Project Events

Terra 2.0

Terra 2.0 is set to launch on May 28

The distribution of new tokens will take place among previous token holders

- LUNA, which were purchased before the attack (pre-attack) - 1 : 1.1;

- UST purchased before the attack - 1 : 0.033;

- LUNA bought after the attack (post-attack) - 1 : 0.000015;

- USTs bought after the attack - 1 : 0.013.

The "post-attack" snapshot will take place on May 27. The "before attack" snapshot was taken on May 7.

On Friday, users will receive 30% of the drop. The remaining 70% will be distributed over 2 years after the 6 month freeze.

Many projects are also supporting the new network by launching their contracts and distributing tokens to the users of the old network.

Soulbound tokens

Vitalik Buterin recently published a paper on the new idea of Soulbound tokens. These non-transferable tokens could function as records and tokens on social reputation.

This could help new projects, companies and institutions send "Soulbound tokens" to real people who have demonstrated relevant experience, skills and value to the project.

Stripe

Stripe partners with OpenNode to allow instant fiat-to-Bitcoin conversions for businesses.

FTX

Cryptocurrency exchange FTX announced its stock trading capabilities. The company had previously acquired a large stake in Robinhood.

Stargaze

Stargaze launched a decentralized NFT marketplace.

Web3

Web3 is ready for enterprises. The #PolygonNightfall Mainnet beta is here!

Polygon has launched Nightfall, the enterprise's most efficient blockchain solution, enabling businesses to orchestrate private transactions for use in supply chains and other key business functions.

With Optimistic-ZK's advanced hybrid approach, businesses get:

- Security: transactions are stored on Ethereum mainnet;

- Efficiency: transaction fees are the lowest possible;

- Confidentiality: transactions are kept private from third parties.

Web3 browser Brave adds Solana support and Ramp Wallet functionality in its latest update.

FIFA

FIFA announces partnership with Algorand.

Seaport

OpenSea introduced Seaport, a brand new web3 marketplace protocol designed to create a decentralized and efficient environment for buying and selling NFTs.

AAVE

AAVE launches Lens Protocol, a decentralized social media protocol, running on the Polygon blockchain.

Highlights of the week

.jpg)

Events for the coming week

.jpg)

Funding

-

Venture capital firm Standard Crypto has raised a new $500 million fund, according to a report from Axios. The fund will "invest in both equities and cryptocurrencies," according to the announcement.

-

Startup ZenLedger has closed a $15 million Series B round led by ParaFi Capital, with participation from Three Point Capital, King River Capital and its Series A lead investor Bloccelerate VC, among others.

-

Solana early-stage investor NGC Ventures raises $100 million for Web 3-focused fund. The Metaverse Ventures Fund will back early-stage projects in DeFi, NFTs and GameFi.

-

StarkWare announced a $100 million Series D investment round at an $8 billion valuation.

Metrics

10 effective coins of the week

Assessment combines altcoin price performance relative to bitcoin and social performance.

.png)

