Project Events

Binance has listed ENS token, and now it is available on Broex

- listing price $42;

- ATH $83;

- current price $56;

- trading volume in 24 hours amounted to $175,800,422;

- the number of token holders is 53864.

Binance has listed MOVR, and it is now available on Broex

- listing price $460;

- ATH $478;

- current price $342;

- trade volume in 24 hours was $30 146 560;

- number of token holders 86252.

Binance have launched LTC mining program with zero commissions in the first month

1inch is preparing to launch a version 4 protocol, in which it is improving the exchange router. As a result, if a user, for example, makes an exchange that includes only Uniswap v3, it will be cheaper than the same exchange made directly on Uniswap or elsewhere because of the gas cost savings.

Update on the BTC network ‘Taproot’ is scheduled for November 16

This brings positive changes such as strengthening crypto, improving privacy and rducing fees.

AAVE

AAVE is preparing to launch version 3.0 of the protocol, whose main goal, according to the developers, is to improve the user experience. New Portal functionality will allow assets to be moved between other networks.

Several modes will also be added:

- ‘high efficiency mode’ (eMode). It will allow depositors to maximize the efficiency of lending and enhance the overall reliability of the protocol;

- and new "listing administration" logic will allow AAVE to transfer its listing rights whereby users can vote for assets they want to see in the protocol.

MANA, SAND

Following the announcement of Facebook's name change to Meta and Mark Zuckerberg's remarks about the prospects of the meta universe, existing meta universe tokens such as MANA, SAND have shown impressive growth of 400% MANA and 330% SAND.

Axie

Axie is releasing its Katana DEX for the recently announced Ronin chain. This chain will host dapps and other games.

This was a warning shot for the potential that AXS native tokens still have. We expect Axie to return to the spotlight in large numbers by the end of the year, closer to V2.

Highlights of the week

Events for the coming week

Funding

- Polkadot CEO is planning to allocate up to $800m to develop its ecosystem and attract developers;

- Alchemy raises $250mn in round C as part of large fund a16z;

- Neon labs closes a $40 million private token sale, with 3AC, Solana Capital and Black Rock as investors. They are creating the Solana EVM, which will facilitate the deployment of Dapps on SOL for ETH.

The only thing hindering Solana right now is that it uses rust rather than solidity. While this has its pluses, the main disadvantage is that it is not compatible with evm. This means that users have to go through CEX for ‘bridge’ into the ecosystem.

- Veterans of Andreessen Horowitz launches $110 million cryptocurrency ‘proprietary’ fund;

- Company Variant, which has supported projects such as Uniswap and Mirror, is launching a new fund designed for projects that use the incentive of token ownership.

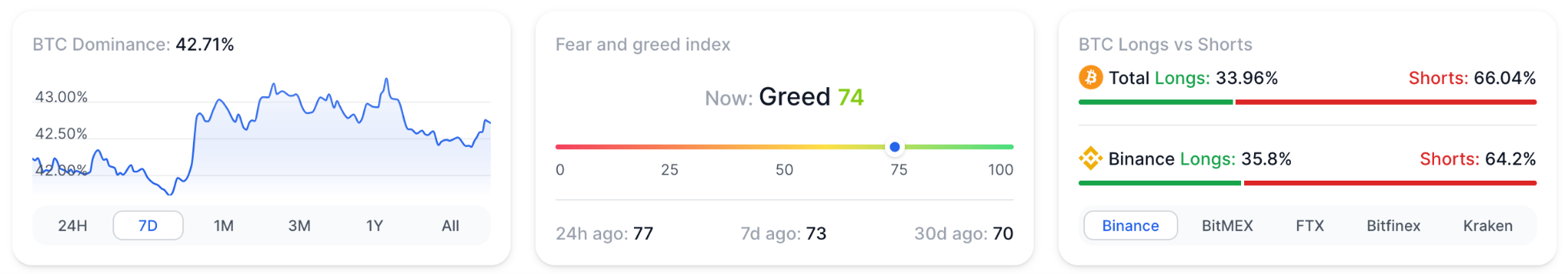

Metrics

10 best-performing coins of the week

The valuation combines altcoin's price performance relative to bitcoin and indicators of social activity.

