The Fear and Greed Index is perhaps one of the most recognizable tools of the cryptocurrency trader. It allows you to determine market sentiment and when it's best to buy an asset. Or sell.

The history of the index, how it works and what assets you can invest in right now are in today's review.

How does the Fear & Greed Index work?

While everyone is used to thinking that the Fear & Greed Index is an achievement of enlightened cryptocurrency minds, the tool actually comes from the world of traditional finance.

The original - the stock F&G - relies on seven equal parameters. There are six metrics left in the version for cryptocurrency from Alternative.me, and some of them are more equal than others:

- Volatility (25%). Bitcoin's current volatility - yes, the index is primarily focused on BTC - has been compared to the average of 30 and 90 days. The stronger the recent fluctuations, the more the index shifts to the level of fear.

- The ratio of momentum to market volume (25%). Here it is simple. If large volumes of assets are bought in a rising market, it means that traders are too optimistic, so the index shifts towards greed.

- Social media reaction (15%). Analysts attribute the unexpected increase in the number of tweets about crypto, their reposts and comments to greed covering the market.

- Polls (15%). Together with strawpoll.com, the Alternative team conducts polls that reach 2,000 to 3,000 industry members. They are currently on hold and are not included in the index.

- Dominance (10%). And again, Bitcoin - analysts associate the growth of its share in the general market with concerns among players. Fearful, traders ditch overly speculative altcoins and invest more in secure BTC.

- Trends (10%). This is where Google Trends comes into play. A variety of requests related to cryptocurrency are taken into account. Before the publication of the next report in May 2018, the Alternative team noticed a sharp jump of 1.550% in "Bitcoin price manipulation" queries. This was a clear sign of pessimism.

So how can you tell when the market is gripped by fear or greed? All data is processed into an overall scale from 0 to 100 points:

- 0 to 24 indicates strong fear (marked in orange)

- 25 to 49 indicates fear (marked yellow)

- 50 to 74 indicates greed (marked in light green)

- 75 to 100 indicates intense greed (marked green)