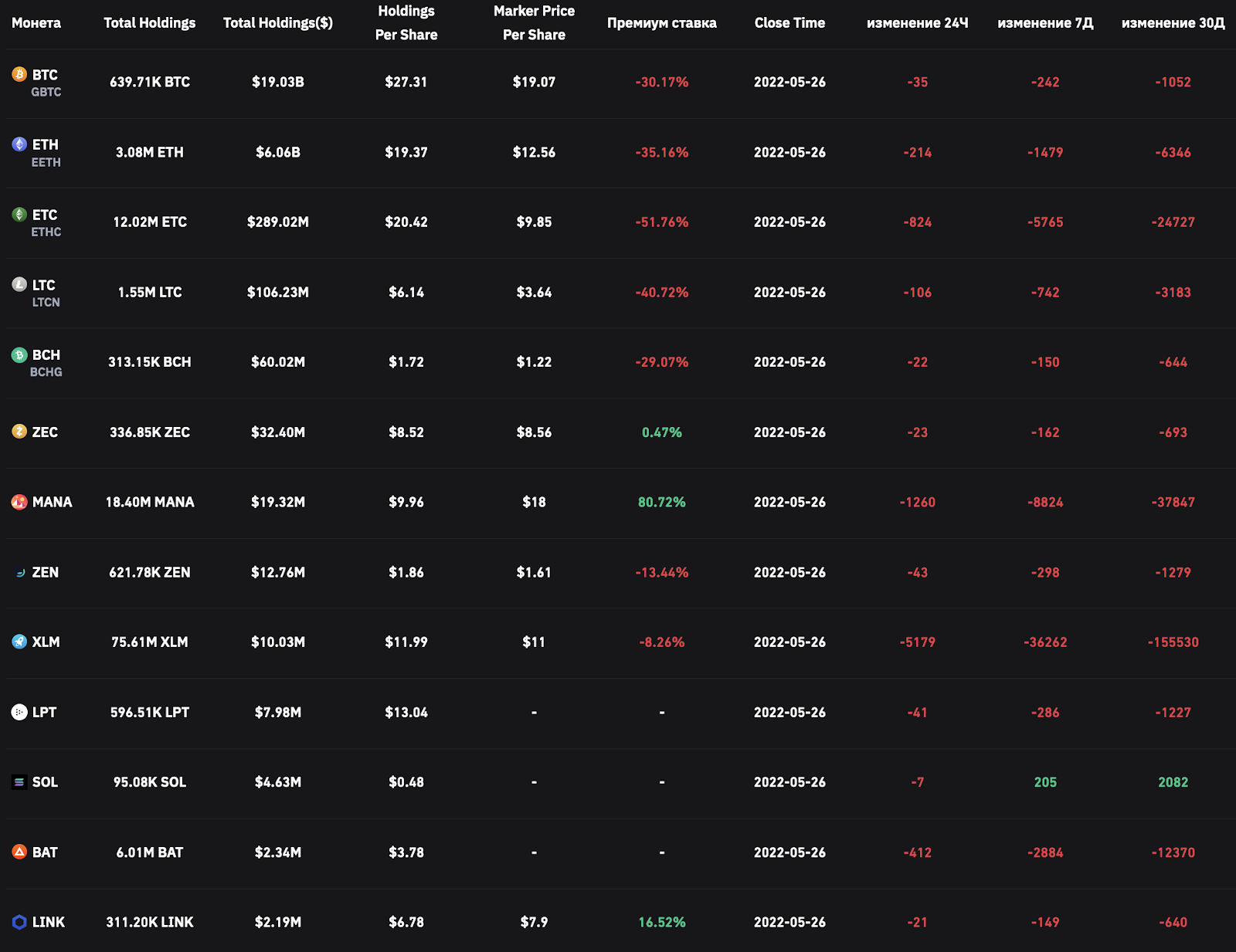

Grayscale fund portfolio dynamics

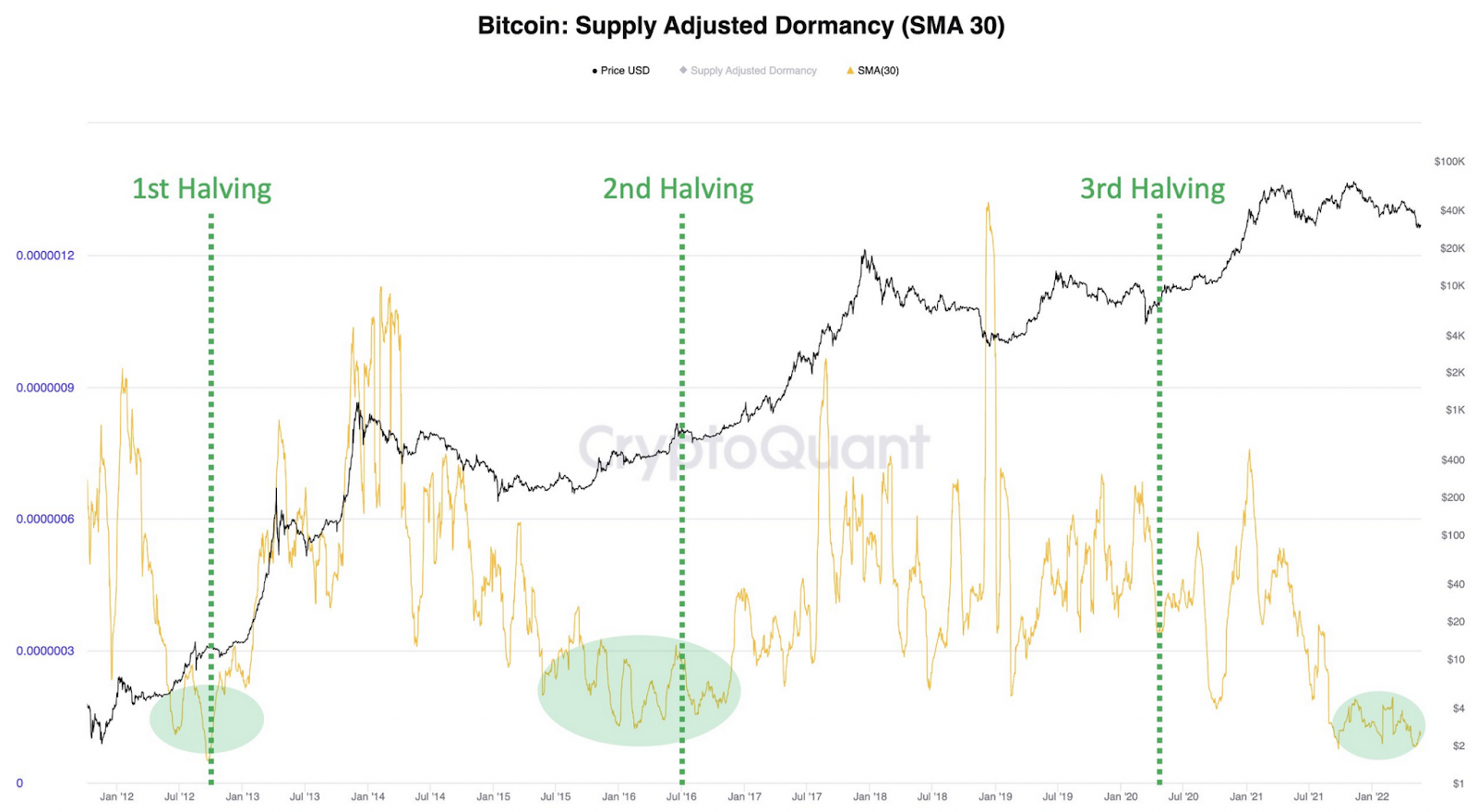

Bitcoin metrics

- Stock to flow

This model views Bitcoin as a commodity comparable to those like gold, silver, or platinum. These commodities are known as "stored value commodities" because they retain their value over time due to their relative scarcity.