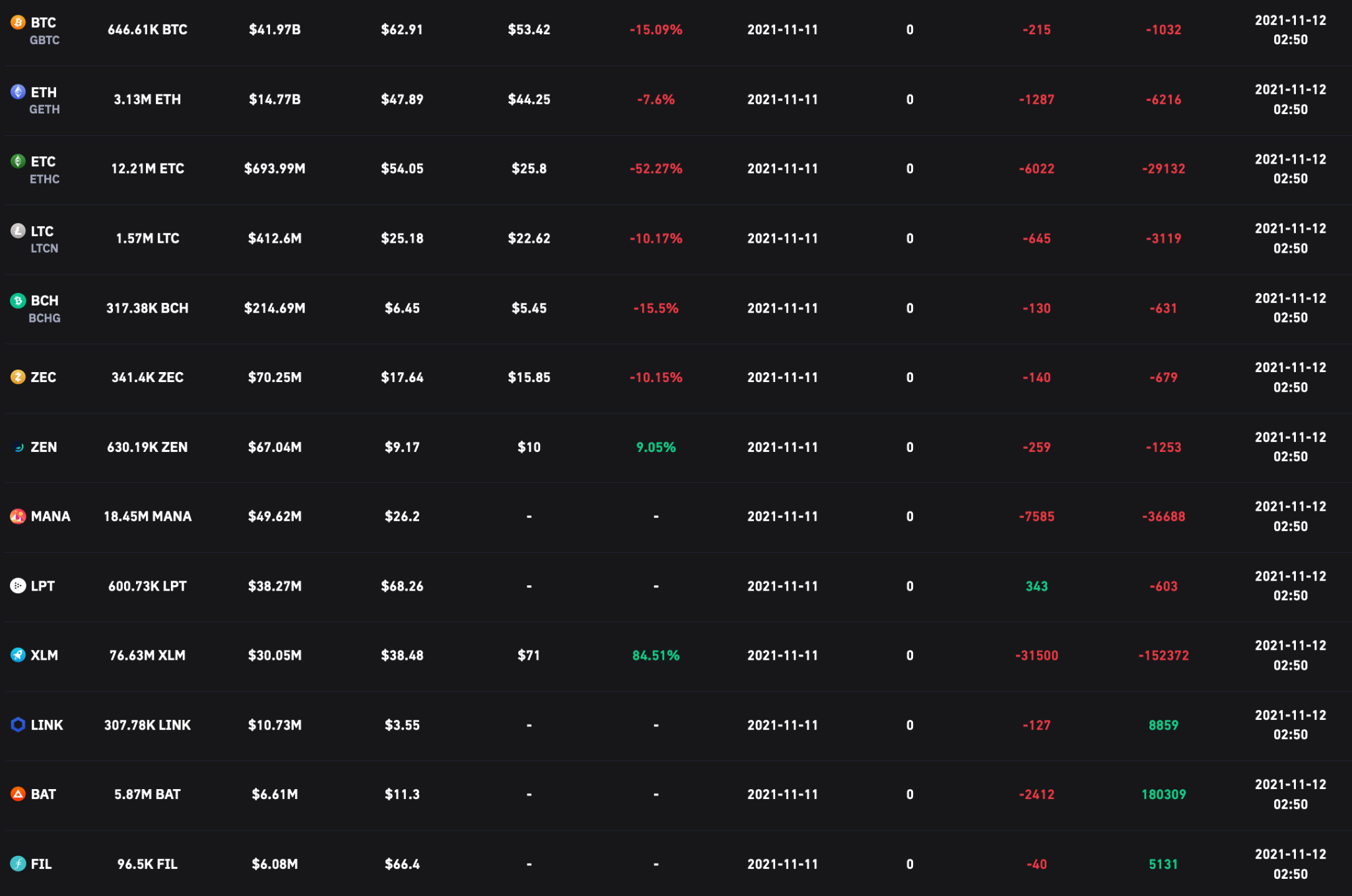

Grayscale Fund Portfolio Dynamics

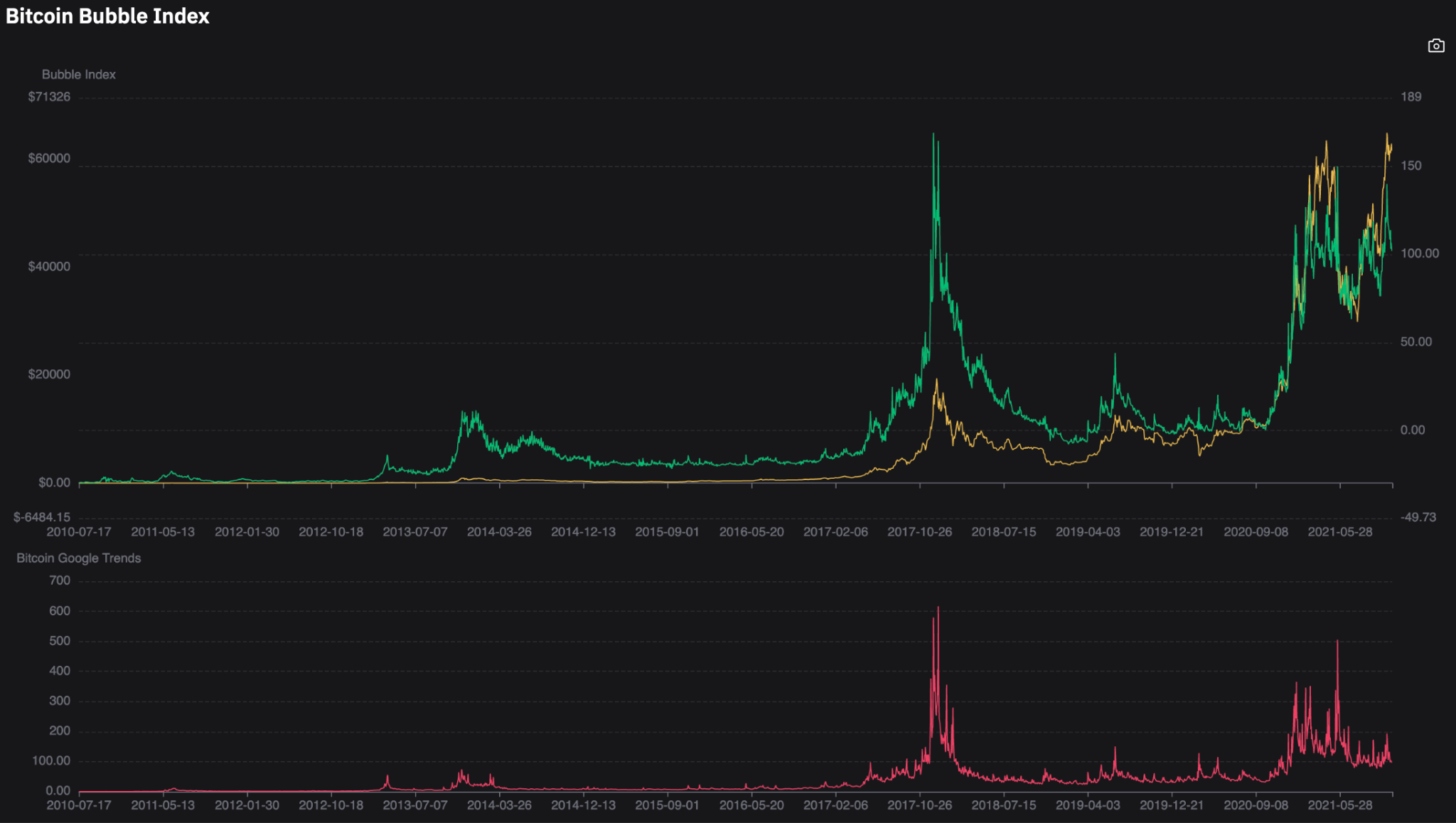

