Project Events

Arbitrum

Arbitrum launches AnyTrust: Cheaper and faster L2 chains with minimal trust requirements.

Polygon

Polygon has published its review of the consensus engine bug/vulnerability.

Yearn and Notional

Yearn and Notional have announced integration, with Yearn allocating $15 million USDC and $15 million DAI to Notional's fixed-rate lending strategies.

Sacred Finance

Sacred Finance launched an early contributor program that empowers people to contribute to workflow-adjusted activities depending on the needs of the project.

BlackPool

BlackPool v2 has launched a BPT token blockchain program to participate in profit sharing protocol.

Chainflip

Chainflip introduced a new AMM protocol design for decentralized crosschain exchanges: Just In Time (JIT).

BNT

BNT holds a vote on changes to the third version of the Bancor protocol:

The changes will address non-permanent loss protection, single-sided deposits into liquidity pools, and a common pool for BNT token deposits.

Lido

Lido launched on the Polygon network.

Yearn Finance

Yearn Finance partners with Tenderly to improve development, debugging, and analytics.

Bastion Protocol

Bastion Protocol announced the token release after a series of tests.

Highlights of the week

Events for the coming week

Funding

- Venture capital firm Electric Capital raises $1 billion to invest in crypto startups.

- Polymer Labs is building secure and reliable IBC (inter-blockchain communication) infrastructure and announced a $3.6M seed round.

- Blockchain infrastructure startup Tenderly raises $40M after 500% year-over-year revenue growth.

Metrics

10 effective coins of the week

Assessment combines altcoin price performance relative to bitcoin and social performance.

