The following article covers the spread between the buy and the sell, as well as the concept of slippage. The significance of these questions for beginners is considerable, since it allows them to avoid unreasonable losses. Proper information will give you a better control of your funds in trading.

Introduction

As you know, when trading on a cryptocurrency exchange, market prices of assets are directly related to both supply and demand. Very often users fail to make transactions at the desired prices.

There are several reasons for this phenomenon, among the main ones are:

- Market liquidity (the ability to sell a coin quickly without loss at the market price);

- Trading volume;

- Current market situation.

Types of orders (an order is an order to exchange to make a transaction to buy or sell cryptocurrency).

Of course, every user wants to reach an attractive price level. This is true for both sellers and buyers. An order book on a cryptocurrency exchange can bring a lot of frustration and losses if there is no understanding of what principles the process is based on. Each party has its own interests and there is a spread between their offers, that is, a certain difference in value.

The bid-ask spread is the difference between the two values: the lowest asked price and the maximum offered value.

The following relationship is observed: the higher the liquidity of an asset, the lower the spread, and vice versa. Often high spreads can be seen in altcoins, which are characterized by a small trading volume.

In the cryptocurrency markets in particular, this phenomenon is a consequence of the difference between limit orders (the type of order to buy/sell at a specifically set price, which guarantees the desired price, but doesn't guarantee the execution of the order itself) of the users. External factors (brokers or market makers) in this case are irrelevant and cannot influence in any way.

In addition, there is a likelihood that the user will encounter slippage (more details about this below). It mainly depends on the amount, as well as the volatility of the used asset.

This is due to the fact that the final price of the transaction differs from the initial request, which is characteristic of the execution of market orders. The final value changes due to market volatility or lack of liquidity. One of the ways to prevent slippage for assets with low liquidity is to divide the volume of one order into several parts.

If the trader wishes to buy directly at the market price, he will have to agree to the maximum price set by the seller. If there is a desire to sell a large amount, then, accordingly, it will be required to accept the lowest price from the buyer.

The concept of liquidity in the cryptocurrency market

For asset markets, including digital currencies, the concept of liquidity is important. The higher this parameter, the faster orders are executed, and traders accordingly spend less time waiting.

Making and maintaining liquidity is a necessary thing, and in the case of digital currencies, it is done directly by the cryptocurrency exchange itself. By attracting more and more participants to their trading floor, creating more favorable and comfortable conditions for them, exchanges thereby create liquidity.

The more coins are listed (adding cryptocurrencies to the list of exchange assets for subsequent trading), the more likely the liquidity will increase, since a large listing always attracts many traders and arbitrageurs.

Arbitrageurs are the same traders in their turn. The only difference is that they buy an asset at a favorable price on one exchange and sell it at a higher price on another exchange.

Nevertheless, in the world of digital currencies market-makers are sometimes involved in creating and maintaining liquidity (more about this below). This is not a common practice, but it is quite significant.

