Project Events

Celsius и 3 Arrow Capital

The bloody week continues, with major crypto funds like Celsius and 3 Arrow Capital suffering serious losses and on the verge of insolvency. All of this keeps dragging the market down.

Solana

Solana is rolling out a new fee prioritization model along with other network upgrades aimed at stability.The model will charge an additional fee during congestion, but only for the most in-demand apps and services. Hopefully this will reduce network congestion.

Animoca Brands

Animoca Brands isn't worried about experiencing a slight global recession. They continue picking up partners and buying stock in companies that have created useful Web3 tools, such as TinyTap. TinyTap provides a code-free platform that empowers educators to create and share interactive content and to receive revenue from its use. Animoca recognizes the utility of creating immutable learning records, and the fact that educators are some of the most prolific content creators.

OpenSea

OpenSea is migrating to the new Seaport Protocol that will allow users to save an estimated 35% in gas fees over the current NFT buy, sell and exchange rates. Seaport is open source and inherently decentralized. It will also provide a more advanced framework that will better protect the future and eliminate the creation fees. In addition, it will empower users with the ability to make offers on entire collections.

USDC Issuer Circle

USDC Issuer Circle is launching a euro-backed stablecoin in the U.S. The Euro Coin will be backed by euro-denominated reserves held by regulated U.S. financial institutions.

WOOFi

WOOFi launches cross-chain swaps between Avalanche, Fantom and BSC.

WOOFi will use LayerZero's Stargate to let users swap native tokens from chain to chain in one click.

Nansen Connect

Nansen Connect announced: a messaging app for Web3.

CoinDesk

CoinDesk recently spoke about $DESK and their relaunched social token. All of this indicates the approaching trend of decentralized social protocols.

Highlights of the week

Events for the coming week

Funding

-

Saga raises $3.6 million to make the middleware of the metaverse, the universe of virtual worlds that are all interconnected.

-

ScienceMagic.Studios raises $10M to demystify Web3 for brands and talent.

-

Upvest raises $42M and lays the groundwork for international expansion. It's one of the few financial institutions in Europe with all BaFin licenses for securities and crypto brokerage, and custody.

