Project Events

dYdX

On November 27 at 05:21 UTC, the dYdX team was alerted to a security issue in a newly deployed smart contract. Deposits were suspended, but the protocol soon returned to working order and user funds remained safe.

SNX

SNX shared details of an upcoming update with perpetual futures that could open up new economic opportunities for users.

Bancor

Bancor has unveiled version 3 of the BancorDAO protocol, which reduces costs for traders and stakeholders and makes it easier for users to earn money on their favorite tokens. Key Features:

- Omnipool allows you to make all transactions online in a single transaction;

- Infinite pools allow unlimited deposits, providing ultra-fluid liquidity that can be simultaneously used for market-making and other revenue-generating strategies;

- The protocol offers instant protection against intermittent losses, instead of users having to wait 100 days for full IL protection;

- Liquidity mining rewards no longer require gas-intensive manual re-mining; rewards are now automatically replenished;

- Bilateral rewards allow third-party token projects to offer IL-free rewards on their pools;

- Revised tokenomics allows for a more cost-effective IL defense system and increases deflationary pressures on BNT;

- Support for multiple chains and L2, and more.

Fei

Fei (rebranded as Tribe) and Rari made the first-ever DAO merger.

Grayscale

Grayscale launched a new trust dedicated to Solana.

StarkWare

StarkWare, the team that pioneered zero-disclosure rollups in 2018, has launched the alpha version of StarkNet's core network, the long-awaited Level 2 Zero Disclosure (ZK) rollup network.

The launch of the alpha version was announced on November 29, while the release initially supports general computing and compositing.

Astroport

Astroport (one of the main DEX protocols on Terra) announced the upcoming launch of a sale period, which will start on December 6.

Highlights of the week

.png)

.png)

.png)

.png)

.png)

.png)

.png)

Events for the coming week

.png)

.png)

.png)

Funding

- Harmony Launcher closed a $1.7mn seed round;

- Tab Trader, a digital asset trading platform, closed a $5.8 million Series A round;

- New privacy (ZK) chain Iron Fish closed a $27 million Series A round;

- Custodial and trustless bank MeanFi closed a $3.5M seed round;

- Play Ventures creates blockchain gaming fund with $75 million;

- Borderless Capital is launching a $500 million fund that will invest in "digital assets powering the next generation of decentralized applications" based on the Algorand blockchain network;

- Colonylab, Avalanche Ecosystem Accelerator raised $18.5 million in a seed round.

Metrics

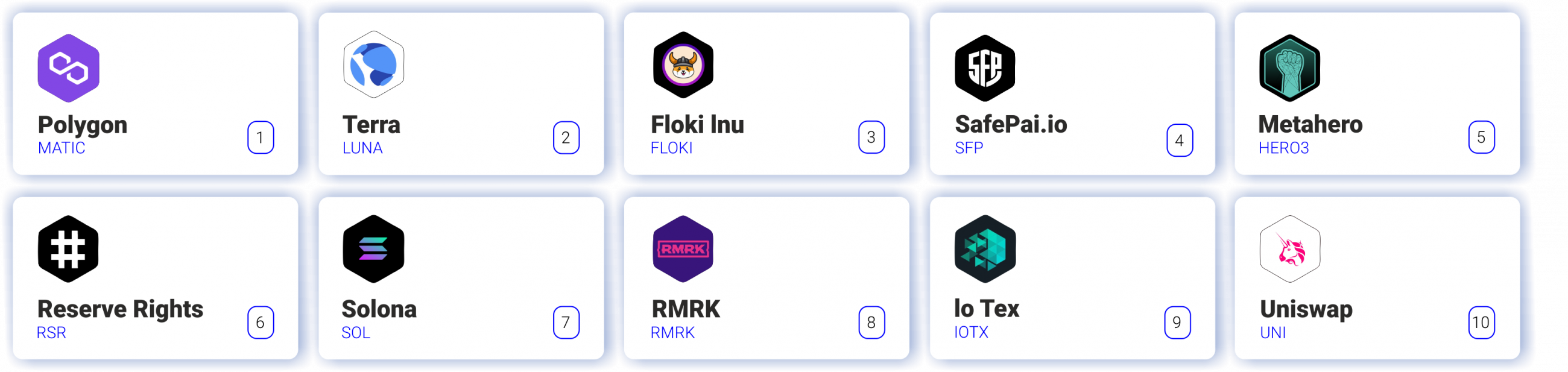

10 effective coins of the week

The valuation combines altcoin's price performance relative to bitcoin and social performance.

Grayscale fund portfolio dynamics

.png)

Bitcoin metrics

- Stock to flow

This model views bitcoin as a commodity comparable to commodities such as gold, silver or platinum. These commodities are known as "store-of-value commodities", as they retain their value over time due to their relative scarcity.

For commodities of value, such as gold, platinum, or silver, a high ratio indicates that they are not primarily consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

.png)

How to look at the chart?

In the chart above, the price is superimposed over the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we can predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event (sometimes called "halving"). This is an event in which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

- BTC Exchanges Reserves

Bitcoin reserves on exchanges continue to decline. Often this signal indicates a possible correction.

.png)

.png)

Funding Rates

Positive funding rates mean speculators are bullish and long traders are paying funds to short traders.

Negative funding rates imply that speculators are bearish and short traders pay funds to long traders.

.png)

PS: Funding rates (0.01%) are black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) are red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

Off chain data

.png)