Spread in the trading terminal

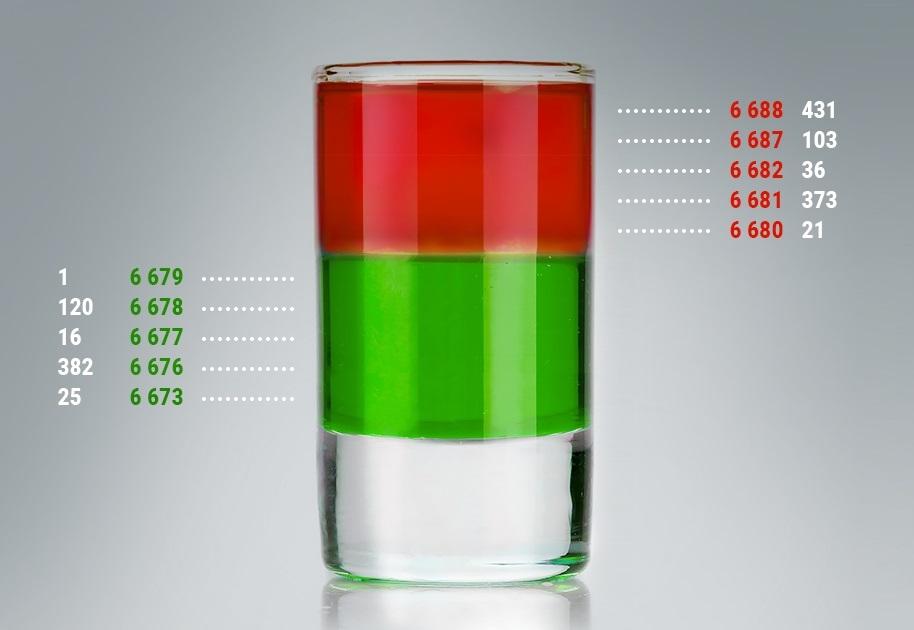

As you know, all transactions on cryptocurrency exchanges are carried out directly in the trading terminal. It has a certain set of tools and different windows, one of which is the order book. This is a section where the information regarding the trading of the selected asset, the offered prices for buying and selling of this coin is given. In addition to the information about the value, there is information about how much crypto is traded in each of the variants.

cryptocurrency order book or trade blotter

For more clarity, traditionally the red color in a separate sector contains the sale prices, and the green - buy prices, respectively.

The orders, in which a specific buy or sell price is indicated, are placed in this section. This type of orders, respectively, is called a limit order.

There are also market orders designed for cases when the user is no longer able to wait for the necessary price and closing of his order. In this case, he is ready to execute the deal immediately at the current price.

The market orders will not appear in the trade blotter, but the transaction will be executed at the moment when the limit and market orders coincide.

There are no limit or market orders alone on exchanges, otherwise users would have to wait for the exact price match. That would not satisfy many people and could have a negative effect on volumes and profitability of trading in general. In addition, each of the users, buyers and sellers are not willing to concede their prices.

That is why the Limit order and regular order work close to each other, and the difference between their values will turn out to be the very spread.

Market Makers

Market makers are organizations that work under contract with a specific cryptocurrency exchange and act as an intermediary between buyers and sellers. It is huge associations, and to maintain the balance, there can be several such organizations operating in the market.

They can compete with each other, which often allows them to achieve spread reduction. Their work is regulated, which makes such cooperation profitable both for exchanges and their participants.

Such an approach makes it possible to find a solution to the following problems:

- Maintaining the exchange structure;

- Ensuring uninterrupted processing of orders;

- Providing the necessary liquidity.

Meanwhile, market makers are also interested in this operating mode since they can use the spread for their own benefit. This is possible due to the simultaneous buying and selling of assets.

They form their profits by constantly buying at a low price and selling at a higher one. With the growth of trading volumes, profits can grow even with small spreads. That is exactly what the stock exchanges and their participants need, since that is how the liquidity is formed.

So, if you want to understand what is a spread in trading, in simple words, let us give an example. One trader wants to buy a BTC for $1000, but the other user sells a BTC for $1001. This in turn creates a spread, in this case equals to one dollar. Each of the participants will have to agree to these terms if they won't correct the price themselves. And market makers support the trading activity and make the spread value itself as their own profit.

