Decentralized stablecoins, decentralized exchanges, decentralized lending. It's all part of the DeFi industry. How does it work, what does it offer, how does it differ from traditional finance, and are there any drawbacks? We'll tell you all about that in this article. Sit comfortably and let's go!

What is DeFi in simple terms?

Although the first attempts to build DeFi services were made in 2014-15 with the emergence of Ether, the phenomenon started to gain significant traction in 2019. And since then, the market has been actively expanding its audience and functionality.

In fact, Maker was launched before Ether

In fact, Maker was launched before Ether

Decentralized finance is an alternative to traditional finance. The DeFi industry offers cryptocurrency users the same services as banks, credit unions, lending services, and other institutions. A major difference is that intermediaries are either eliminated or their influence is mitigated.

DeFi refers to all financial services and applications built on blockchain, such as Ethereum or EOS. Of course, to start taking advantage of this new market, it's a good idea to have a crypto - TRX, SOL or ETH. For convenient channels to buy and a wide range of coins, go to Broex.

But why do we need decentralized finance at all? And we have five reasons for this:

The first reason is the opportunity to generate additional revenue for those who already have cryptocurrency. Certainly, holding digital coins looks lucrative itself, but who's going to turn down more? In the DeFi industry, cryptocurrency can be

- traded faster with lower commissions;

- deposited on stake or in liquidity pools - in general, think of it as a bank deposit;

- lent or, conversely, borrowed.

The second reason is the ability to access banking or brokerage services, even if you are surrounded by taiga and fat striped raptors fattened by reserve keepers.

The third reason is that it's cheap. Transaction fees on cryptocurrencies are usually much lower than on traditional banking systems.

The fourth reason is the opportunity to make the financial market honest and more resilient to the influence of corporations. The transparency of blockchain and open source contribute to this.

The fifth reason - actually we needed five reasons to post a funny picture.

Here it is, by the way.

But yeah, there's a fifth reason, too. It's an opportunity to bring your asset to market. Well, previously only large companies could do this, but currently you can do it as well. It is called tokenization, and everything can be tokenized - a startup's shares, an unexpected oil well discovery, a Rolex bought at a Chinese flea market, your own skills of an expert in political science and ergonomics of lying on the couch. In general, anything you want.

Degrees of Decentralization

We’ve mentioned here that DeFi allows us to eliminate or at least mitigate the influence of intermediaries. Hence, the conclusion - not all DeFi is equally decentralized.

DeFi is commonly divided into 6 degrees. Thus, services of degree 1 include nearly centralized products. Unlike centralized exchanges, they don't store customer assets, but perform updates centrally, set rates centrally, and operate on coin rate data from centralized services. In contrast, services of degree 6 have each element - quotes, percentages, development - decentralized.

What is staking?

DeFi is largely associated with cryptocurrencies that support Proof-of-Stake. Most of the projects that have boosted decentralized finance - Cosmos, which integrates different blockchains, Chainlink's oracle, or EOS, which aspires to be a better version of ether - all support the Proof-of-Stake (PoS) mechanism.

An awesome article from Broex about Proof-of-Stake can be found here. For now, here's a brief recap of the previous series:

Bitcoin and other early cryptocurrencies run on Proof-of-Work. Their idea is to keep the network secure and to mine new coins with computational power - a process known to all and called mining.

But years went by, and another promising solution appeared - Proof-of-Stake. Its idea is to replace calculations with validation - blocks can be processed not by those who have a more powerful mining equipment, but by those who have more coins on the stake, a special account. In reality, though, the idea looks a little more complex and elaborate. Ordinary users with a smaller supply of coins are able to make money as well - the coins can be delegated to promising candidates for validators. This way of earning is called, as you have already guessed, staking.

Ethereum, by the way, is still using Proof-of-Work algorithms, but the team has finally begun the transition to Proof-of-Stake. You can earn with Ethereum staking right now, and you can buy your first (second and third) ETH with your credit card or other payment systems with Broex.

Crosschain

One of the DeFi features of 2022 is crosschain. Users are able to exchange assets between different blockchains - for example, to use Ethereum on one of the Binance Smart Chain ecosystem services, if the terms there seem more favorable.

Not that we're bragging, but Broex is an official Binance partner. And Binance Coin is also available to users of the company wallet.

