Project Events

Starbucks

Starbucks to launch NFT this year, offering access to "unique experiences and benefits".

California

California governor signs executive order to spur crypto industry in the state.

Optimism

Optimism launches OP token with Airdrop for early users.

HOP Protocol - Airdrop

HOP Protocol - Airdrop is almost confirmed, and we can see that cross-chain protocols are starting to launch their tokens and attract new users.

DeFI

More than $1.6 billion stolen from DeFI protocols in 2022.

Balancer

Balancer launched veModel and improved Balancer tools with extensive analysis and calculation features.

Polygon

The winner of the hackathon in the Polygon app category is NFTFY, which allows to share ownership of NFTs.

Telegram

Telegram launched TON crypto payments with the Telegram Wallet bot.

Evmos

Evmos has been successfully relaunched after a botched roll-out in March.

1inch Wallet

1inch Wallet introduced crypto purchases with fiat through Transak.

Algorand

Algorand partners with FIFA. Blockchain will be a regional supporter of the World Cup in North America and Europe and also the Official Sponsor of the Women’s World Cup next year.

MetaMask

MetaMask has implemented crypto purchases for fiat through MoonPay.

Yearn

The biggest update of Yearn vaults v3.

With the Keep3r network, almost all aspects of Yearn's vault management will be automated, and many new features will appear.

Thorchain

Cross-chain exchange protocol Thorchain comes to Cosmos

Algorand

Algorand partners with FIFA. Blockchain will be a regional supporter of the World Cup in North America and Europe and also the Official Sponsor of the Women’s World Cup next year.

Blur

Blur has announced an upcoming beta launch. They are creating a platform developed specifically for professional NFT traders.

Polkadot

Data exchange between parachains is now available on the Polkadot network.

Opensea

Opensea acquired NFT aggregator GEM.

Highlights of the week

.jpg)

Events for the coming week

.jpg)

Funding

- Argent raises $40M in Series B funding round.

- 0x raised $70m round and launched DAO.

- Amberdata raises $30M to improve cryptocurrency and DeFi data delivery.

- The funding round was led by Knollwood Investment Company and included contributions from Coinbase and Nexo.

- Team DAO - Tokenized Esports Asset Management, the metaverses first guild 3.0, announced it has raised $5 million in Series A of funding co-led by Krust Universe and Animoca Brands.

- MYSO Finance closes a seed round, successfully raising $2.4 million to build the leading DeFi protocol for zero-liquidation loans.

- BundlrNetwork raises $5.2 million to expand Arweave's decentralized storage network.

- Stakes raises $5.3M for NFTs for sports wagering fans.

- Privacy startup Nym raises third-party backers for $300 million developer fund.