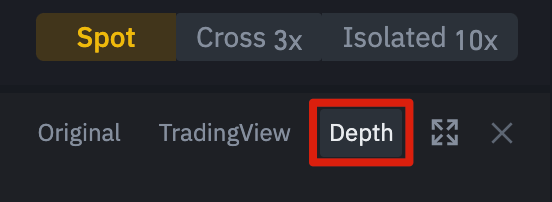

A depth chart

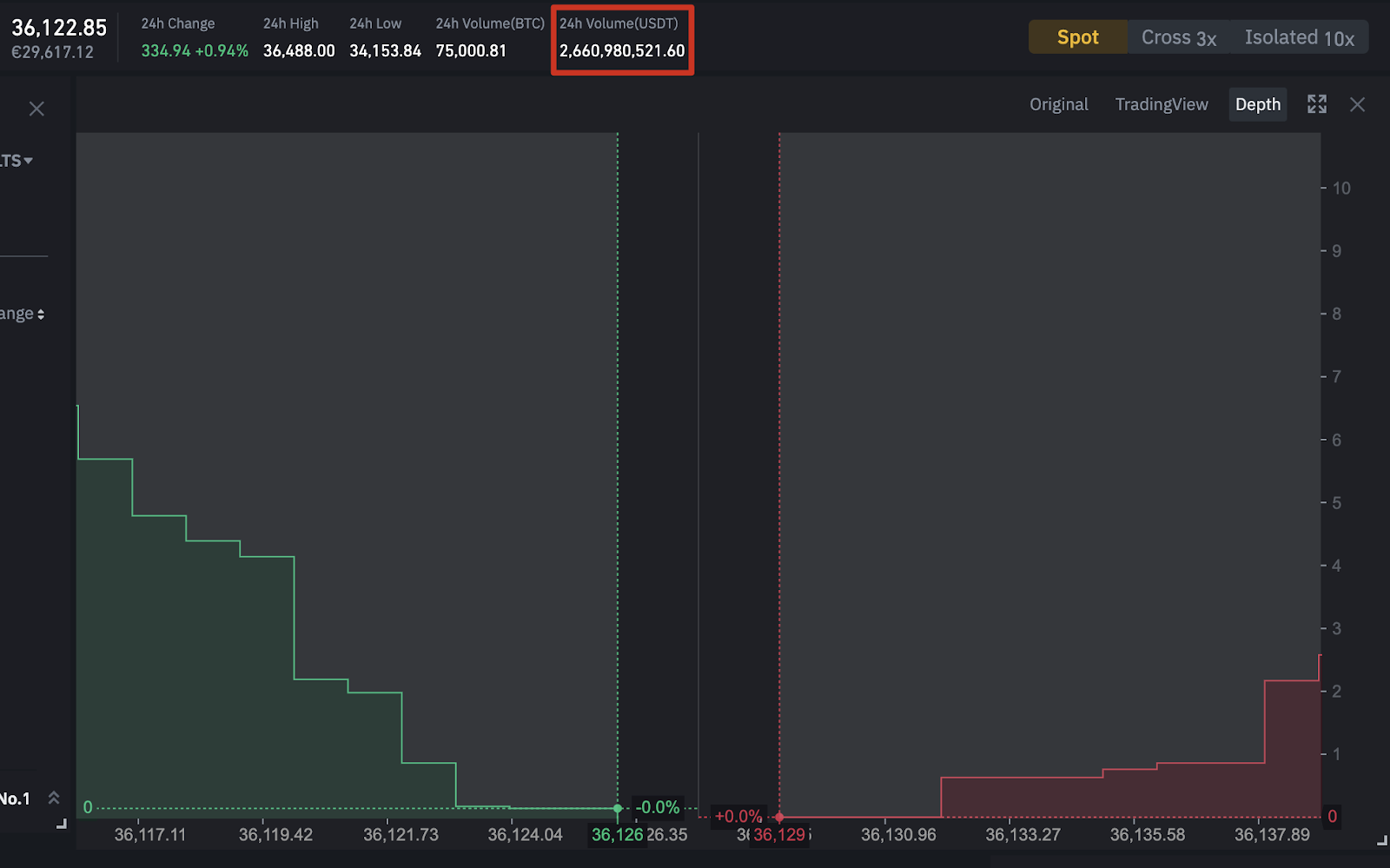

For a better understanding of the article's topic, there is an opportunity to give more illustrative examples, which show the existing correlation between the liquidity, spread and volume. There are special tools that can be used to trace this relationship and see the spread between supply and demand at a glance. For example, on one of the popular cryptocurrency exchanges Binance, you can turn on the view mode "Depth", which means a depth chart.

The chart below, as an example, is a graphical representation of the order book for a specific asset. The green part of the chart shows the supply available in the market and the red part shows the demand. Here you can also find out how many bids there are, and what kind of prices are offered.

Obviously, there is a certain gap between these charts, which displays the trading spread discussed in this article. This spread between supply and demand can be determined by subtracting the green price from the red price.

As mentioned earlier, there is a correlation between liquidity as well as small spreads. The trading volume can serve as an indicator of liquidity, with the growth of which the percentage of spread vs. prices naturally decreases. However, due to the popularity of BTC, as well as some altcoins, increased competition between crypto traders who want to make money on the spread can be created.

By the way, in addition to Binance, you can do it on other reliable trading platforms. One of them is Broex. It is a comprehensive service for trading cryptocurrencies and managing your crypto portfolio. Some of its advantages include:

- its own secure online wallet;

- user-friendly interface;

- favorable commissions.