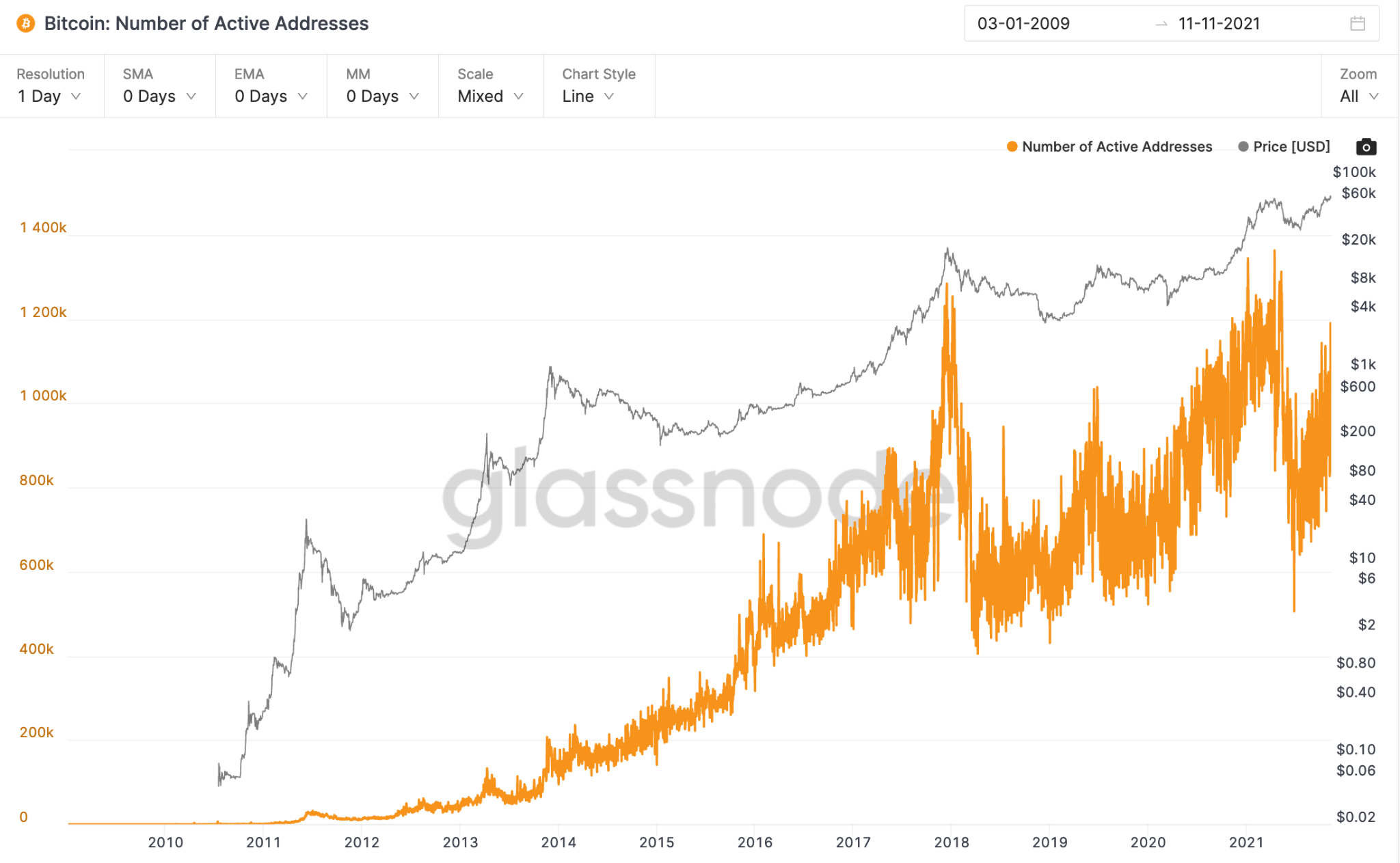

We see the level of interest in bitcoin beginning to match the peaks after which bitcoin began its decline in 2017

The number of active addresses is approaching peak values, indicating high activity in the network, which can lead to sharp price movements.