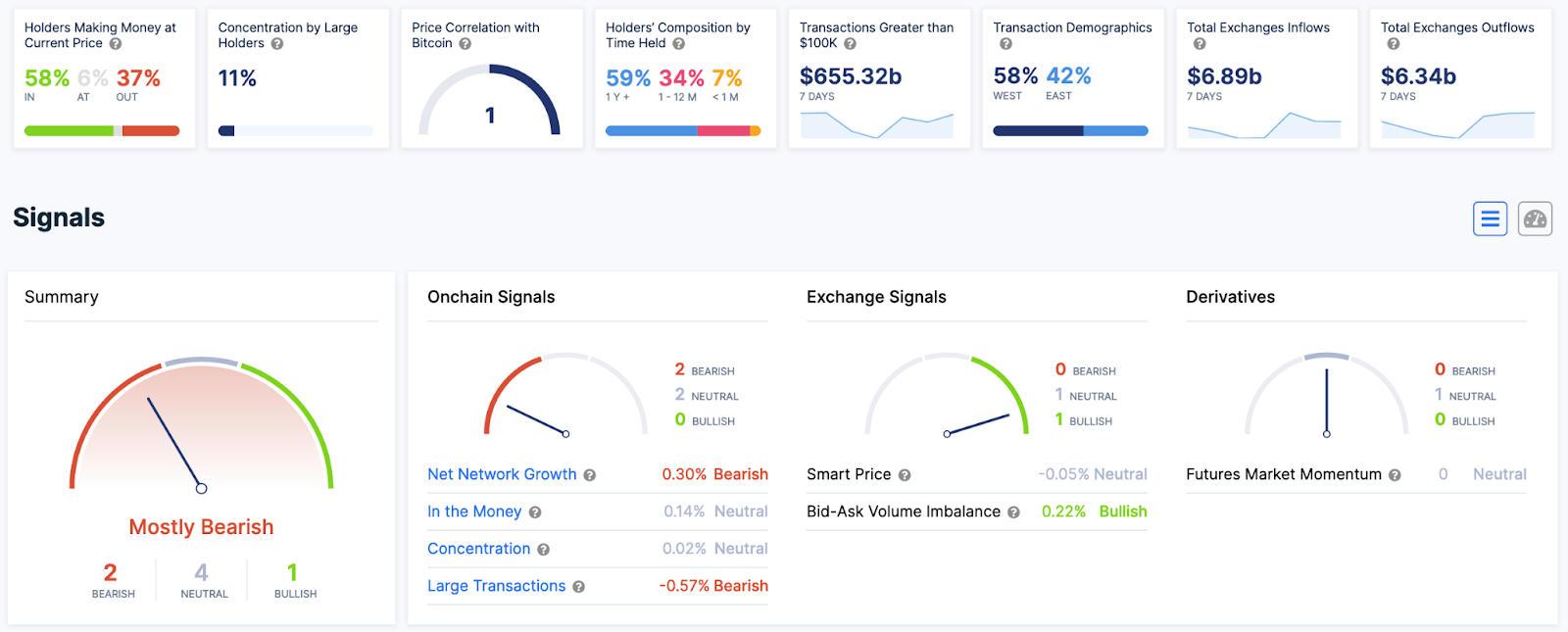

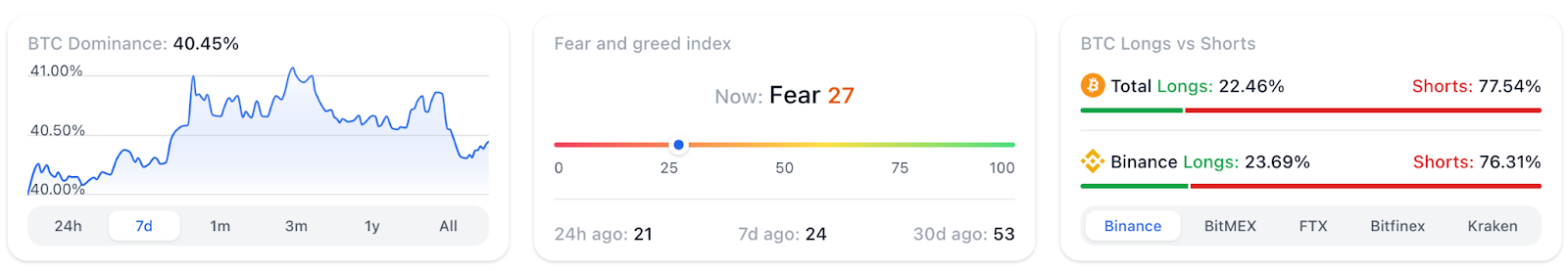

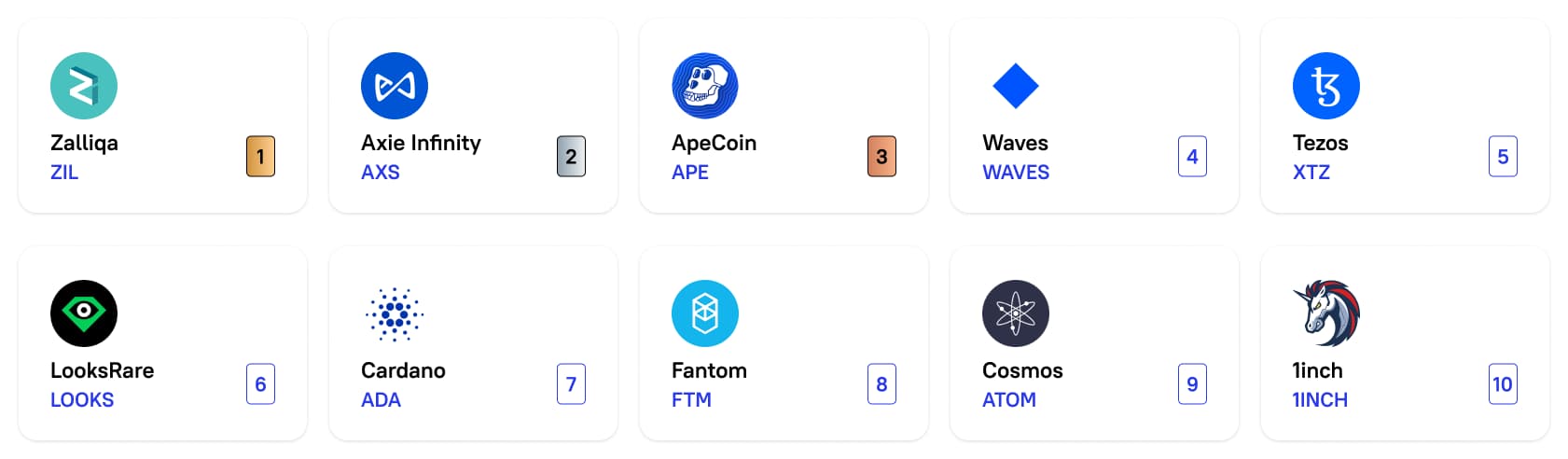

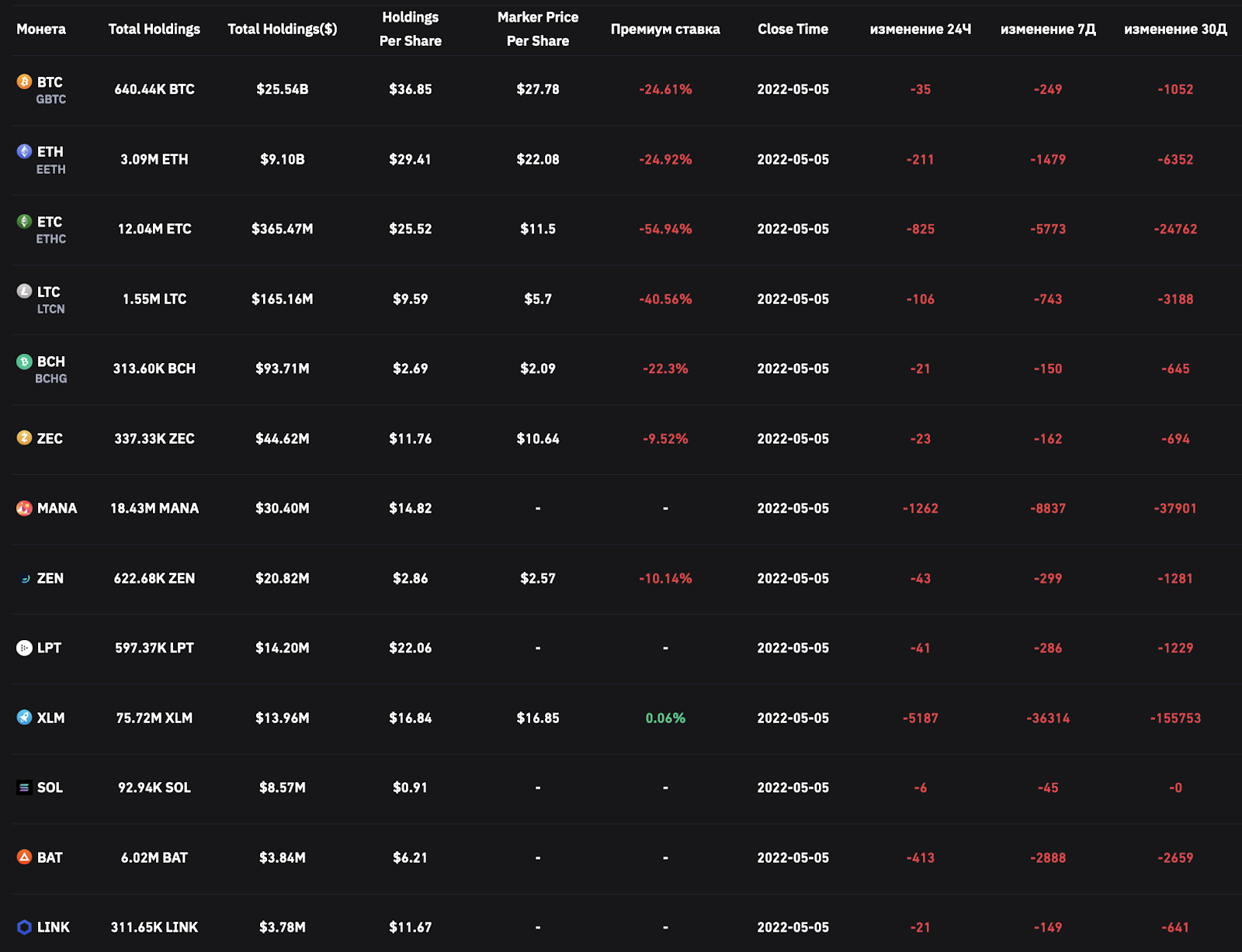

Metrics

10 effective coins of the week

Assessment combines altcoin price performance relative to bitcoin and social performance.

