Liquidity pools are one of the key technologies of the entire DeFi industry. It's used in the creation of new digital assets, cryptocurrency games, and, of course, on DExs like Uniswap or PancakeSwap.

What are liquidity pools in simple words, how they work and whether you can earn money - in our new review.

What is a DEX?

Before you start to get acquainted with liquidity pools (aka LP), it's a good idea to know more about decentralized exchanges - the main market where this technology is required.

In the early days of the crypto market, centralized exchanges, or CEX, were the primary - and almost the only - platforms for exchanging tokens. They include Binance, Kraken, OKEx, and Huobi.

However, the market evolved, and CEX soon had formidable competitors - decentralized exchanges, or DEXs. What is the key difference between these two types of trading platforms?

As for CEX, the following takes place: A new trader registers on the exchange and opens a special exchange account. In return, he gets access to a user-friendly interface for trading and a highly liquid market - in other words, the desired asset at the right time the trader can exchange with about 100% probability.

At the same time, the client gives the exchange his private keys to the company. The exchange is the guarantor of the security of the funds - and, in fact, the real owner of the coins. It selects the best counteroffers based on the buy/sell orders created by users, and keeps some coins in its own reserves to make sure the orders are fulfilled.

A different approach is used in DEX. Here, users are not required to share their private keys. They - the users - are responsible for exchange reserves, filling those same liquidity pools.

What are liquidity pools?

Here we come to the main heroes of today's review - LPs, or liquidity pools.

Liquidity pools are special accounts where each user can allocate his money, thus maintaining a high level of exchange reserves. Of course, in return such a client claims a reward - a part of the platform's commission.

Since users always exchange two currencies - for example, it can be ETH to MKR - the pools that support referrals also require depositing two currencies. In our example, the user deposits ETH and MKR into the pool, respectively. Coins are deposited in 50/50 ratio - with correction for exchange rate.

If MKR is now at $2,000 and ETH is at $3,000, 3 MKR and 2 ETH are needed. Of course, you can deposit a larger or smaller amount, for example, 6 MKR and 4 ETH.

Each DEX offers a large number of exchange directions, which means many pools on which you can earn.

While two assets in a pool is a standard, some platforms don't mind experimenting with numbers and complex schemes. For example, Balancer offers pools where the number of assets is expanded to eight.

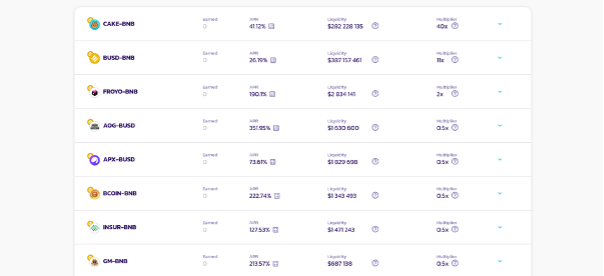

Screenshot from DEX PancakeSwap.finance page

How to earn in liquidity pools?

So, we have just figured out where the liquidity provider's rewards come from - the users who fill the pools. This source is fees (or rather, part of them) paid by other traders.

Here's where it's worth noting: if you put money in the UNI/AAVE pool, you will receive rewards only based on transactions between these two currencies. For example, UNI/ETH - this is a completely different pair and a completely different pool. Commissions will not be charged from it.

How to join the liquidity pool and start earning? In brief, it looks as follows:

- Select a suitable DEX. Interested in trading Ethereum ERC20 tokens - ETH, UNI, AAVE, MKR, WBTC, and more? Then you should probably choose Uniswap or Sushi.

- Install a Wallet. There is no usual login, password or email on DEX - you enter through special applications-wallets. One of the most popular is MetaMask. Once you installed the wallet, you will return to the website of the selected exchanger and click Connect Wallet.

- Deposit the address. The app is installed, the address is generated, but it's still empty - there is not a single token on which you could earn. It's about time to fix that! If you already use Broex, you can easily buy tokens for the address you want by card or any other convenient way.

