Project events

Web3

As the market falls, developers build ecosystems

Web3 is at an all-time high:

- 18k+ monthly developers

- 2.5k monthly developers in DeFi

- 3k new developers touch web3 code every month

- Several evolving ecosystems are growing faster than @Ethereum at the same point in its history.

- 20-25% of new developers each month start with @Ethereum

Aave

Aave is developing a crypto wallet

FATF

Estonia is planning to crack down on crypto startups and join the FATF

Samsung

Samsung announces three TV models for 2022 with NFT trading capability

Polymarket

The Commodity Futures Trading Commission (CFTC) fined crypto betting service Polymarket $1.4 million for unregistered swaps

According to the CFTC, Polymarket's betting pools constituted binary options.

illuviumio

After discovering a security flaw in its staking platform, gaming platform illuviumio has drained the liquidity from the Uniswap v3 pool in an attempt to block an attacker from cashing out.

Messari Crypto

Messari Crypto lead analyst Ryan Watkins leaves his post

Cosmos

Terra has launched a bridge to the Cosmos blockchain

Yearn

Andre Cronje (founder of Yearn) is planning to launch a new experimental project this month on Fantom

Uniswap

Uniswap has launched V3 on the Polygon blockchain and is releasing a number of features to improve pricing and gas cost optimization for swaps:

- An updated auto-route that finds the best price on Uniswap v2 + v3 while optimizing gas prices.

- The autorouter supports the Uniswap protocol in Layer 2 networks

- Real-time gas pricing on your swap

- More intelligent auto-slippage

Sushiswap

Sushiswap is thinking of its community and planning to implement non-permanent loss protection mechanics like in Bancore

Chainlink

Chainlink has launched its oracles on the Harmony network

Rari Capital

Rari Capital, holders of Fei protocol tokens, approved the multi-billion dollar merger of DeFi

One of the most high-profile DAO mergers with DAO in history took place.

Yearn

Yearn is likely to undergo a massive change in tokenomics

and is about to stimulate the migration of tokens from weak hands to strong hands.

This DeFi blue chip keeps evolving and shows itself to be the best decentralized managed protocol

Luna

Luna, despite negative market sentiment, breaks through its ATH amid Astroport launch

El Salvador

El Salvador buys 21 more Bitcoins

Terra

Terra launches bridge to Near

Highlights of the week

Events of the next week

.png)

.png)

Funding

- BinanceLabs has made a $12 million strategic investment in WOOnetwork which provides liquidity on Binance Smart Chain and other protocols.

- NFT-focused Metaversal raises $50 million in Series A funding

- Square Enix is planning to invest more in blockchain games in 2022

- CryptoSlam, a leading provider of data and transparency for the NFT industry, today announced the close of a $9 million capital raise.

- NFT marketplace OpenSea raised $300mn in Series C

Metrics

10 effective coins of the week

The assessment combines altcoin's price performance in relation to bitcoin and indicators of social activity

Grayscale fund portfolio dynamics

Bitcoin metrics

- Stock to flow

This model views bitcoin as a commodity comparable to commodities such as gold, silver, or platinum. These commodities are known as "stored value commodities" as they retain their value over time due to their relative scarcity.

For commodities of value, such as gold, platinum, or silver, a high ratio indicates that they're not largely used for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We see the price continues to follow Bitcoin's stock-to-flow ratio over time. Thus, we can predict where the price might go by observing the projected stock-to-flow ratio line, which we can calculate as we know the approximate timeline for Bitcoin mining in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event (sometimes called "halving"). This is an event in which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

