Project Events

Bentley

Bentley announced a limited-edition NFT collection on the Polygon network.

eBay

eBay announced its purchase of NFT marketplace KnownOrigin.

ParaSwap

ParaSwap launches first NFT P2P mobile trading app on iOS.

Uniswap Labs

Uniswap Labs acquires Genie, the first NFT marketplace aggregator.

All of this makes us wonder about the future use of the NFT technology. We believe the trend isn't over yet.

Arbitrum Odyssey

The blockchain popularization event Arbitrum Odyssey has already started. The first week - testing of bridging protocols.

WeChat outlaws all cryptocurrency activity. Violators face a permanent ban.

Split

Split protocol has announced an imminent launch and its tokenomics, in which they plan to distribute a portion of the proceeds to users.

Tether

In early July, Tether will launch a GBP₮ stablecoin pegged to the British pound sterling.

Stablecoin will initially be available on Ethereum.

dYdX

dYdX will move to its own blockchain in the Cosmos ecosystem.

Decentralized derivatives exchange dYdX said the company began development of dYdX V4, based on Cosmos and the Tendermint Proof-of-Stake protocol to move beyond the Ethereum ecosystem.

In addition, dYdX will create a completely decentralized orderbook, autonomous system and matching engine to scale the number of orders and support more orders than any other blockchain.

Ava Labs

Ava Labs releases Core, an all-in-one Web3 operating system for Avalanche.

The non-custodial browser extension allows for seamless use of Avalanche dApps and tools, providing Web3 users with a superior experience.

Teller

Teller protocol will bring DeFi to the real estate industry.

Teller is working to bring real world assets into DeFi. Their partnership with real estate veteran Tower Fund Capital is accelerating the process.

This partnership, which will allow LPs to earn interest on real estate investment loans, is just one of many products they are integrating to take DeFi beyond rate fees and exchange commissions.

Highlights of the week

Events for the coming week

Funding

-

FalconX, a digital asset platform, raised $150M in a Series D funding round co-led by GIC and B Capital.

-

Other investors who also participated include Tiger Global, Thoma Bravo, Wellington Management, and Adams Street. The company doubled its valuation from $3.75M to $8M

-

1confirmation announced the launch of a $100M NFT fund to support early-stage NFT creators.

-

NFT marketplace Magic Eden, launched just nine months ago, has raised $130M in a Series B co-led by Electric Capital and Greylock Partners, bringing its valuation to $1.6B.

-

Astaria has raised $8 million in a seed round to develop a high-functioning NFT lending protocol.

-

Immutable launches $500 million development fund to boost web3 gaming.

-

Endaomentdotorg announced raising $6.67 million to support its charitable mission, administration of the nonprofit protocol, and further development of its smart contract-based financial services.