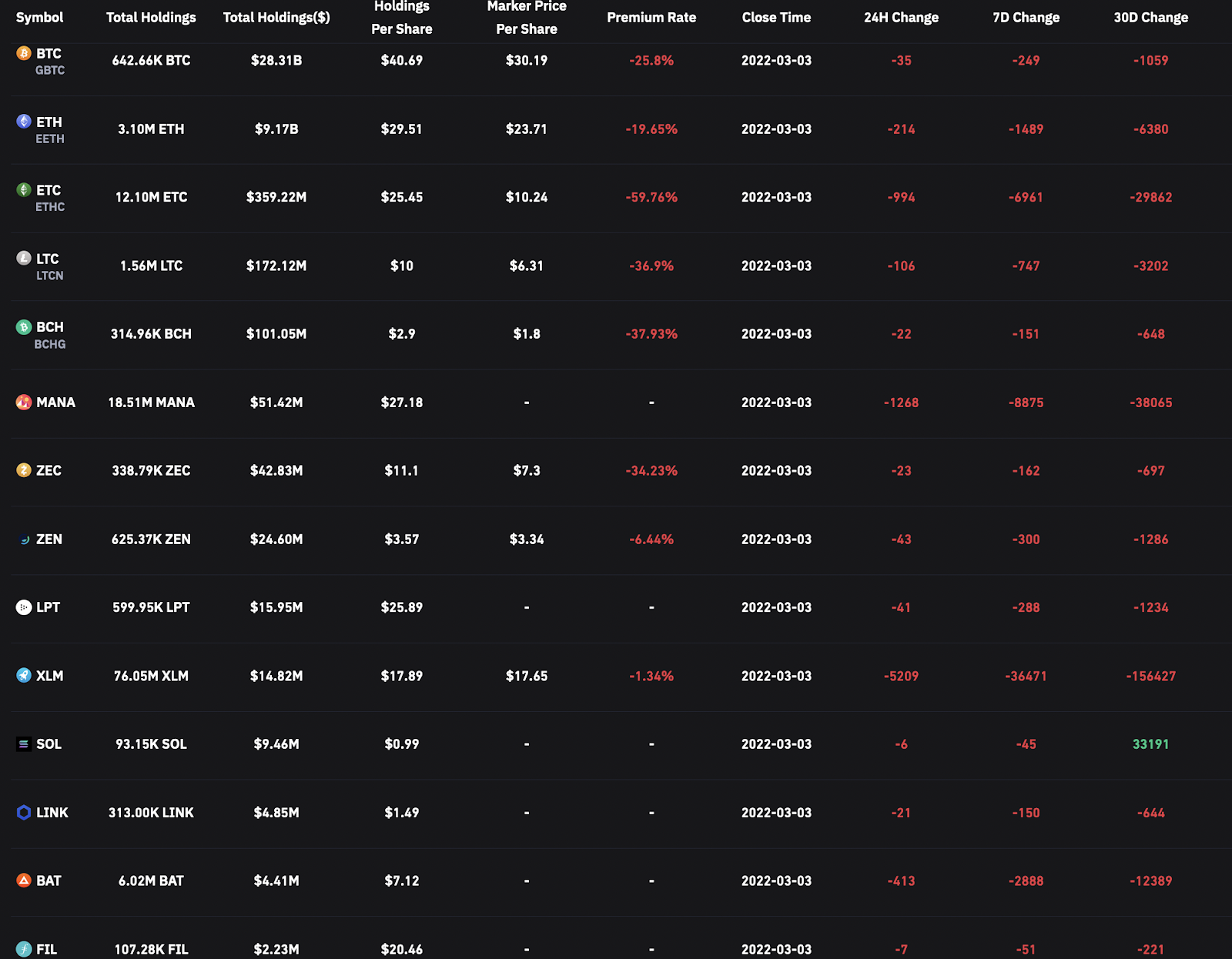

Grayscale fund portfolio dynamics

Bitcoin metrics

- Stock to flow

This model views Bitcoin as a commodity comparable to those like gold, silver, or platinum. These commodities are known as "stored value commodities" because they retain their value over time due to their relative scarcity.

For commodities of value, such as gold, platinum, or silver, a high ratio indicates that they are not primarily consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we are able to predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event. It's an event during which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

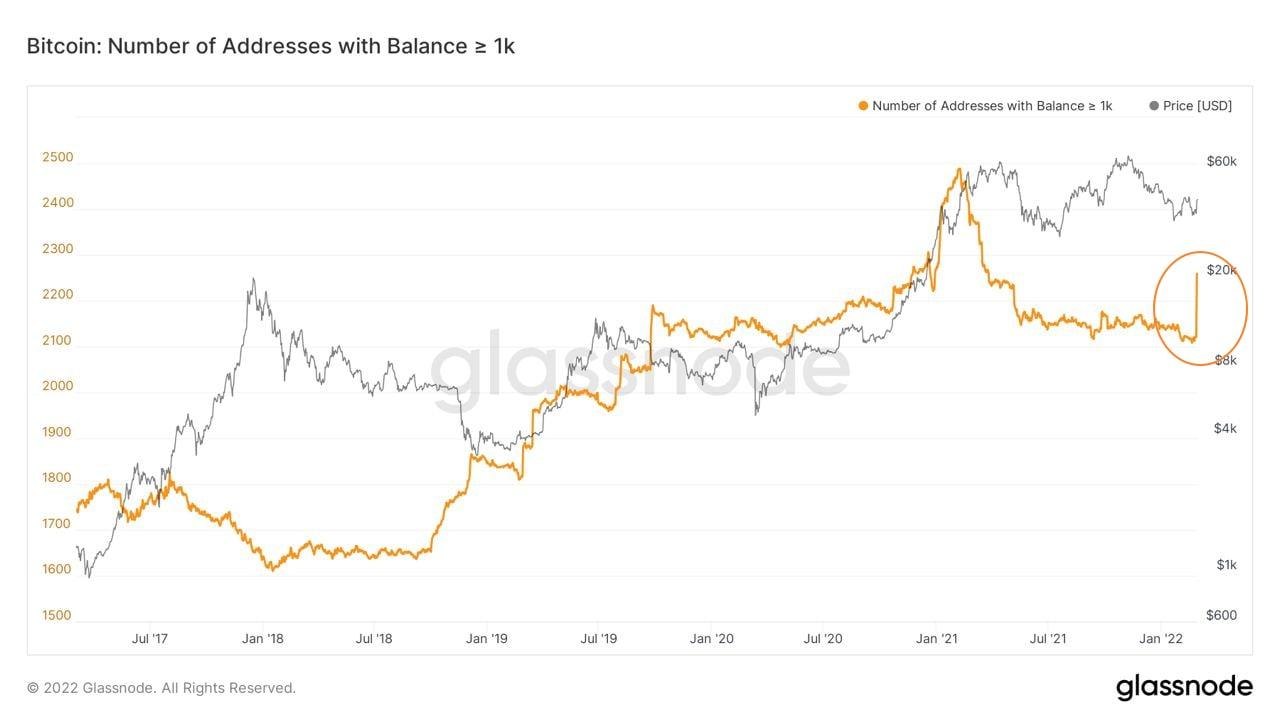

- BTC OnChain

Whales have significantly accumulated BTC over the past 7 weeks. Since Dec. 23, addresses with $1,000BTC or more have added a total of $220,000BTC to their wallets, representing the fastest accumulation since September 2019.

