Project Events

ZigZag Exchange

ZigZag Exchange deployed the alpha version of the Mammoth pool (AMM model Balancer) on testnet on StarkNet.

Sacred Finance

Sacred Finance has successfully launched a testnet, attracted early investors and is now ramping up the community with an early user program in preparation of mainnet and the launch of the DAO

Yearn

Yearn has launched on Arbitrum.

Serum

Serum launches its own accelerator to support promising new projects in its ecosystem.

Ethereum StarkNet

Ethereum scaling solution StarkNet has now fully launched - with plans to be handed over to its community.

Ethereum

zkSync 2.0: Public Testnet is Live! zkEVM has arrived, the first EVM-compatible ZK Rollup on Ethereum's testnet.

TEMPUS

TEMPUS launched on FANTOM network.

FTX Gaming

FTX Exchange launches new division - FTX Gaming offers complete solutions for companies and projects wishing to take the next step into web3.

OpenSea

OpenSea suffered a phishing attack, with many users losing their NFTs.

Olympus OHM

Olympus OHM fork - Spartacus_Fi has amassed a treasury of >$50 million, has a community of thousands and has been abandoned by its founder, who decided to grab all users' money.

Highlights of the week

Events for the coming week

Funding

- The Luna Foundation Guard raises $1 billion to form UST reserve denominated in Bitcoin, a stablecoin in the ecosystem.

- Ren Labs raises $7.5 million to create "Catalog" cross-chain exchange.

- Brahma raises $4.2 million in an effort to provide access to diversified, sustainable returns in DeFi.

Metrics

10 effective coins of the week

Assessment combines altcoin price performance relative to bitcoin and social performance.

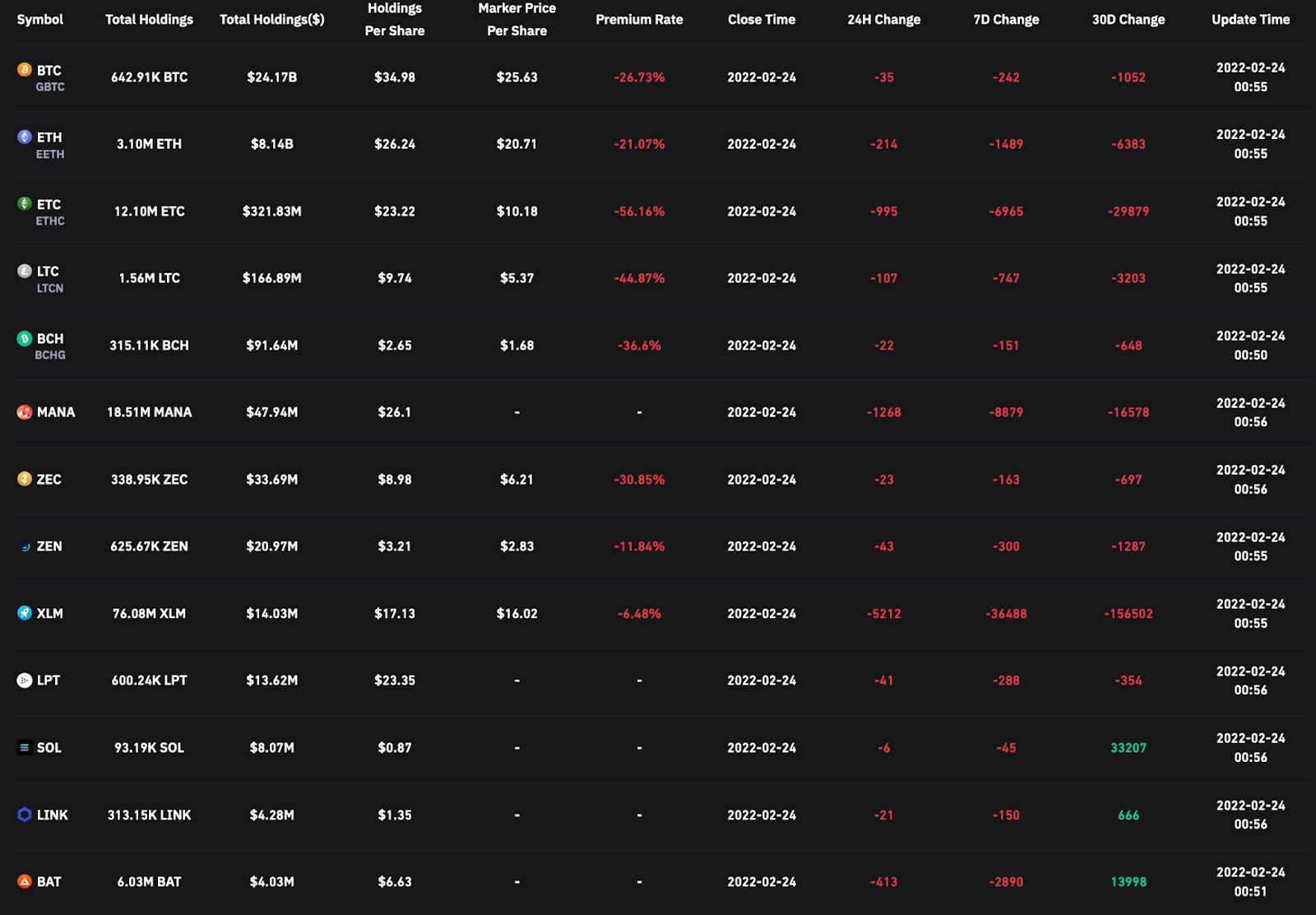

Grayscale fund portfolio dynamics

Bitcoin metrics

- Stock to flow

This model views Bitcoin as a commodity comparable to those like gold, silver, or platinum. These commodities are known as "stored value commodities" because they retain their value over time due to their relative scarcity.