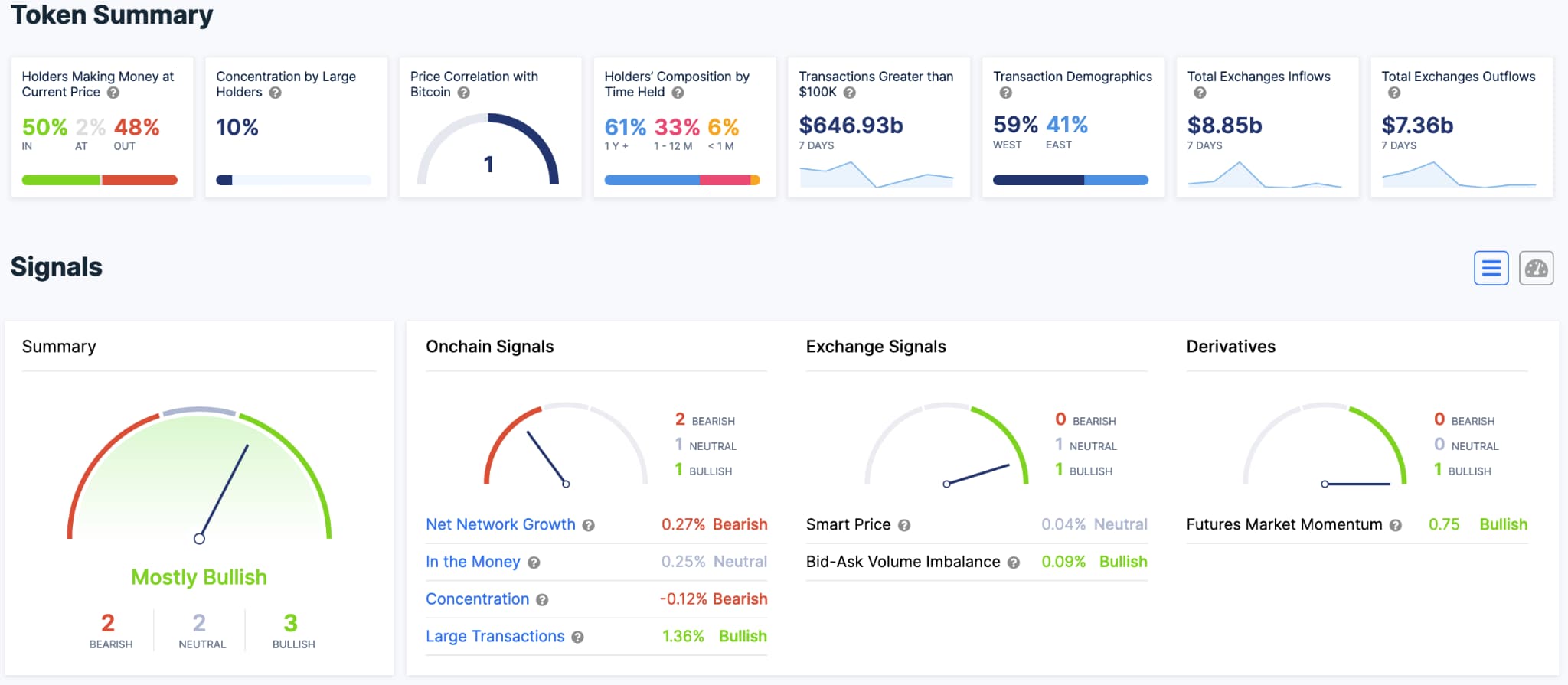

Metrics

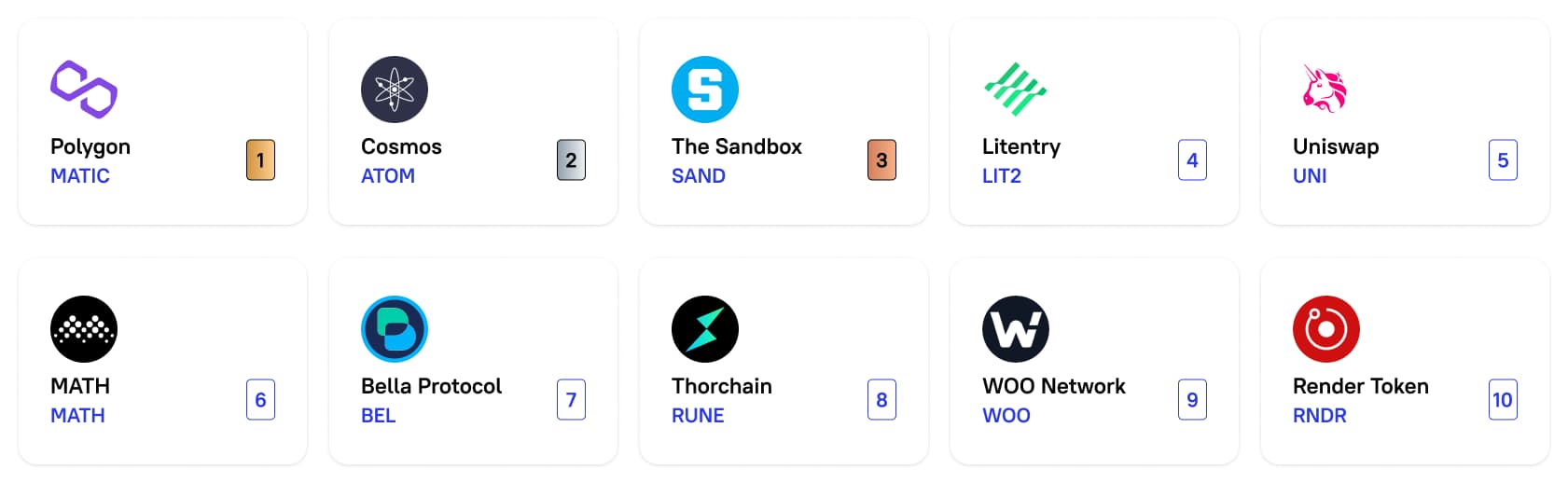

10 effective coins of the week

Assessment combines altcoin price performance relative to bitcoin and social performance.