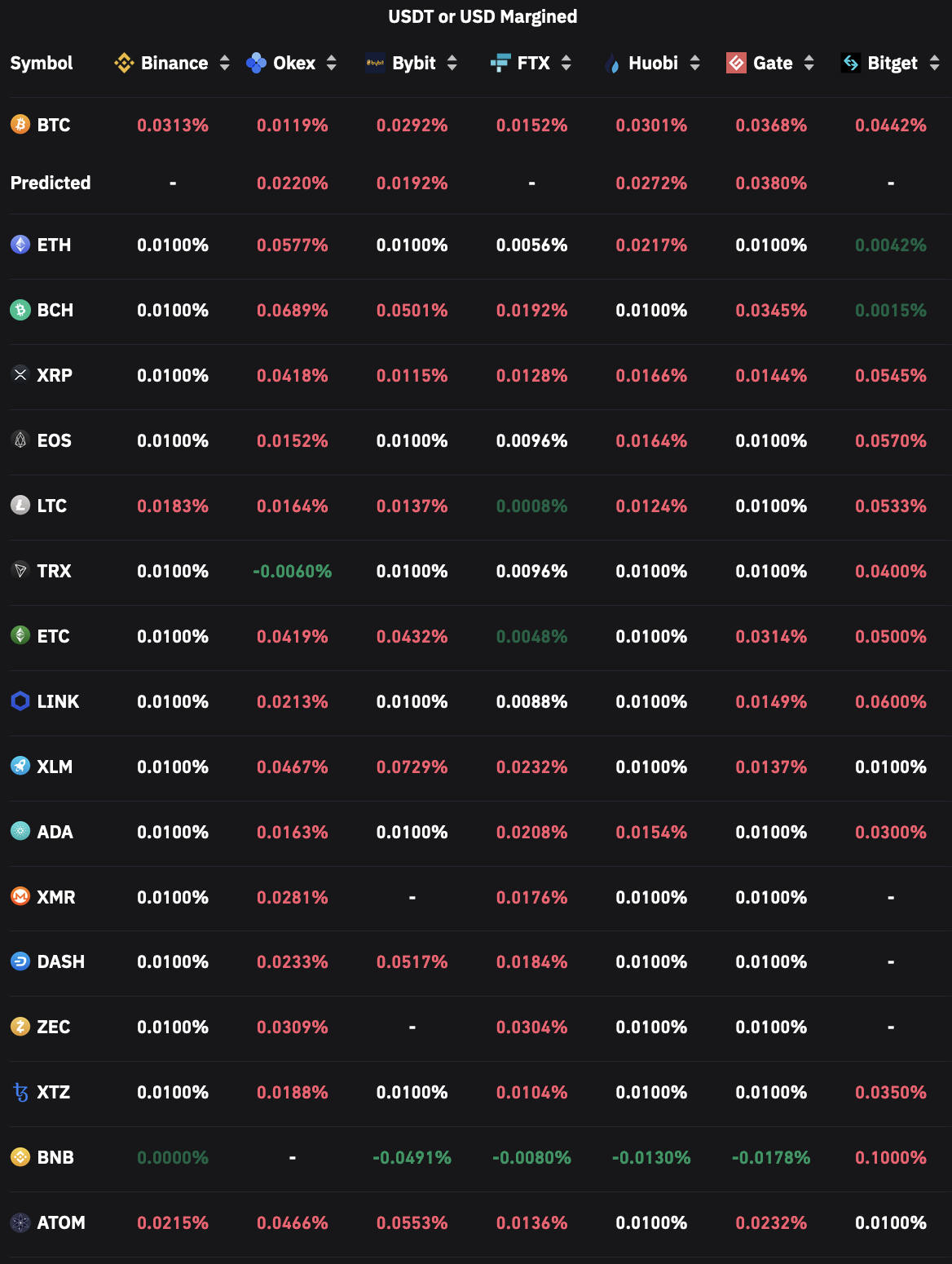

Funding Rates

Positive funding rates imply that speculators are bullish and long traders pay funding to short traders. Negative funding rates imply that speculators are bullish and short traders pay funds to long traders.Click Exchange to sort, click on the funding rate value to view historical data.

