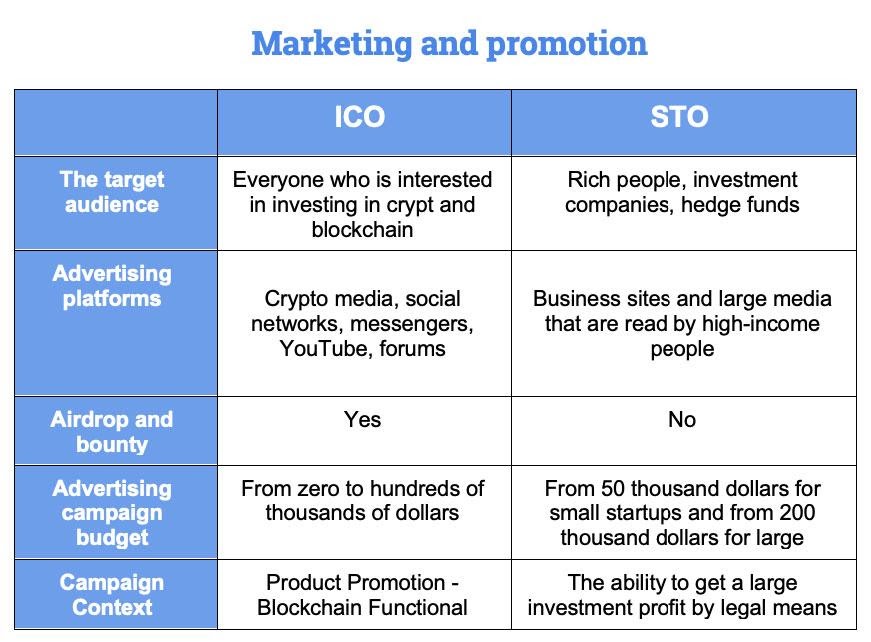

Differences between STOs and ICOs

Based on the above, it becomes clear that the STO and ICO - are almost identical procedures, which differ in the complexity of the organization and the threshold of entry. Anyone can conduct an ICO, providing there is enough credibility to convince the market that it is a worthwhile project. As for STOs, the state regulators will have to be persuaded as well.

Therefore, participating in the ICO, the user runs the risk of running into a fraudulent project. Developers may turn out to be swindlers, raising funds for a product that will not be launched in the future. Or it will be launched, but in a low-quality and incomplete form. In this case, the tokens of the project will fall in value, and the investor may face a big loss.

By taking part in STO, there is no need to check the trustworthiness of the developers.

Pros and cons of ICO

To better understand the differences between ICO and STO, let's look at the advantages and disadvantages of each fundraising method. ICO has the following advantages:

- Low entry threshold. Usually you can invest even $10, so participation is available to ordinary users who have just begun to master the crypto market.

- Anonymity. You don't need to disclose your identity - the only requirement is to register and make a deposit, and the cryptocurrency of the project will go to a decentralized wallet.

- Automatic distribution of tokens. Digital coins will be sent to the wallets of the ICO participants on a predetermined date.

- Simplicity of profit making. When a user receives cryptocurrency, he can immediately sell it on one of the decentralized exchanges. However, this project must be attractive to the market - otherwise no one will buy these tokens, or their price will be very low.

- Through ICO anyone can increase their own funds, provided they can choose a reliable project.

Now consider the disadvantages of ICOs:

- The risk of coming across a fraudulent project. No one can guarantee that the cryptocurrency will really grow in price, and you will be able to get profit.

- Potential problems with development. Even an honest and decent company can encounter unforeseen difficulties, and their solution will take a long time. In this case, there is a possibility that it will take a very long time for the price of cryptocurrency to increase.

Pros and cons of STO

It is important to take into account that in the case of STO, cryptocurrency is equated by the regulators to securities. Accordingly, the company is subject to certain laws.

The advantages of STO:

- Only reliable projects. Regulators have already checked the company admitted to STO. Investing funds, you can be sure that the project will not be a fraud.

- Clear profit realization model. It is usually known in advance on which platforms the cryptocurrency of the project will be traded. Moreover, these platforms will also be subject to the law, so you can use them without any fear.

At first glance, it may seem that STO is much better than ICO, because of the differences in terms of regulation. However, there are disadvantages that make participation in STOs a less affordable investment option:

- You'll have to wait longer for profits. It usually takes much longer from the time of fundraising to the release of the cryptocurrency in the open market in comparison to an ICO. Sometimes all stages of the procedure can take more than one year.

- Participation is not available to everyone. You can't just register, make a small deposit, and eventually sell cryptocurrency at a higher price. Qualified user status is required, requiring a number of checks to be passed in order to obtain it.

- A large deposit is required. In most STOs, to invest, you need from 2-3 thousand dollars minimum.

Is it worth taking part in STOs and ICOs

With the right approach, both STOs and ICOs are good ways to raise capital. Each method of fundraising is time-tested. They have proven themselves among the market participants as a way to increase the deposit dozens of times in a short period of time - from a month to a year.

However, participation in STOs is inaccessible for most ordinary users. As for the investment in ICOs, they are connected with big risks. Therefore, both methods, unfortunately, are not suitable for beginners who have just begun to study the cryptocurrency market. Of course, no one will prohibit investing in a promising startup conducting an ICO, but whether you can find a reliable project is a big question.

That's why experts offer beginners to invest in time-proven cryptocurrencies that everyone understands. For example, Bitcoin or Ethereum. They always grow in the long run, so whenever you buy digital coins, in a few months or years you will be able to sell them with a big profit.

How to buy cryptocurrencies

To invest in classic digital assets like BTC or ETH, we recommend using Broex. It's a reliable exchanger that has received an official license to operate in Estonia. In addition, Broex also provides a coin storage service. So, you don't have to withdraw them to third-party wallets - you can quickly buy cryptocurrency, and when the time comes - also easily sell.

Besides, Broex offers:

- low commissions from 0.1% per transaction;

- minimum deposit - 1500 rubles;

- instant deposit of funds with a bank card or through AdvCash;

- a wide range of cryptocurrencies and digital tokens;

- user-friendly interface even for beginners.

Join Broex if you want to invest in cryptocurrencies quickly and easily!