For commodities of value, such as gold, platinum, or silver, a high ratio indicates that they are not primarily consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we are able to predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event. It's an event during which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

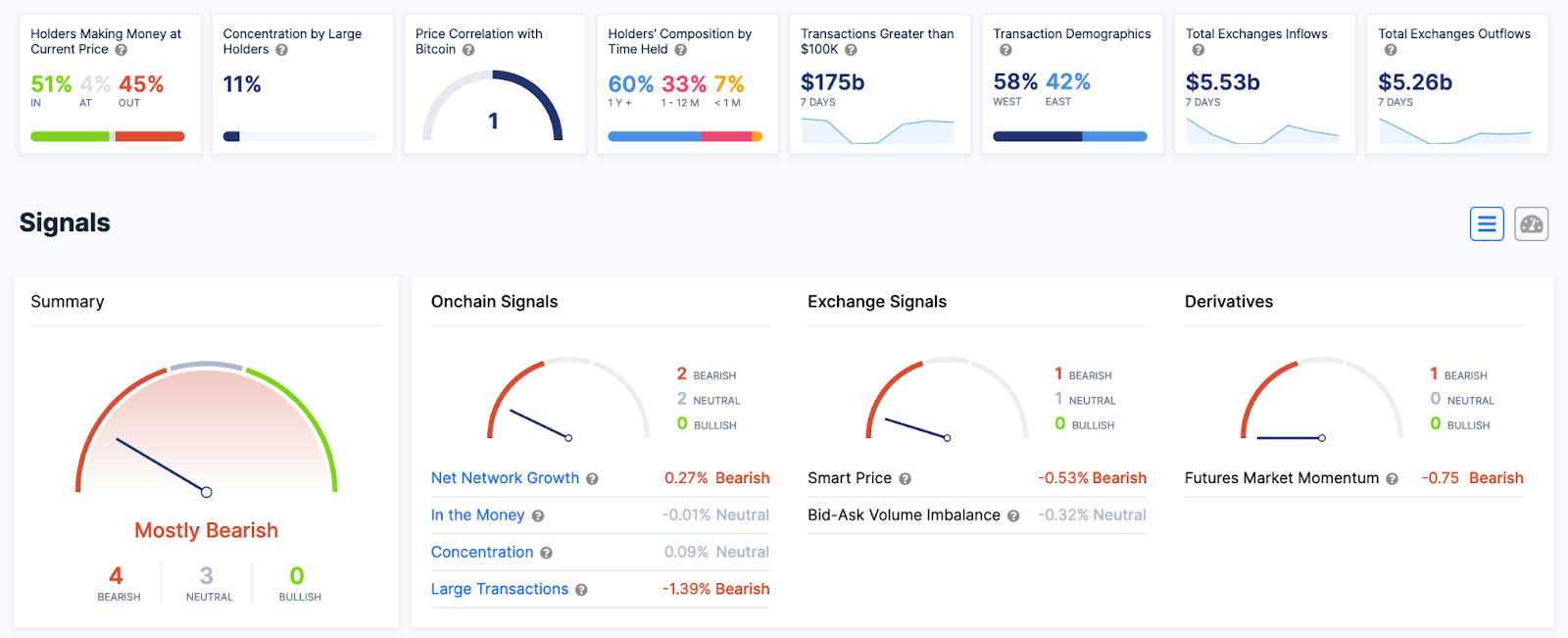

- BTC OnChain

Despite the panic, the number of Bitcoin addresses with a balance of more than 0.01 BTC has reached 10 million.