Grayscale fund portfolio dynamics

Bitcoin metrics

- Stock to flow

This model views Bitcoin as a commodity comparable to those like gold, silver, or platinum. These commodities are known as "stored value commodities" because they retain their value over time due to their relative scarcity.

For commodities of value, such as gold, platinum, or silver, a high ratio indicates that they are not primarily consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we are able to predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event. It's an event during which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

- BTC OnChain

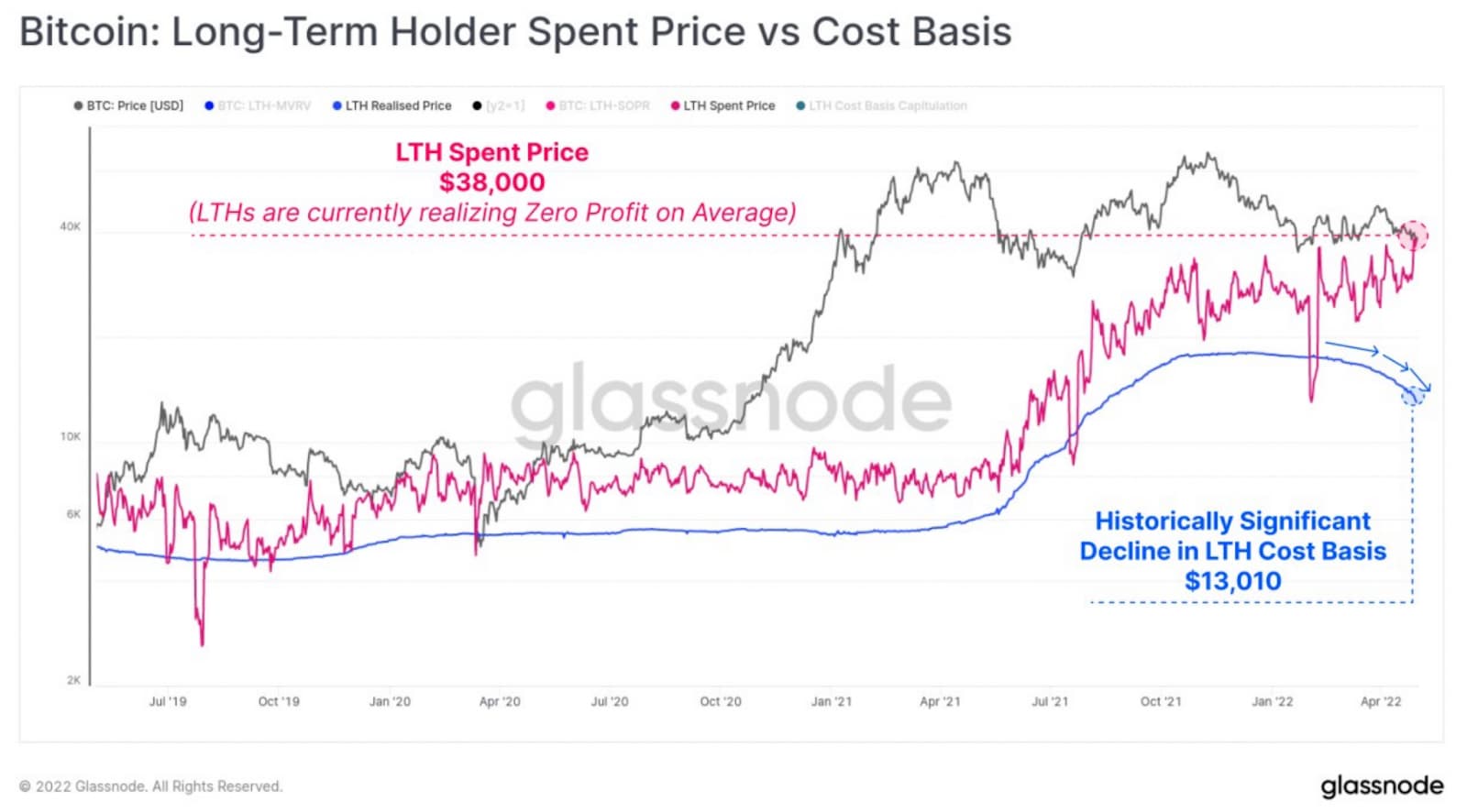

Long-term Bitcoin holders continue to back down, with a huge discrepancy between their buy price (blue) and sell price (pink).

This is the largest capitulation of long-term holders in the history of Bitcoin.

Funding Rates

Positive funding rates imply that speculators are bullish, and long-traders pay funds to short-traders.

Negative funding rates mean that speculators are bearish, and short-traders pay funds to long-traders.

P.S. Funding rates (0.01%) - black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) - red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

Off chain data