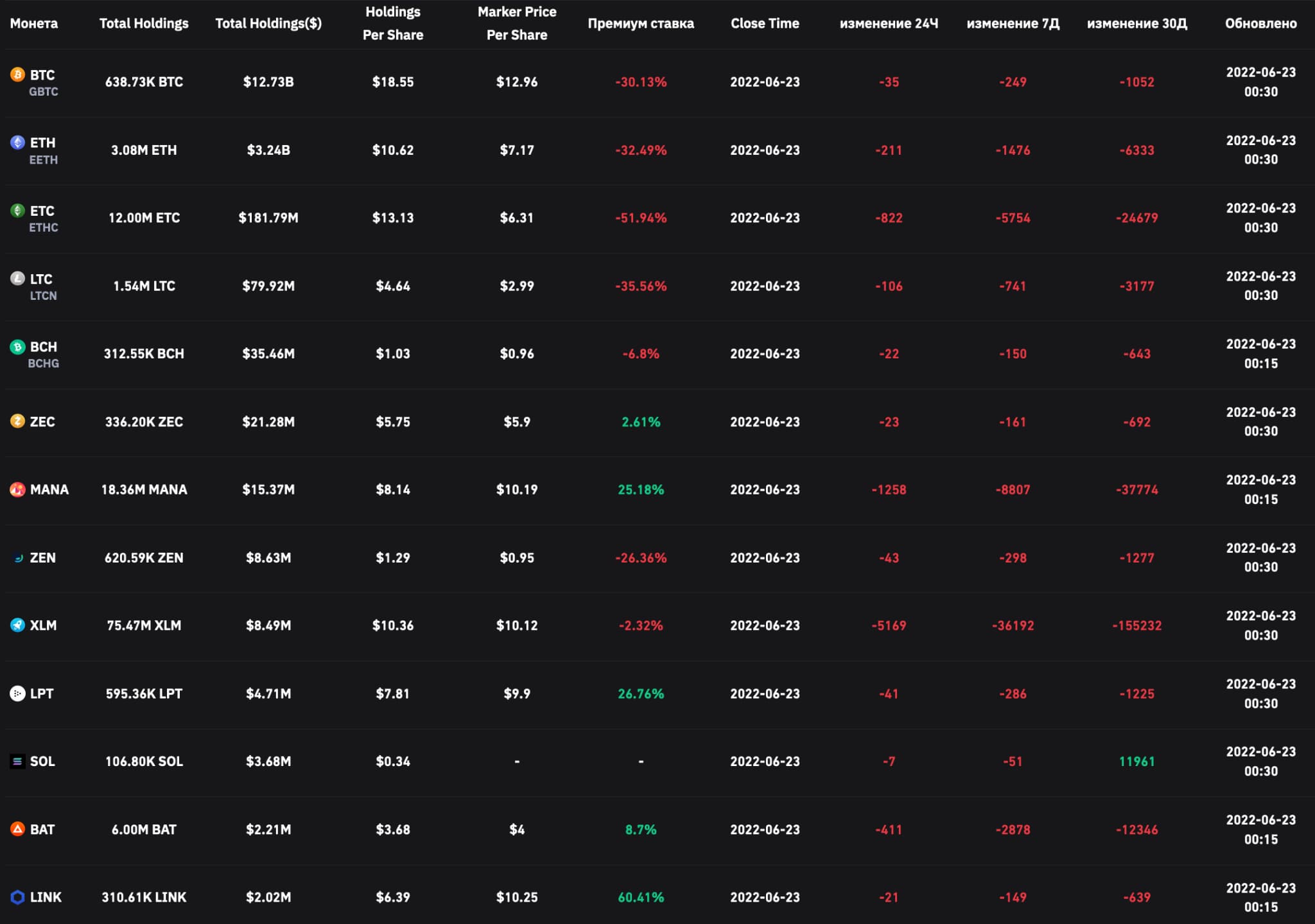

Grayscale fund portfolio dynamics

Bitcoin metrics

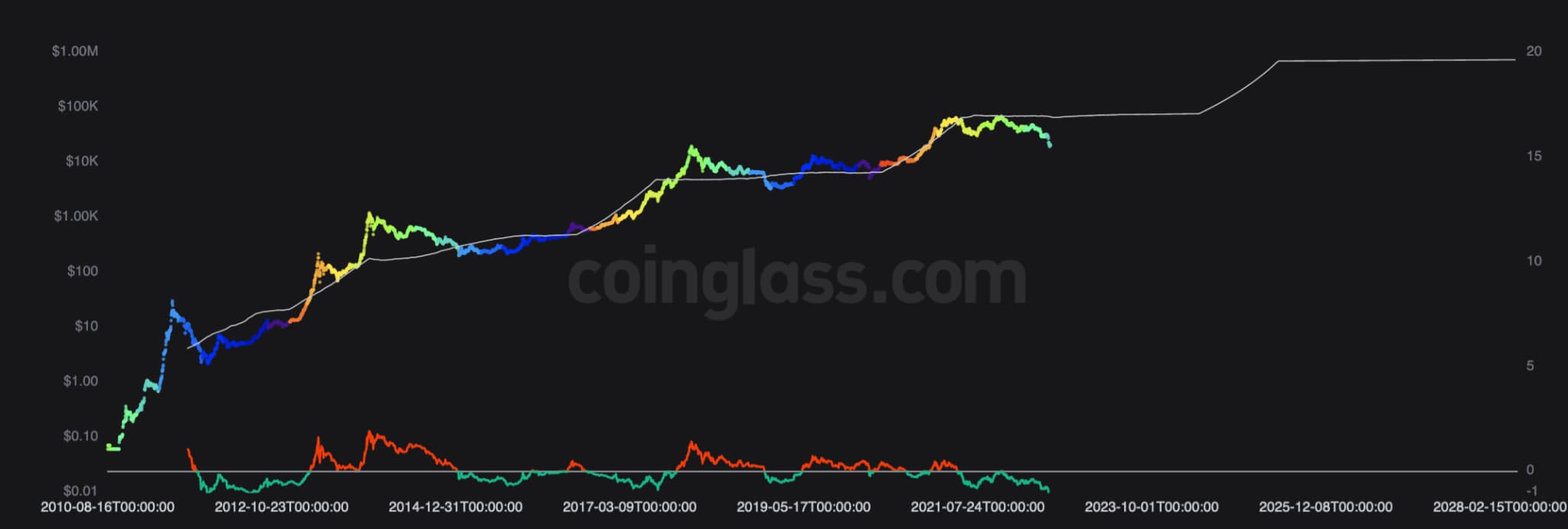

- Stock to flow

This model views Bitcoin as a commodity comparable to those like gold, silver, or platinum. These commodities are known as "stored value commodities" because they retain their value over time due to their relative scarcity.

For commodities of value, such as gold, platinum, or silver, a high ratio indicates that they are not primarily consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we are able to predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event. It's an event during which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

- BTC OnChain

Despite the panic, the number of Bitcoin addresses with a balance of more than 0.01 BTC has reached 10 million.

Funding Rates

Positive funding rates imply that speculators are bullish, and long-traders pay funds to short-traders.

Negative funding rates mean that speculators are bearish, and short-traders pay funds to long-traders.

P.S. Funding rates (0.01%) - black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) - red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

Off chain data