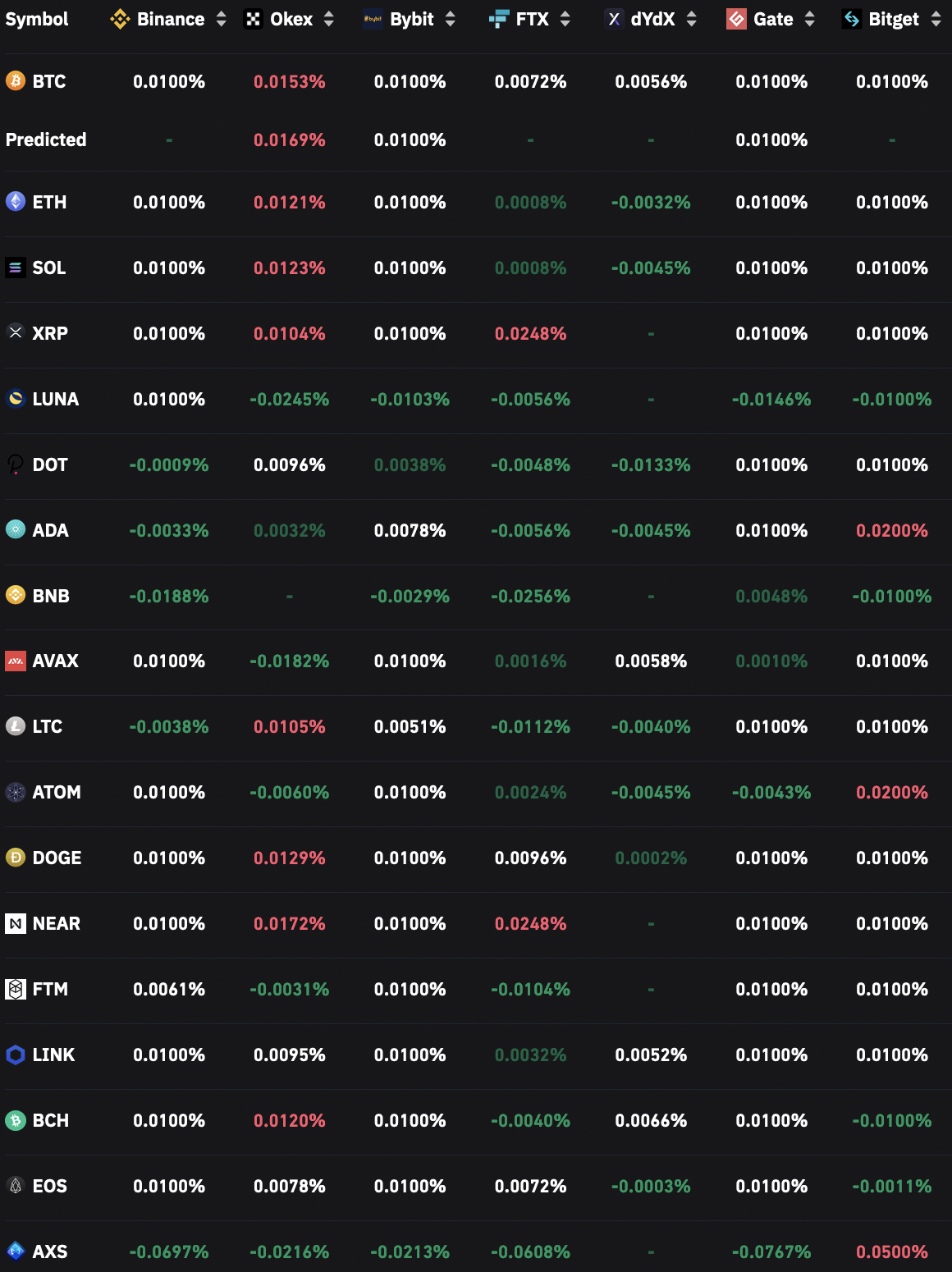

Funding Rates

Positive funding rates imply that speculators are bullish, and long-traders pay funds to short-traders.

Negative funding rates mean that speculators are bearish, and short-traders pay funds to long-traders.

P.S. Funding rates (0.01%) - black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) - red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

Off chain data