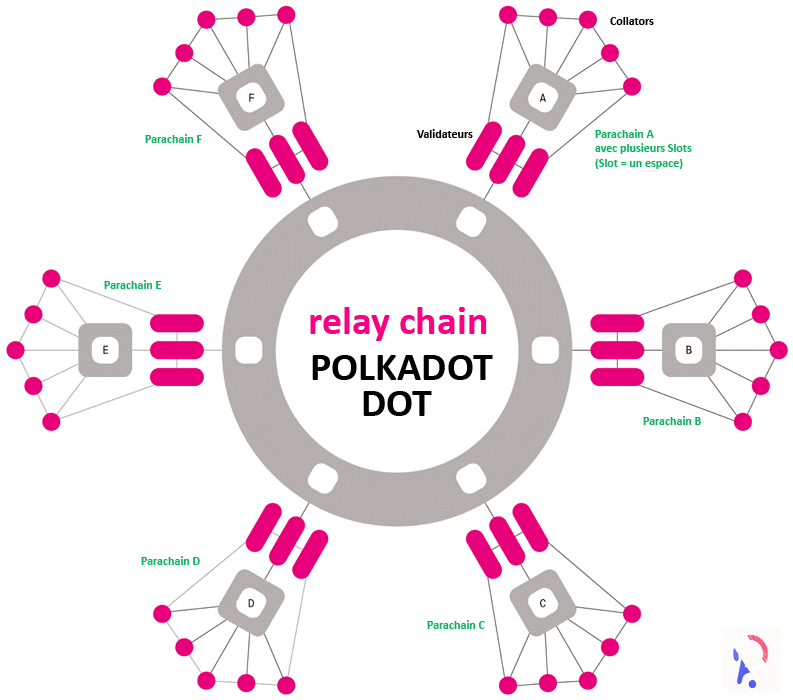

The direction is actively developing - here you can find a variety of solutions for combining chains and assets: bridges, wrapped tokens, parachains.

French community explains how parachains work in Polkadot

What is a decentralized exchange, and how does it work?

Let's move on to perhaps the most delicious part of our narrative - decentralized exchanges (DEXs).

In general, first attempts to build DEX were made about the time when Ethereum appeared. Early DEXs were exactly what was expected - they were platforms where users exchanged tokens without intermediaries.

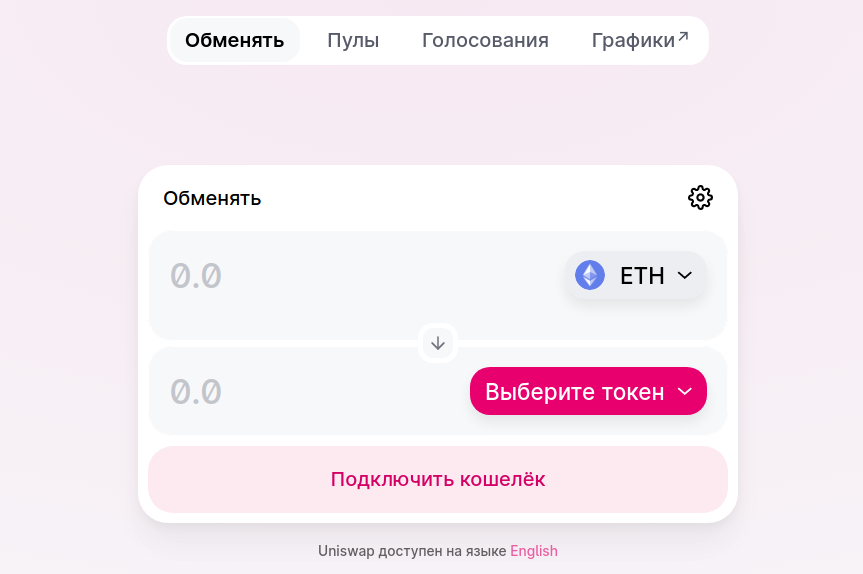

Today's Uniswap, SushiSwap, and Pancake are more complicated and don't even require a participant to be present at the other end of the exchange. These services are also called Automated Market Makers (AMMs) - and now we are going to look under the hood of these majors.

Uniswap: like an exchanger, but cooler

AMM users earn money by supplying liquidity pools (LPs) with their coins. For example, you can put your ETH and UNI into a special ETH/UNI account (pool). Someone comes to the service to exchange Ether for Uniswap token or vice versa? The coins he needs will be given to him from the appropriate pool.

Those who supply the pools with their assets get rewards - they are generated from the fees paid by the traders.

And as you have already guessed UNI, COMP and other tokens are on the Broex list.

This pooling approach keeps things decentralized, but doesn't require users to interact directly with each other. And yep, it's a great way to make money.

Pay attention: some centralized services masquerade as decentralized, so before you start using the next platform, it is worth checking it out.

What is crypto lending?