- BTC Onchain

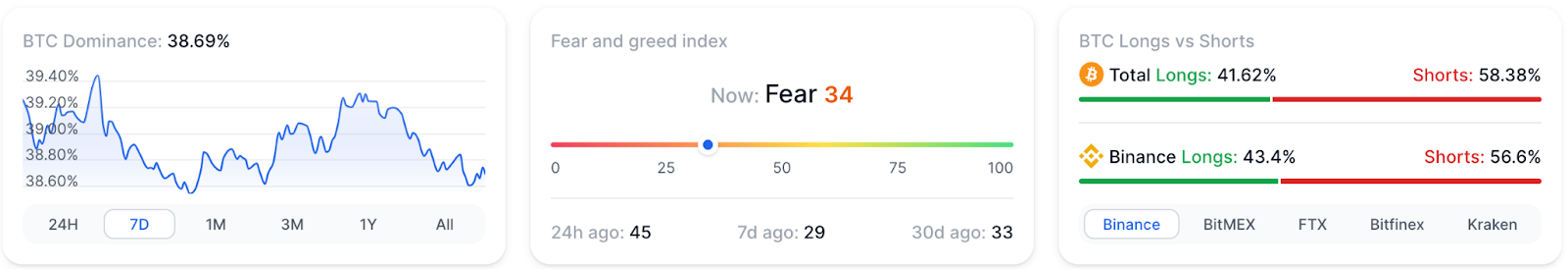

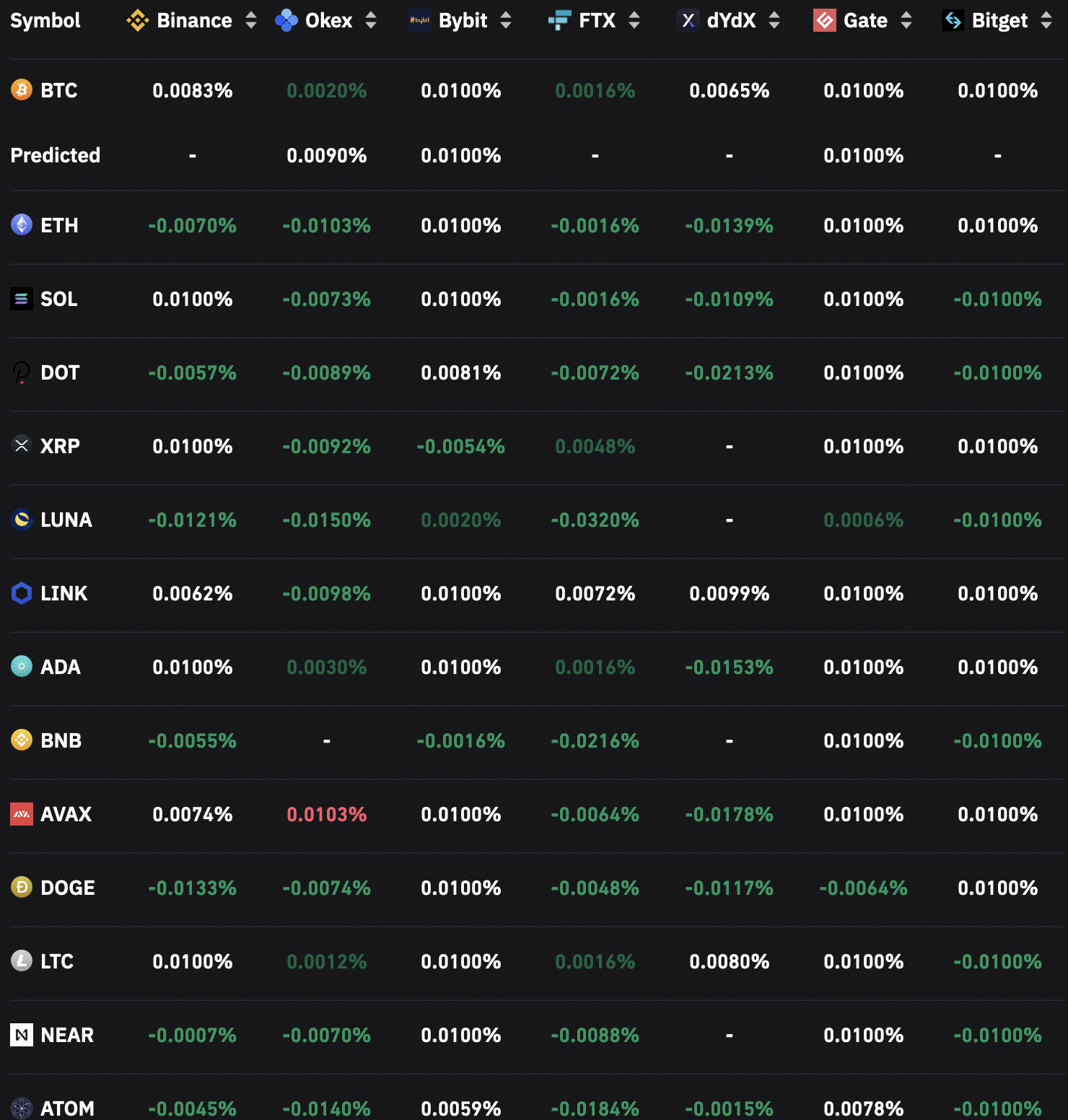

Funding Rates

Positive funding rates imply that speculators are bullish and long-traders pay funds to short-traders.

Negative funding rates indicate the speculators