- Connect to the pool. All you need to do is connect to the right pool, specifying how much you want to add to your account. And don't forget to confirm the transaction in the MetaMask wallet or its alternative.

Lifehack: the best way is to connect to a small pool with high transaction activity.

The Risks of Liquidity Pools

The advantages of LPs are very clear - it's the ability to make N+1 tokens out of N tokens in a simple and straightforward way. Kind of a deposit in a bank account.

But this venture has risks, and you should be aware of them.

Hacks. Perhaps it's the biggest problem with DEX, lending services, and other platforms that use pools. Hackers use the slightest vulnerability - and often the incompetence of service developers - to steal millions of dollars that recently belonged to traders.

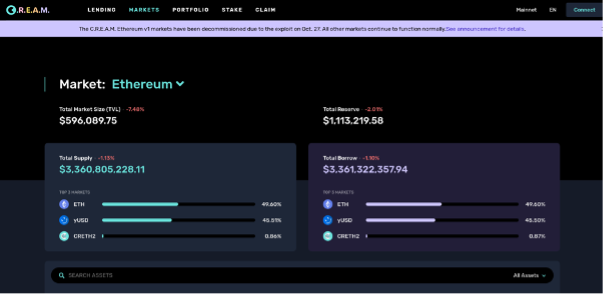

Case in point: CREAM Finance, once a popular DeFi platform, has fallen victim to hackers several times. During one of these attacks, cybercriminals became $130 million richer. Users didn't.

CREAM Finance, despite exploits, remains in business

Impermanent Loss. A rather complex topic that often gets overlooked is impermanent losses. It's better to give an example to illustrate:

We have a pool of ETH/MKR on exchange X. And there are 20 ETH and 30 MKR in this pool. One trader has contributed 2 ETH and 3 MKR, for a total of $12,000. His share in the pool is 10%.

But the volume of the pool changes: at some point, 10 ETH and 60 MKR remain in the pool.

The user decides: now is the time to withdraw funds. But he can withdraw 10% of the total pool volume. That is, 1 ETH and 6 MKR.

The trader withdraws funds - even with some profit - but the reality is that his original 2 ETH and 3 MKR would have been worth more if he had kept them in a simple but safe wallet - yeah, we're talking about Broex, of course.

Trends

Decentralized exchange keeps evolving. One of the main trends in recent months is cross-chain. Uniswap works exclusively with Ethereum ERC20 tokens (these are already familiar ETH, WBTC, MKR, UNI, and others), while PancakeSwap works exclusively with Binance Smart Chain tokens (BNB, BTCB, CAKE, and others). However, the new platforms are preparing to provide exchange of assets from different ecosystems - Ethereum, Binance Smart Chain, Solana, Cardano - well, here everyone has their own preferences and technical abilities.

Of course, to join such cross-chain aggregators, you will also need to top up your addresses to begin with. Once again, Broex comes to the rescue - all the top coins from different ecosystems are collected here:

- ETH;

- SOL;

- BNB;

- DOT;

- ADA;

- MATIC;

- BTC;

- and many others.

ChainSwap: perhaps the oldest cross-chain exchange platform in development

Conclusion

Whether you want to hodl crypto, use it in pools, or trade it all, you need a reliable wallet with user-friendly functionality.

Liquidity pools is a technology that, like crypto itself, has come to stay. The Broex wallet will be an excellent assistant for many years to those interested in DeFi.

With Broex it's easy to fund any account, send funds to a friend, get the main information about the market, and, of course, to withdraw the multiplied digital funds.

All this is safe, according to European standards and under the guidance of a team of professionals.

You can use your wallet via desktop on any OS - all through a browser. Or - through one of the handy mobile apps for iOS or Android. It is not only simple and comfortable, but also allows you to keep your funds always at hand. Literally. All these features are in Russian, settlements are made in the usual currency - Russian rubles, and there is no less Russian-speaking support team in touch 24/7. All in all, it's a good place to start a successful purchase.