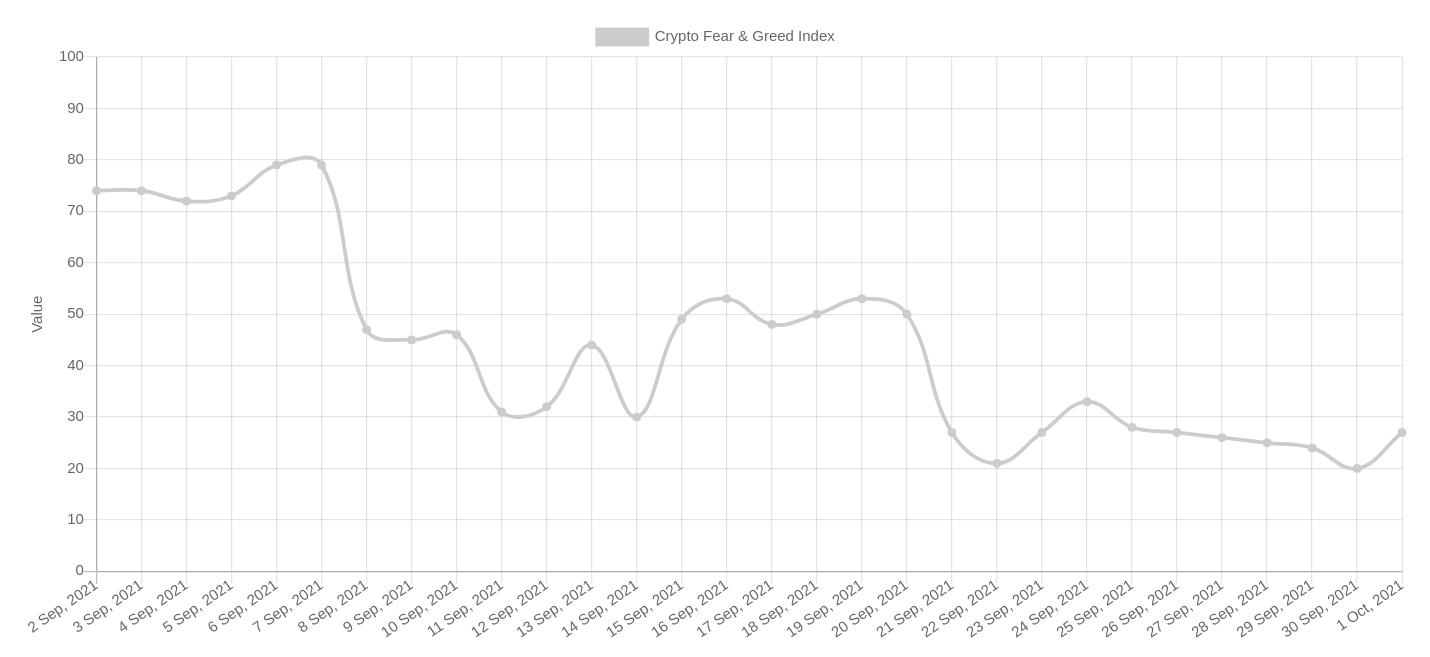

October market starts with the exit from the zone of extreme fear

How to track?

The official Alternative.me updates the indicators on a daily basis. In addition to the figures for the current day, you can study the figures for yesterday, a week, and a month.

In addition to the usual scale, moods are presented in the form of a graph - for 7 days or even the entire observation period.

Crypto Fear & Greed Index has an open API. Third-party developers can use the index data on their sites and modify it. For example, use the index only for BTC or only for ETH.

Updates to the Etherium Index are published daily by the popular EthereumFear Twitter feed.

When to buy or sell?

An extreme position is not held for too long. Extreme fear will be followed by a reversal and upward movement. And vice versa - a long period of greed will be replaced by a decline and deterioration in sentiment.

A market downturn accompanied by pessimism is a great opportunity to buy an asset and wait for a trend reversal.

Accuracy

Although Crypto Fear & Greed Index is a useful tool and quite accurate, investors should not forget about their own research.

Let's take a concrete case:

- At the end of February 2021, BTC reached $58,000 and the index was at a record 95 points by that time.

- Then the price collapsed to $45,000, and with it the rating went down to 38 points.

- It didn't take long for the currency to head toward a peak of $65,000, but F&G barely rose above 80 points.

The hottest tokens of October

Another great tool is Coincodex. In addition to the built-in Fear and Greed Index, it has:

- bullish/bearish metrics from Sentiment;

- sentiment analysis of Google, Facebook and the general Internet;

- conclusions based on technical indicators.

So which tokens have caught the wave and are waiting for their investor now?

- Cosmos (ATOM). Sentiment's bullish outlook at 97%. A large and fairly long-established project, Cosmos has pleased investors this year by making x5. The recent launch of IBC, a proprietary technology that connects blockchains, allowing each of them to maintain their own rules and security sets, has contributed to growth.

- Cardano (ADA). Bullish outlook at 83%. The success of Charles Hoskinson's platform came with the deployment of smart contracts and the launch of the first decentralized applications. Now ADA is #3 in the top of the largest cryptocurrencies. Fast and cheap transactions give it the opportunity to compete with Etherium for the 2nd line.

- Algorand (ALGO). A bullish outlook at 90%. Algorand is actively promoted in the DeFi space. The ecosystem has built-in asset tokenization toolkits, ASA. And it has become the first major platform to implement the idea of NFT with multiple owners.

Where to Buy?

Buying an asset quickly, safely and successfully is what any trader needs. The first depends on the ability to use special tools such as charts or indices. And the last two points are impossible without the right choice of platform - proven and with a clear interface.

Have you studied the indices and found the best assets? Now it's time to decide WHERE to buy and safely store them. In addition to a wide assortment of assets, the service should be proven and comfortable. Broex is a great solution, and it has several advantages:

- Currency basket. Bitcoin, Etherium, everyone's favorite Dogecoin and many others are already on Broex's list. You can add almost any asset at the user's request - all thanks to the official partnership with Binance.

- Security. Multiple security loops, no employee access to funds, cold wallet storage - Broex offers customers the highest standards.

- Legitimacy. Broex not only uses cutting-edge technical solutions, but also follows the law - the platform is registered in Estonia, known for its best practices in the field.

- Liquidity. Many traders use the platform - so you can quickly buy or sell assets at the best price.

- Comfort. Minimum fee, user-friendly interface, portfolio management, notifications on important events - Broex cares about its clients!