are bearish and short-traders pay funds to long-traders.

P.S. Funding rates (0.01%) are black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) are red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

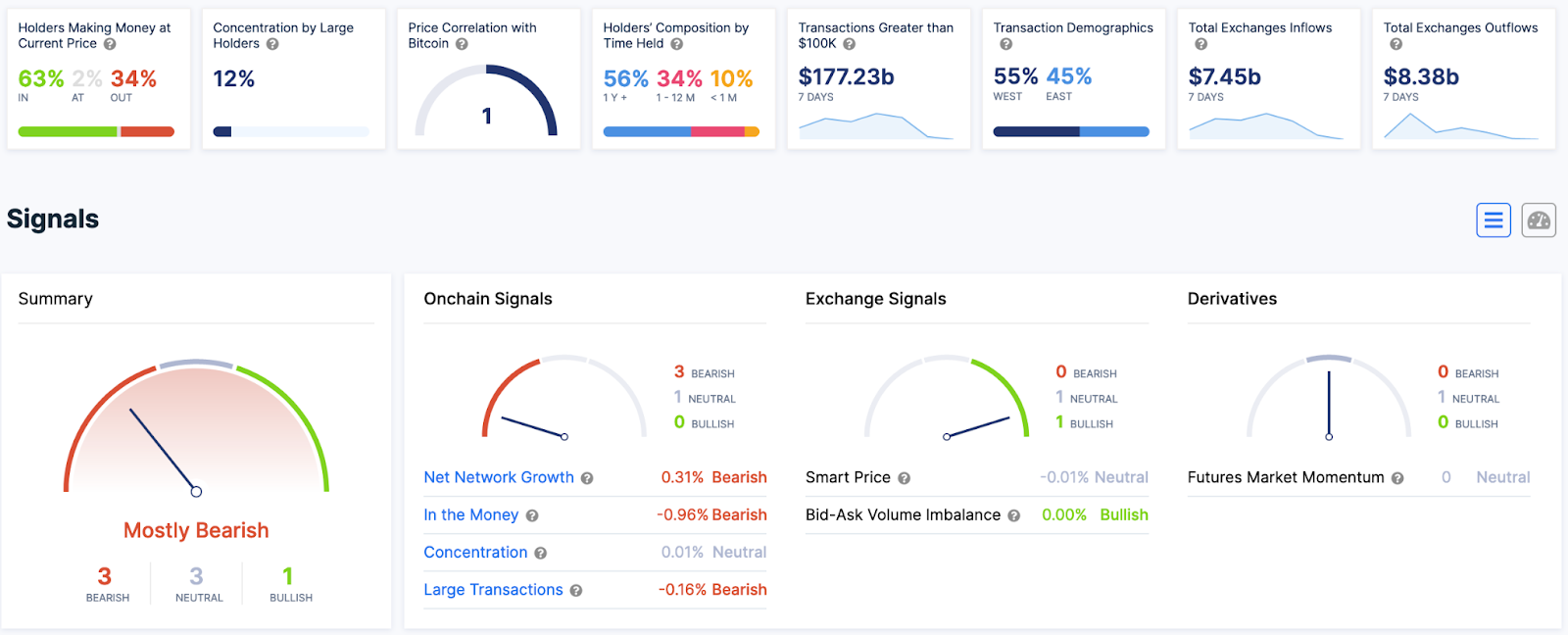

Off chain data