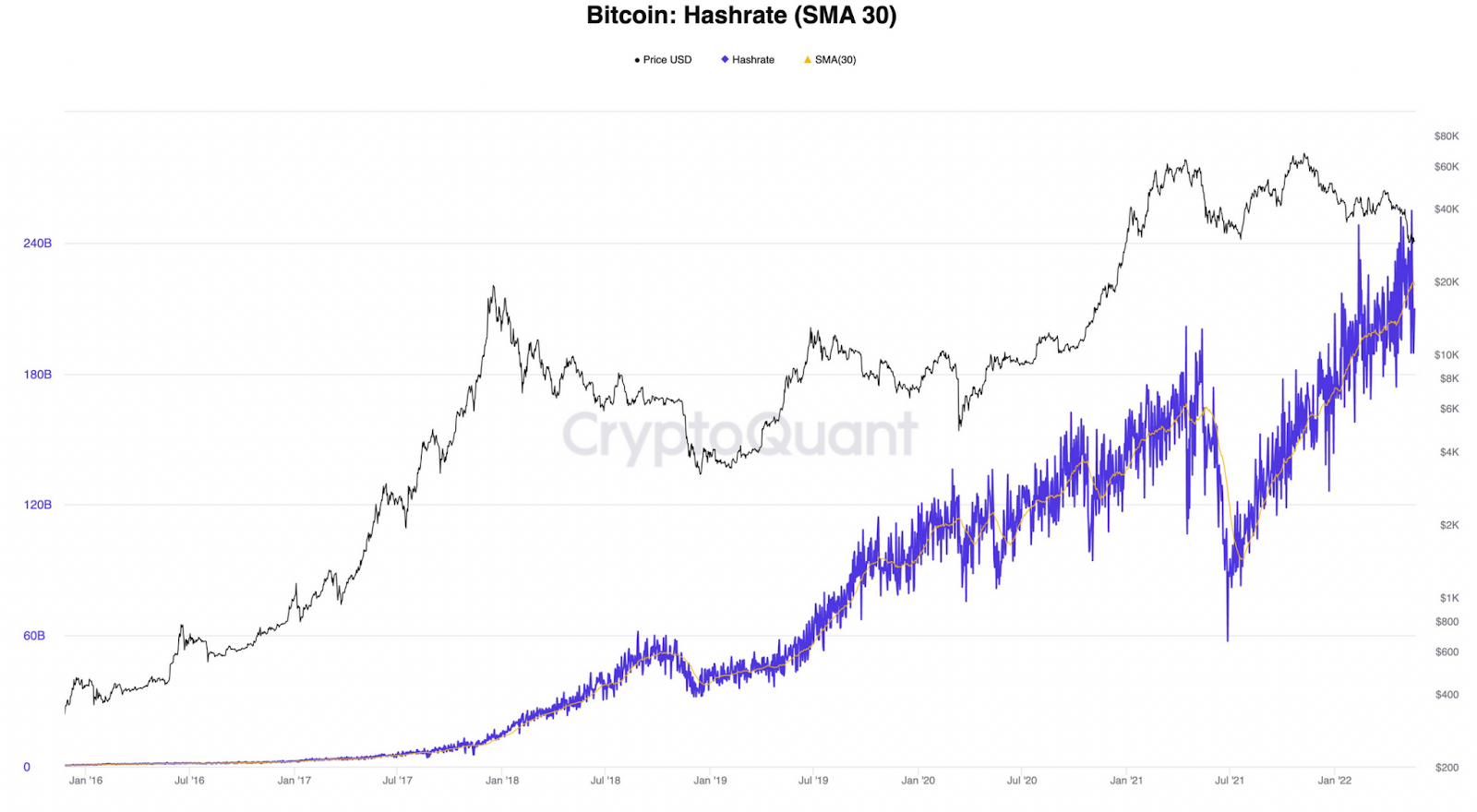

While the price of $BTC has dropped 56% since November 2021, the hash rate has grown by +75%.

This metric appears to be fundamental in assessing the "health" of the blockchain.

Funding Rates

Positive funding rates imply that speculators are bullish, and long-traders pay funds to short-traders.

Negative funding rates mean that speculators are bearish, and short-traders pay funds to long-traders.

P.S. Funding rates (0.01%) - black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) - red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

Off chain data