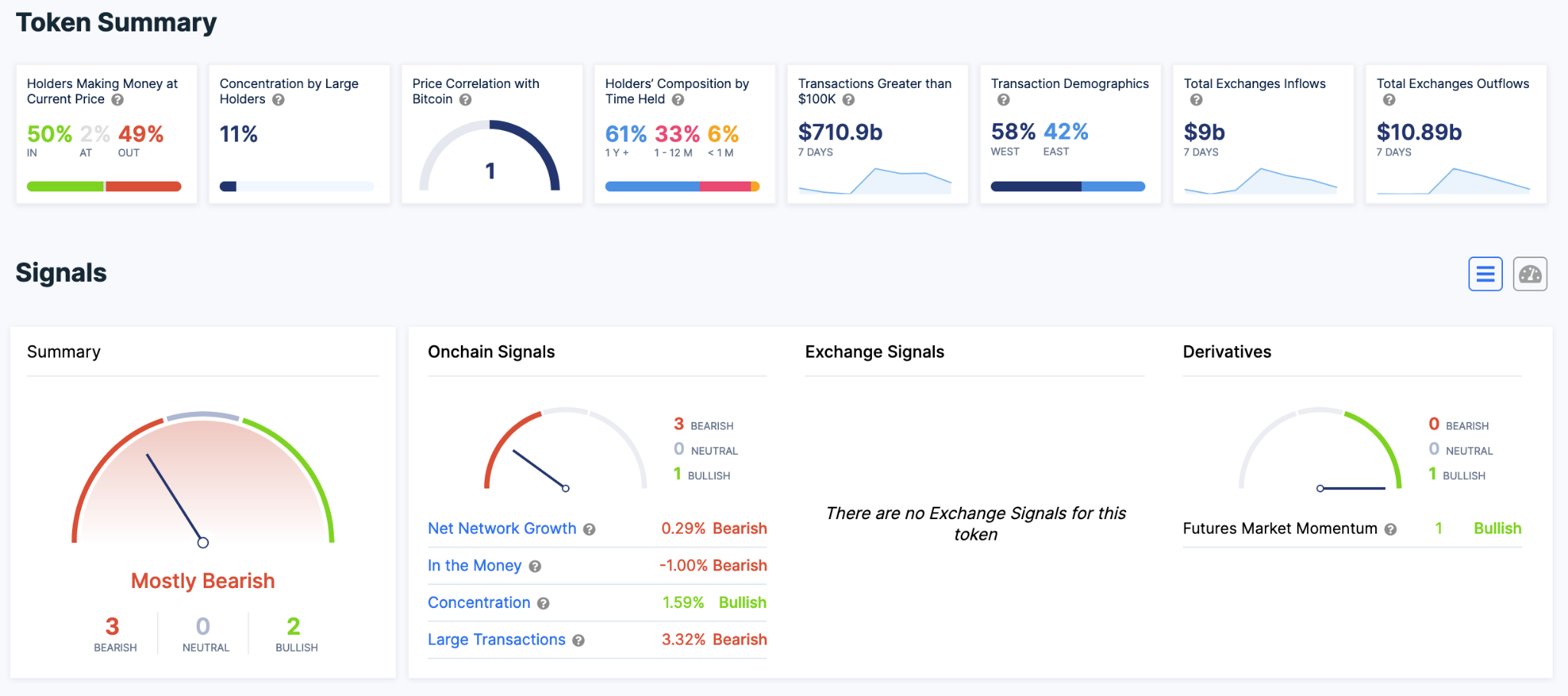

Metrics

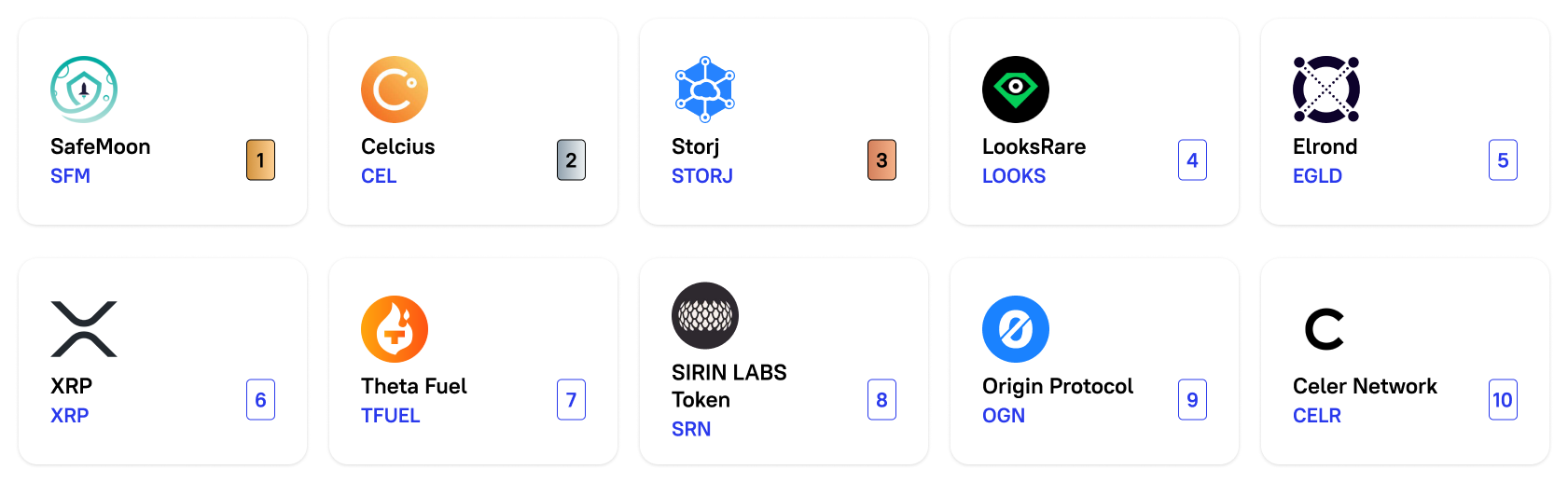

10 effective coins of the week

Assessment combines altcoin price performance relative to bitcoin and social performance.

Grayscale fund portfolio dynamics

Bitcoin metrics

- Stock to flow

This model views Bitcoin as a commodity comparable to those like gold, silver, or platinum. These commodities are known as "stored value commodities" because they retain their value over time due to their relative scarcity.

For commodities of value, such as gold, platinum, or silver, a high ratio indicates that they are not primarily consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we are able to predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event. It's an event during which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

