Project Events

This week has been marked by a number of serious incidents affecting the overall state of the market:

Terra UST

Terra's UST stablecoin lost its peg to the dollar, causing a hyperinflation of the LUNA token, which lost 99% of its value. The community is currently thinking of forking the network and giving away new tokens to those suffered.

Additionally, a number of stablecoins also lost their peg to the dollar, which also caused a cascade of liquidations in the credit market. Currently, the best performing currencies are USDC/BUSD/LUSD. We advise you to divide your savings into several parts.

Yearn

Yearn community encourages holders to sell YFI tokens, so that the community builders can buy them back at a discounted price. This will lead to a concentration of tokens in the hands of more valuable developers for the community, indicating the core community's commitment to the project.

Lens Protocol

The framework for decentralized social media, Lens Protocol, developed by Aave, is coming to Polygon.

web3

A number of web3 interfaces have detected a phishing module while using Etherscan, SpiritSwap, Coingecko. Be careful and do not confirm unknown transactions in your wallet.

Symbiosis

Symbiosis has implemented the 1inch tool to provide the best price for cross-chain exchanges.

Robinhood

Robinhood launches DeFi wallet to rival Metamask.

Hop

Protocol for L2 transactions Hop launches a DAO to hand over control of the protocol to its community.

Pancakeswap

Pancakeswap will limit its token supply to 750 million coins, meaning their issuance is now limited to that amount, which is a generally good sign that could later reflect in the growth of the asset's price.

Moonriver

Moonriver has leased a slot on the Kusama parachain network to expand its ecosystem.

Ethereum

The Ethereum mainnet will be merged with proof-of-stake in early June. The test run will take place on the Ropsten network, after which it will be launched in the mainnet. After that, the blockchain will move to a more deflationary model of token issuance.

Spotify

Spotify begins testing NFTs on its platform, Music Ally reports.2

Polygon

A high-performance version of the Polygon chain has been proposed that would attempt to solve the infamous transaction spam problem, reduce MEV capabilities and lower the cost of data transfer, while providing fast transmission and immutability.

Highlights of the week

Events for the coming week

Funding

-

Venture capital firm 6th Man Ventures, which has already made more than 100 investments and is launching a second $145M fund, is investing up to $4M in early-stage cryptocurrencies, with an average of $1M to $2M.

-

Coinshift closes a $15M Series A funding round.

-

Aurora launches a $90M fund for Near development.

-

Pine Protocol, an NFT-backed crypto loan platform, has raised US$1.5 million in a seed round.

-

Andreessen Horowitz launches a $600M fund dedicated to gaming startups.

-

FreshCut, the gaming platform founded by the former Twitch executive, has just raised $15M to develop its short video content platform, with plans to reward both viewers and content creators.