PS: Funding rates (0.01%) are black, this is a neutral situation. Funding rates (below 0.01%) are green, this is a bullish situation. Funding rates (above 0.01%) are red and this is a bearish situation. The stronger the bearish or bullish sentiment, the darker the colour.

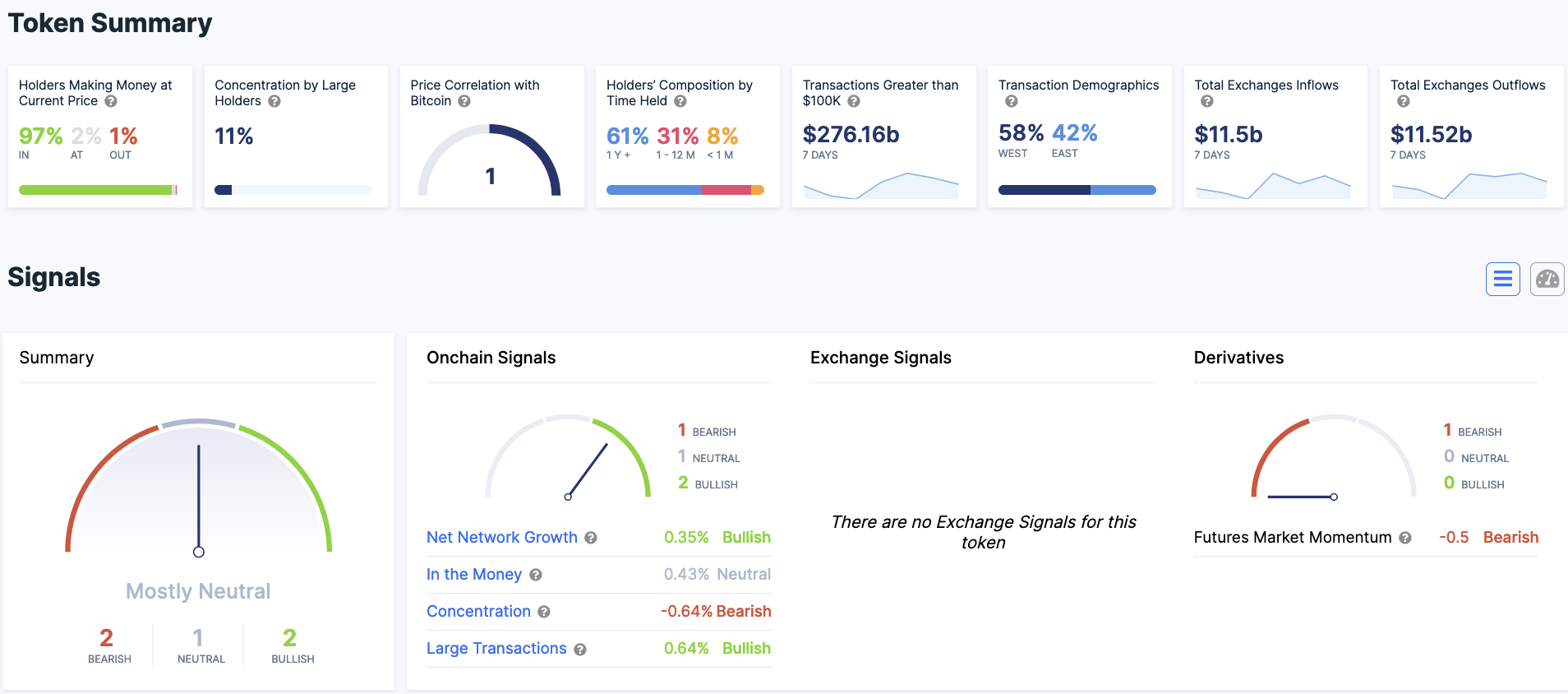

Off chain Data