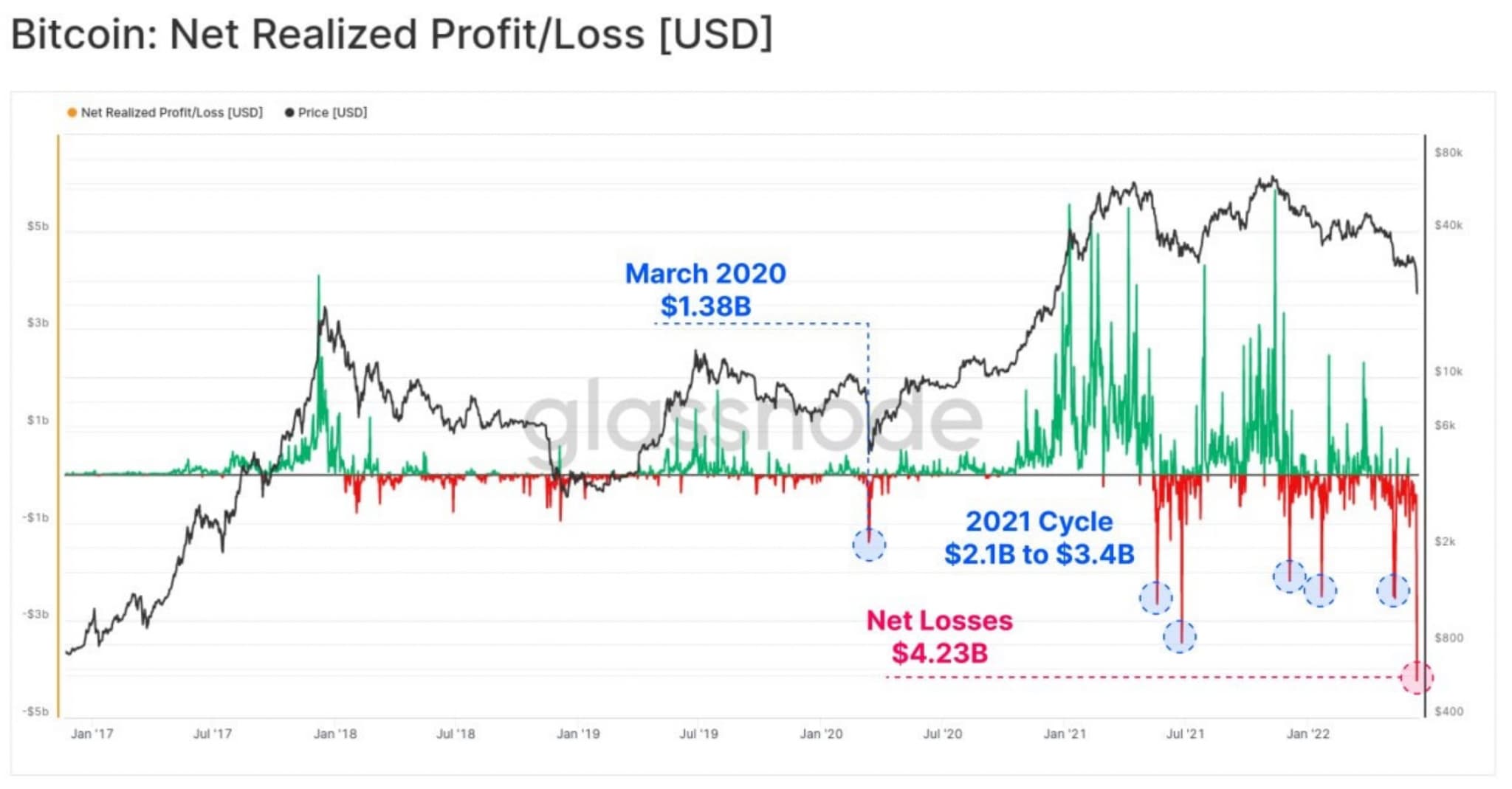

- BTC OnChain

Despite the panic, the number of Bitcoin addresses with a balance of more than 0.01 BTC has reached 10 million.

Funding Rates

Positive funding rates imply that speculators are bullish, and long-traders pay funds to short-traders.

Negative funding rates mean that speculators are bearish, and short-traders pay funds to long-traders.

P.S. Funding rates (0.01%) - black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) - red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

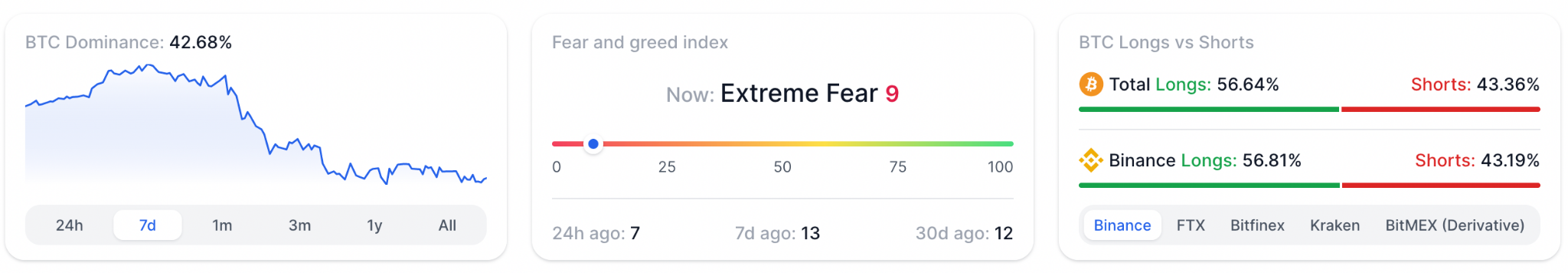

Off chain data