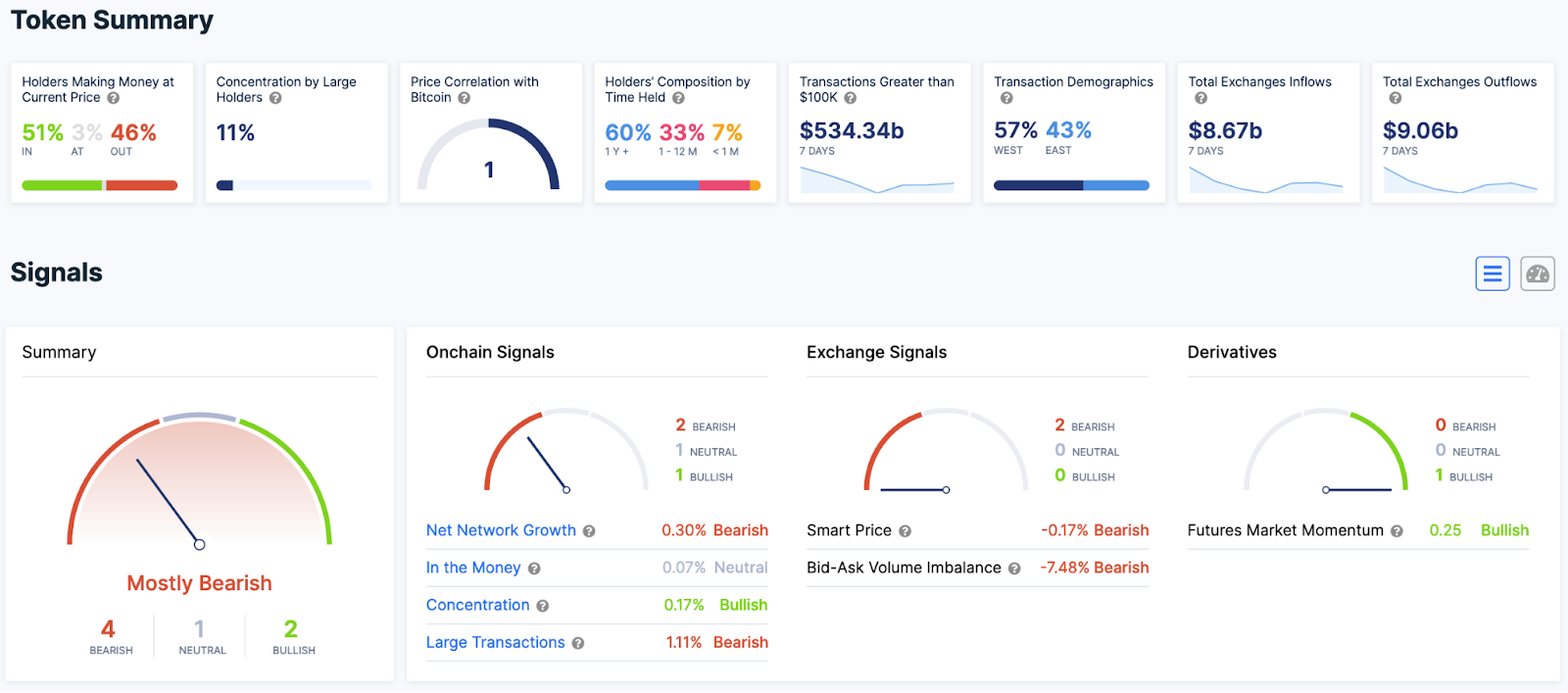

Metrics

10 effective coins of the week

Assessment combines altcoin price performance relative to bitcoin and social performance.

.jpg)

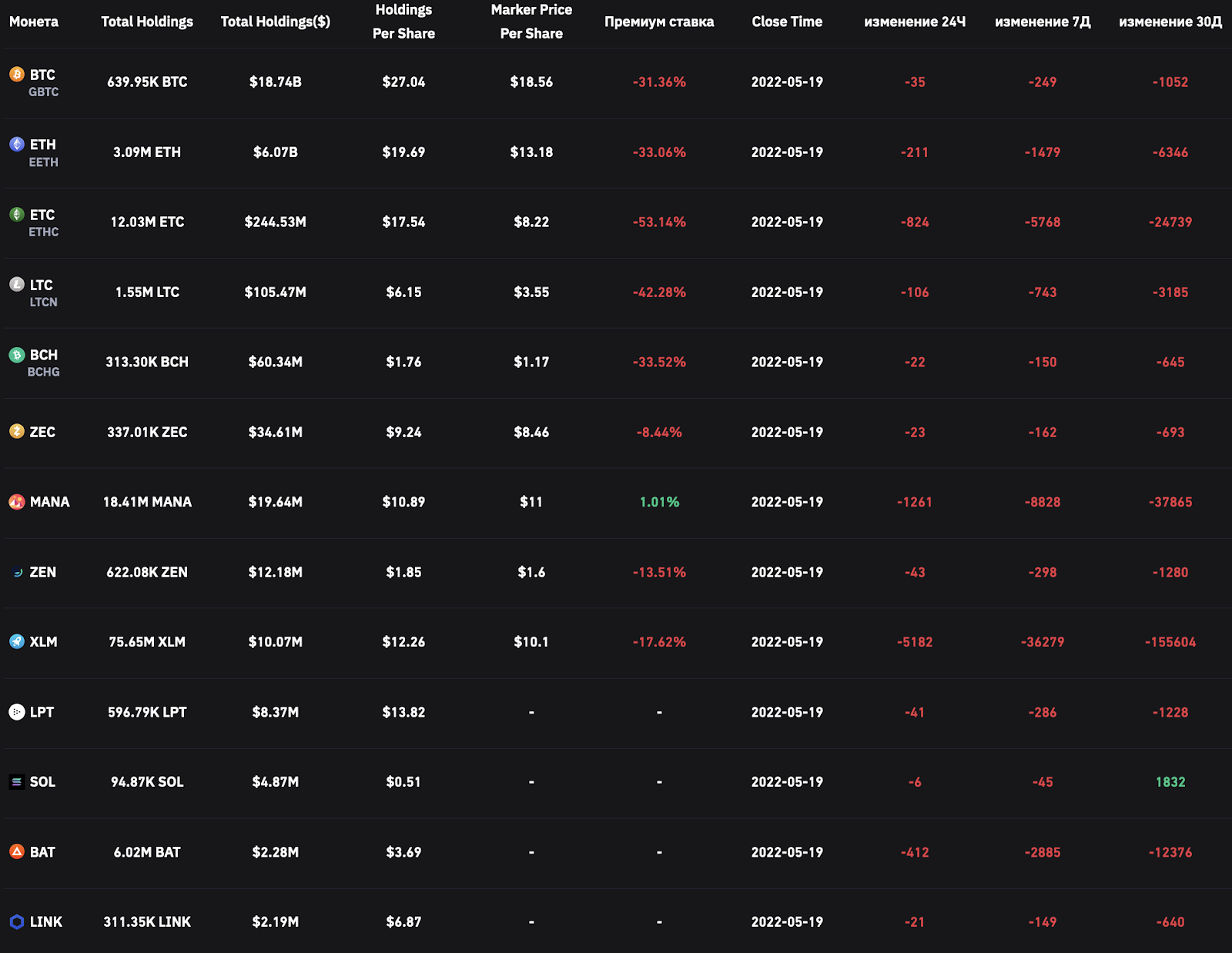

Grayscale fund portfolio dynamics

Bitcoin metrics

- Stock to flow

This model views Bitcoin as a commodity comparable to those like gold, silver, or platinum. These commodities are known as "stored value commodities" because they retain their value over time due to their relative scarcity.