For commodities of value, such as gold, platinum, or silver, a high ratio indicates that they are not primarily consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we are able to predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event. It's an event during which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

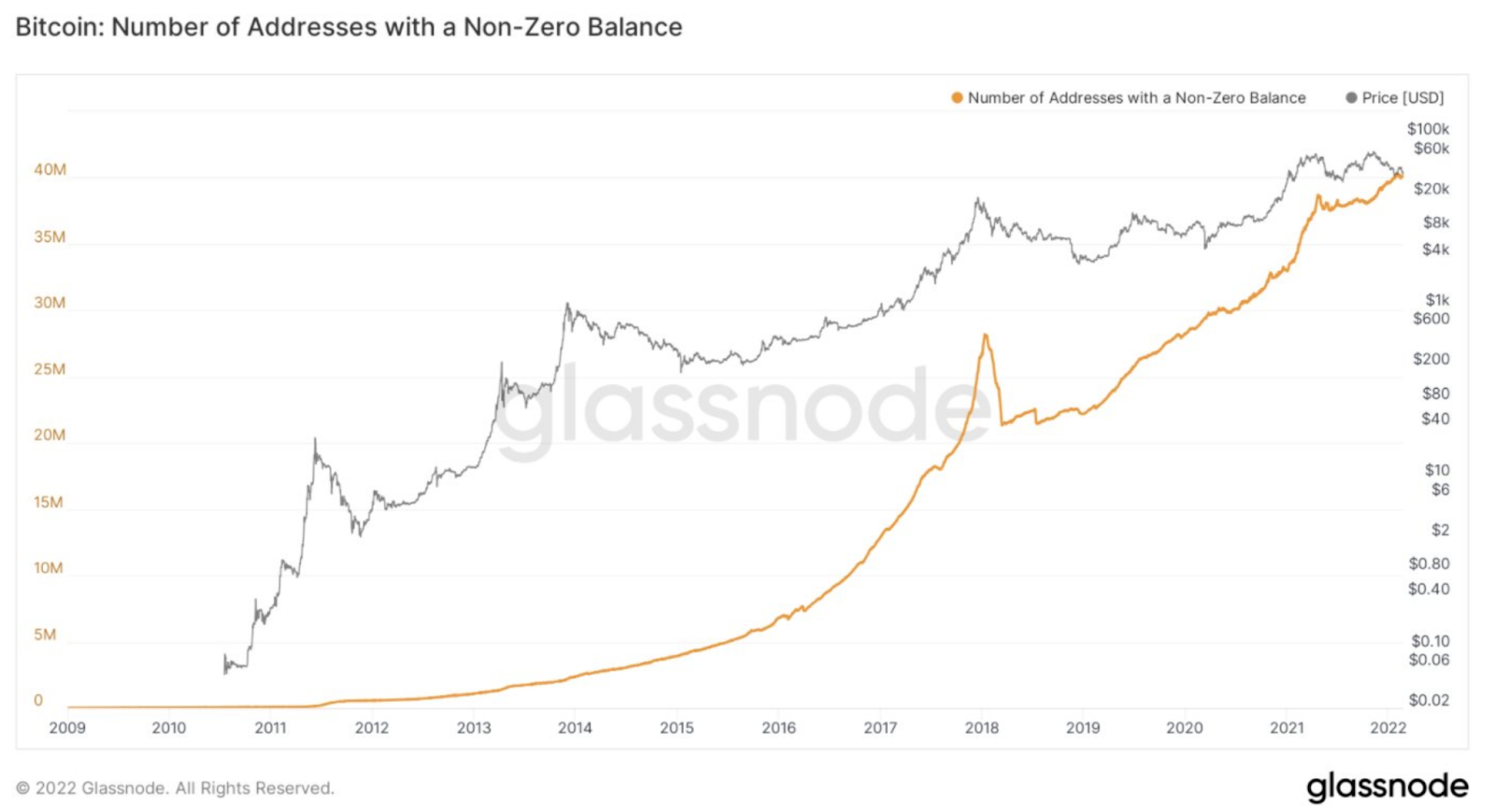

- BTC OnChain

Whales have significantly accumulated BTC over the past 7 weeks. Since Dec. 23, addresses with $1,000BTC or more have added a total of $220,000BTC to their wallets, representing the fastest accumulation since September 2019.

Funding Rates

Positive funding rates imply that speculators are bullish, and long-traders pay funds to short-traders.

