Project Events

Superfluid

Superfluid protocol has been hacked, and about 2,700 ETH is currently in the hacker's wallet.

B.Protocol

B.Protocol, the largest Stability Pool interface in Liquity, integrates with Vesta Finance, and automatically converts liquidated ETH, renBTC and gOHM back to VST and re-deposits them into Stability Pools.

VST providers to the Stability Pools using B.Protocol benefit from locking the liquidation profits, minimizing their exposure to volatile assets, compounding passive APY on VST (no need to manually rebalance their position) and strengthening Vesta's stability.

SAFE

The Gnosis Safe team has submitted a proposal to establish the safeDAO and launch a SAFE token.

SEC

Hester Pierce of the SEC warned that proposed SEC reform of securities trading platforms could threaten DeFi.

Gearbox

Gearbox Protocol talked about Gearbox DAO coordination, as well as rewards to the first active contributors.

Tron

Tron's Justin Sun accused of "governance attack" on Compound protocol.

Cryptocurrency think tank GFX Labs says a prominent whale may be attempting to swing a vote in his favor.

The community believes that there are further opportunities to improve BAL's tokenomics and some sort of staking/blocking needs to be implemented.

The protocol suggested the following updates:

- Long-term alignment. With BPT blockchain, token holders will be encouraged to support Balancer in the long term instead of short-term speculation.

- Compatibility with the Curve ecosystem.

- Saving time and efforts of developers for the core work of Balancer.

Bitfinex

Bitfinex announced the return of a significant portion of bitcoin stolen during the 2016 hack.

AAVE

AAVE Polygon Market now supports indexcoop token $DPI.

HopProtocol

HopProtocol announces a collaboration with Gnosischain.

$FEI

$FEI is now collateral on @AaveAave.

SushiSwap

SushiSwap plans to release v2.

Gelato

Gelato network integrates Flashbots.

SPL

SPL releases v2 of the protocol.

Highlights of the week

Events of the coming week

Funding

- Alchemy has raised $200 million in a new round of funding led by Lightspeed and Silver Lake.

- MetaStreet raises $14 million in Seed & Initial liquidity Capital to help NFT Debt scale.

- SO-COL (Social Collectables), a decentralized alternative to Discord, Snapshot, and OnlyFans, today announced it has closed a $1.75 million seed funding round. The funding round was co-led by DeFiance Capital and Animoca Brands, with participation from Three Arrows Capital, Mechanism Capital, Global Founders Capital, Double Peak Group, Antifund, Genblock Capital, and Kronos Research.

- Polygon has raised $450 million from Sequoia Capital India, SoftBank, and Tiger Global.

- Pillow, a Singapore-based startup that helps generate yields on crypto, has raised $3M in seed funding.

- The company intends to use the funding to create DeFi's alpha-generating strategies for popular crypto assets (including $BTC, $ETH, and popular stablecoins), accelerate global expansion, build a strong user community, and develop the brand.

- DAO liquidity provider Rift Finance raises $18 million in round led by Pantera Capital.

- The protocol wants to help DAOs deploy treasury management tokens to deepen token liquidity, without having to give up ownership.

Metrics

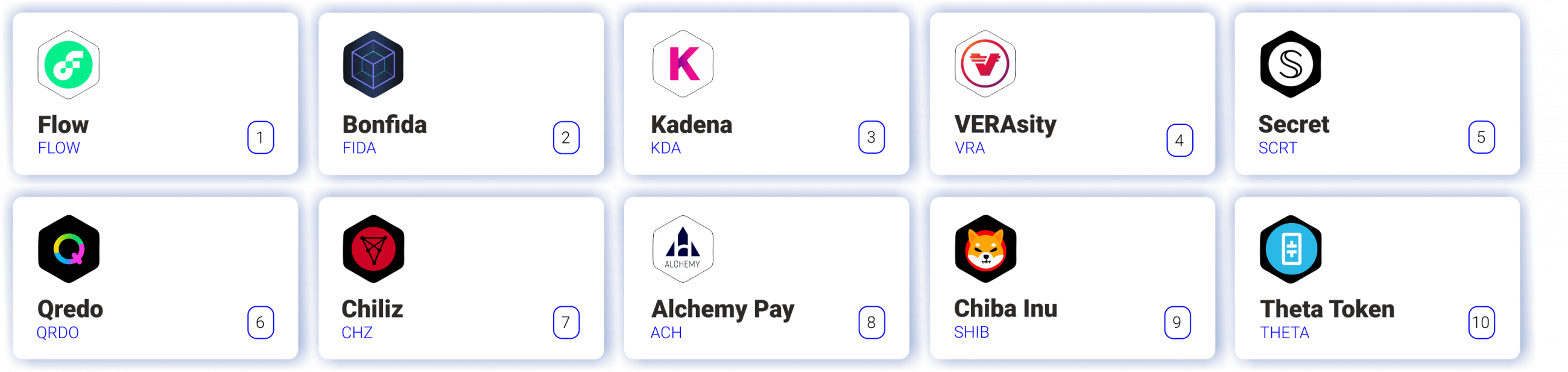

10 effective coins of the week

Assessment combines altcoin price performance relative to bitcoin and social performance

Grayscale fund portfolio dynamics

.png)

Bitcoin metrics

- Stock to flow

This model views Bitcoin as a commodity comparable to those like gold, silver, or platinum. These commodities are known as "stored value commodities" because they retain their value over time due to their relative scarcity.

For commodities of value, such as gold, platinum, or silver, a high ratio indicates that they are not primarily consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

.png)

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we are able to predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event. It's an event during which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

- BTC OnChain

Whales have significantly accumulated BTC over the past 7 weeks. Since Dec. 23, addresses with $1,000BTC or more have added a total of $220,000BTC to their wallets, representing the fastest accumulation since September 2019.

.png)

.png)

Funding Rates

Positive funding rates imply that speculators are bullish, and long-traders pay funds to short-traders.

Negative funding rates mean that speculators are bearish, and short-traders pay funds to long-traders.

.png)

P.S. Funding rates (0.01%) - black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) - red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

Off chain data

.png)