For commodities of value, such as gold, platinum, or silver, a high ratio indicates that they are not primarily consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we are able to predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event. It's an event during which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

- BTC OnChain

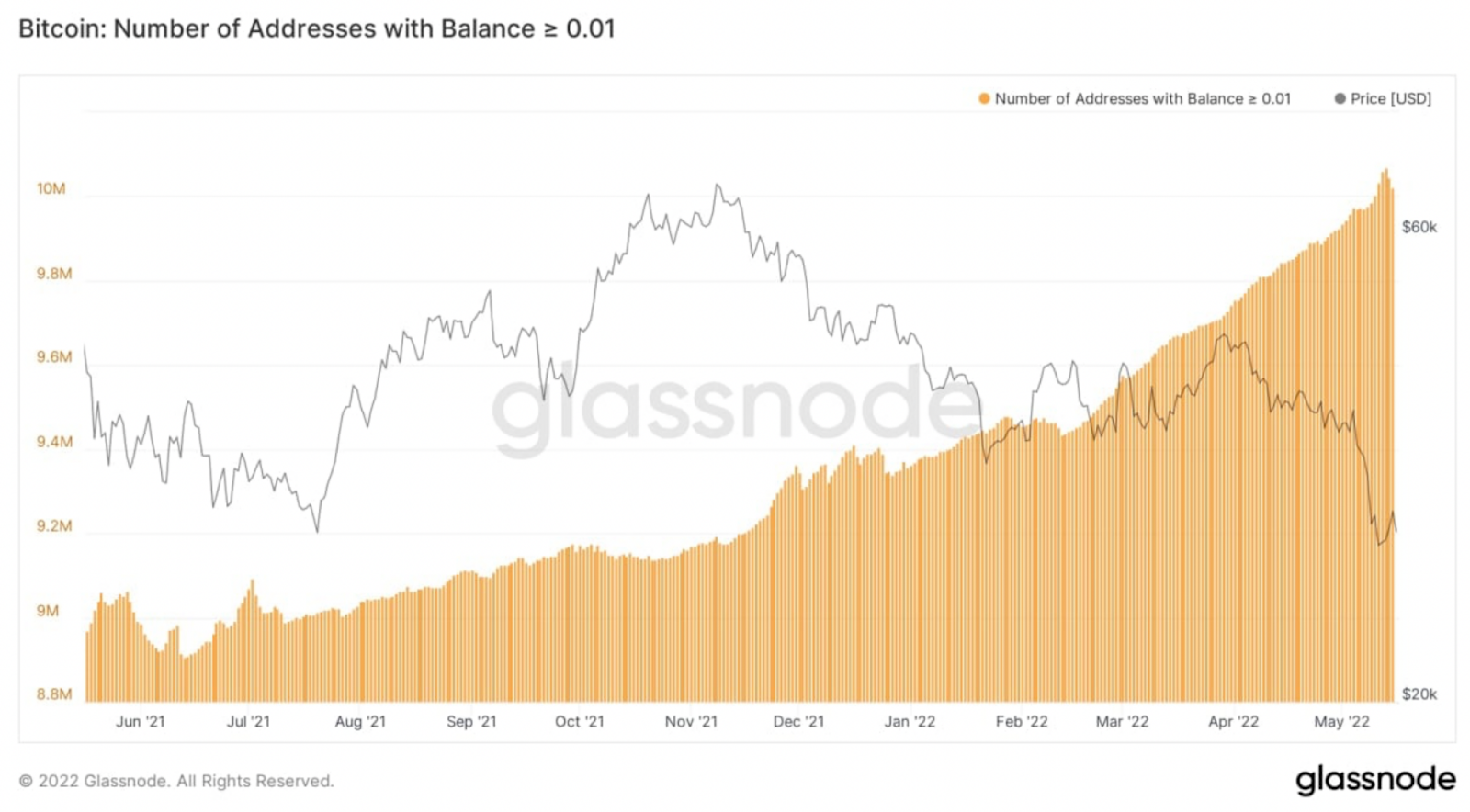

Despite the panic, the number of Bitcoin addresses with a balance of more than 0.01 BTC has reached 10 million.

Funding Rates

Positive funding rates imply that speculators are bullish, and long-traders pay funds to short-traders.

Negative funding rates mean that speculators are bearish, and short-traders pay funds to long-traders.

P.S. Funding rates (0.01%) - black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) - red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

Off chain data