Negative funding rates mean that speculators are bearish, and short-traders pay funds to long-traders.

P.S. Funding rates (0.01%) - black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) - red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

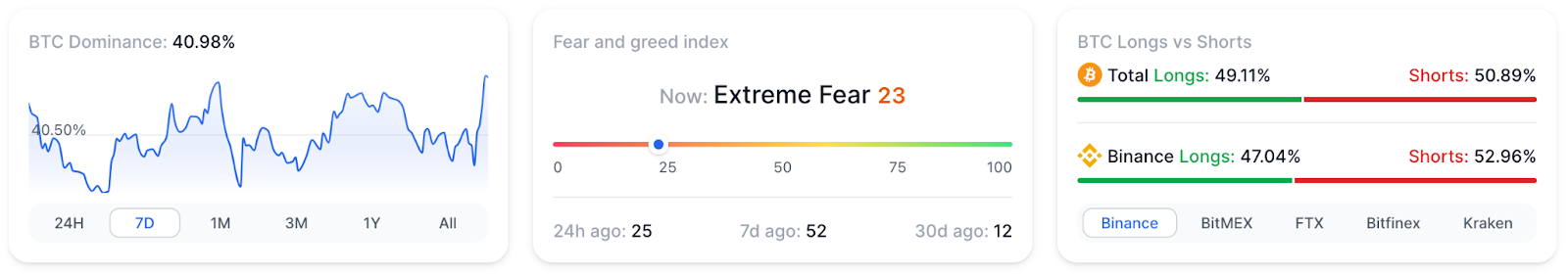

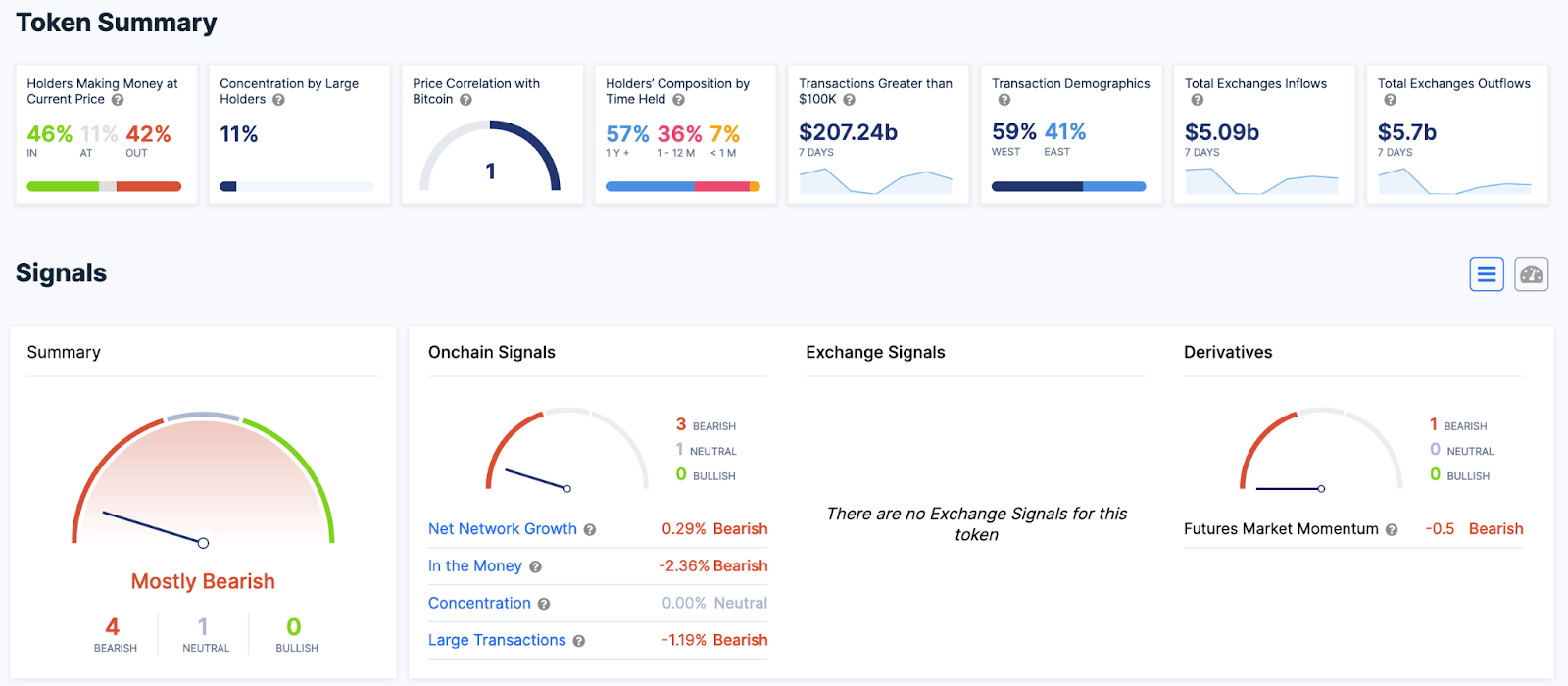

Off chain data