DeFi loans, or crypto loans, is another prominent trend in the decentralized finance market. The idea is simple: the user takes crypto from the pools, uses it at his/her own discretion and returns it with interest. Or vice versa - he transfers it to the same specialized pools and gets his interest from those who took the loan.

Everything is fast and automated - a great alternative to real microloan services. The most popular examples are AAVE (Ethereum ecosystem) and Venus (Binance Smart Chain ecosystem).

Crypto lending platforms have their own disadvantages:

- rather high fees for microlending transactions;

- the requirement for collateral greater than the amount the user intends to borrow;

- unclear schemes for calculating the debt and interest of the reward.

What are tokenized assets?

It's a bit of a forgotten but still promising trend. The idea is to turn assets like gold or company stock into a token - like ETH, SHIB or UNI.

For example, a tenth of Tesla stock could be traded as one TSLA token. This is convenient for those who don't have access to the stock market; for those who for some reason don't want to buy a whole share at once and for those who want to exchange shares on any platforms and at any hours without following strict constraints of the traditional market.

NFT in decentralized finance

Non-fungible tokens, or NFTs, are being developed in parallel with DeFi. What do we know about NFT? Well, it's a digital art that is sold in the crypto market for hundreds of thousands of dollars. Additionally, NFTs can be in-game items that are exchanged by gamers.

In fact, NFT is used in the areas we mentioned above. The first startups are already offering NFT to deposit art with interest, or even to create new works of art to use as collateral.

Got a knack for contemporary art and know how to put pixels in the right places? Go to cryptocurrency lending services!

What are decentralized stablecoins?

Stablecoins is an essential component of the DeFi marketplace. No secret what stablecoins are - they are coins backed by other assets. For example, the USDT token is backed by dollars at a 1:1 ratio. It replaces the real dollar in the crypto market which is convenient - not everyone has quick access to currency - and allows for more efficient risk management in a volatile market.

Stableсoins have different functions in the decentralized finance market. For instance, they are used to calculate how much the client has to pay back to the service for cryptocurrency loans.

In general, if you want to take advantage of stablecoins - it's time to buy them on Broex and choose the service you are interested in.

But the market idea goes further: apart from USDT and other stablecoins, which are backed by centralized companies, decentralized stablecoins are getting more and more attention. Their value is maintained by special algorithms that encourage traders to make certain transactions - that's how the rate of decentralized stablecoins is kept at a certain level. The leader of the trend, which, of course, is represented on Broex, is UST. The token is part of the powerful Terra ecosystem (LUNA), which consists of a number of interconnected cryptocurrencies.

Bitcoin in DeFi

We've been talking about altcoins, haven't we? Can we somehow adapt the old Bitcoin to all this DeFi? Of course, we can!

An easier way is to buy wrapped tokens. It's like stablecoins, but instead of dollar or euro, they are secured by Bitcoin.

The best known examples are wBTC (Ethereum ecosystem wrapped token) and BTCb (Binance Smart Chain ecosystem wrapped token).

All you need to do after the purchase is to use the newfangled tokens for their direct purpose: on DEX or in the lending services.

Wrapped Bitcoin (WBTC): a rising Bitcoin star with its own logo

But there are more intriguing options. For example, the Stacks and PortalDeFi teams are working on their own solutions to extend the functionality of the BTC blockchain itself with certain extensions and add-ons. Portal, led by a representative from Blockstream, the team that created Lightning to make Bitcoin payments faster and cheaper, is keeping the intrigue alive. But Stacks (STX) can already brag about a full ecosystem with NFT and AMM.

Looking ahead, BTC itself may well expand functionality and offer familiar services to DeFi fans. DEX, NFT and blockchain games - the bitcoin fork, Bitcoin Cash (and Bitcoin Cash is available on Broex - you know the drill) already has all that.

DeFi Risks

We've been getting to know the benefits of the decentralized finance market throughout this long, like Tolkien cycles, article. But what about the risks? They certainly exist, and they're also worth knowing about.

Hacks and insiders. Perhaps the richest people in the DeFi sector are not traders, but hackers who steal hundreds of millions of dollars from the platform. Or, perhaps, unscrupulous platforms that create the appearance of hacking, stealing all the same hundreds of millions from gullible clients. In general, it is worth directing funds only to time-tested platforms.

Changes. Some new platforms move quite abruptly from one market to another, or equally drastically change the form of management, which is not always beneficial to their users.

DeFi Perspectives

Market functionality and awareness of it is growing. Maybe we'll have to wait before DeFi compares to the traditional market. But there's a lot of prospects ahead for the new direction. And you can be among the first to join and use the offerings now - together with Broex!