The bid-ask spread percentage

Sometimes it is necessary to calculate the spread percentage, for example, in order to compare this value for different assets or exchanges. To perform this calculation, you must calculate the difference between the buy and sell price. Then divide the calculated value by the selling price and multiply the result by 100. The result will be the spread percentage.

An example may be given in numerical form, for more clarity. For instance, BTC is sold at $907 and bought at $901, which means that spread is $6. So, further calculation will be:

(907-901)/907×100=0,66%

In this example, the spread percentage is 0.66%, and a similar analysis can easily be performed for other situations. On the basis of the data obtained, conclusions are drawn about the liquidity of the selected asset, and the risk of overpayment is determined. The lower the percentage, the more liquid the asset is.

What is slippage?

As mentioned above, sometimes traders may face the phenomenon of slippage. This is the term for the moment when a trade is closed at a value that is contrary to the user's expectations.

Slippage is an unobvious risk for the novice crypto trader

This is a frequent case characteristic of markets with high volatility and low liquidity, which typically happens with new coins, altcoins. In cryptocurrency, it often occurs on decentralized exchanges. One of the reasons may also be the work of automatic market makers.

The likelihood of slippage additionally increases in those markets where instability is increasing. This may be a reaction to some events or news, or a consequence of the mood and behavior of the prevailing mass of traders.

Everything that happens in the cryptocurrency (and not only) world and can affect the quotes of digital currencies can be a direct or indirect cause of slippage.

Consequently, slippage is the result of sharp jumps in the market and volatility (a measure of how much quotes fluctuate over a short period of time). It is also associated with a delay in the execution of orders of trading users.

Types and principle of slippage

Here is an example to illustrate how it works.

Let us assume a user wants to place a buy order of $100. However, there may be not enough liquidity to execute such an order at a specified (desired) price. Therefore, the trader has to accept the higher prices in the market to execute the order. In fact, the average purchase price will be higher than the desired $100.

This means that when the trader creates a market order, the exchange automatically analyzes it. Orders are then placed in the order book. As a result, the order book will select the best price offer, but the user will extend the order chain if there is not enough volume to the desired price. At the end of the day, the market will execute that order, but at a different price than the desired price.

The curious thing is that slippage is not always a negative phenomenon, it also happens to be "positive slippage". This can happen when a user places a buy order when prices are going down in the market, or a sell order when prices are going up. In volatile markets, this sometimes allows a transaction to be closed at a better price, but this is not common.

Thus, we can distinguish two types of slippage: positive and negative. The first option unexpectedly gives benefits and increased profits, and the second, respectively, brings losses.

Ways to deal with slippage

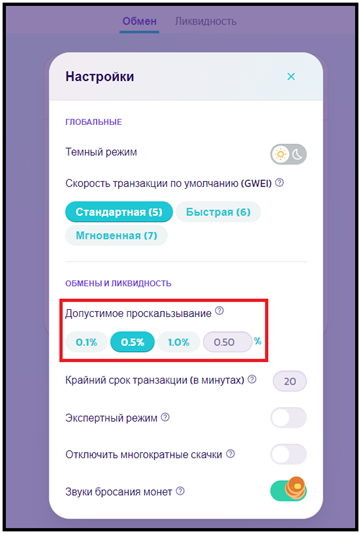

There are some ways to resist the effect of slippage or minimize its impact. For example, some exchanges automatically set and regulate the level of resistance to slippage. Also trading platforms sometimes allow users to do it manually. It may look as follows:

However, depending on the slippage value, the order execution time changes. If the slippage level is set too low, the order may take a long time to be executed or will not close at all. If slippage is too high, other market participants can outrun you.

Recommendations to minimize the negative slippage effect can be as follows:

- Instead of creating a large order, break its volume into several smaller ones;

- Don't trade on exchanges with high commissions;

- Using limit orders ensures that trades are closed at the desired or better price.

In addition, it is necessary to take into account the volume of liquidity of the selected asset and the number of participants in the trades.

Conclusion

Making trades in cryptocurrency, for example, on Broex or other exchanges, it is always important to consider spread and slippage factors. It's not possible to be 100% immune from them, but potential losses can be minimized.

Choosing the right cryptocurrency exchange with large trading volumes and low commissions will be helpful. When opening and closing orders, you need to consider the difference in price and the current level of volatility. It's better to divide large trading volumes into smaller parts.