Project Events

Arbitrum Odyssey

The Arbitrum Odyssey event caused a huge stir among users, so the network was paused. Developers promise to bring back to work with the implementation of the scale-up solution called Nitro, but no exact timeframe was announced yet.

Compound

Compound, one of the earliest and oldest credit protocols, is planning to become a multi-chain protocol, and is introducing a number of upgrades that will make it more secure and attractive to investors.

Polygon

Polygon deploys custom blockchain scaling solution 'Avail'

The scaling solution allows developers to launch application-specific blockchains on the Polygon network.

Ronin

Ronin Bridge, which has been recently hacked, has undergone 3 audits and announces its relaunch.

All user funds are fully backed 1:1 by the new bridge. All users have been compensated for the previous hack.

MakerDAO

MakerDAO is voting to allocate $500 million DAI to investments in low-risk U.S. Treasury bills and bonds. This move demonstrates the solidity of the community's approach to risk management of the protocol.

TON

TON mining is over. From now on, new toncoins will only enter circulation by PoS. The price of the coin has surged on this news.

DAO

According to data in the Chainalysis report: Less than 1% of all holders have 90% voting power in DAO, indicating a clear centralization in the governance of many protocols.

Coinbase

Coinbase adds support for the Polygon and Solana networks.

EulerDAO

EulerDAO was announced by Euler Finance as part of the process of creating governance and decentralization.

Gucci

Gucci invests $25K in DAO of NFT marketplace SuperRare to launch digital art vault.

The high-end luxury fashion house has purchased tokens to launch a digital "art vault".

The Sandbox

The Sandbox announced the deployment of LAND to Polygon.

Double Protocol

The new EIP-4907 token standard launched by Double Protocol for the NFT rental marketplace has passed the final Ethereum developer review to become the 30th ERC standard.

Highlights of the week

Events for the coming week

Funding

-

SithSwap announced a $2.65M seed funding round to build the next generation of AMMs on StarkNet.

-

Peaq raises $6M in funding round led by Fundamental Labs.

-

The Web3 network aims to help users create, manage, own and earn from decentralized apps.

- FTX Token DAO raises $7M from community of Sam Bankman-Fried fans.

The money is destined for a fund that will contribute to community-led projects in DeFi and crypto education.

- Kaiko announces that it has raised $53M in Series B funding. This round was led by Eight Roads, with participation from Revaia and existing investors Alven, Point9, Anthemis, and Underscore. The funding will further strengthen Kaiko's position as the global industry benchmark for centralized and decentralized digital asset data services.

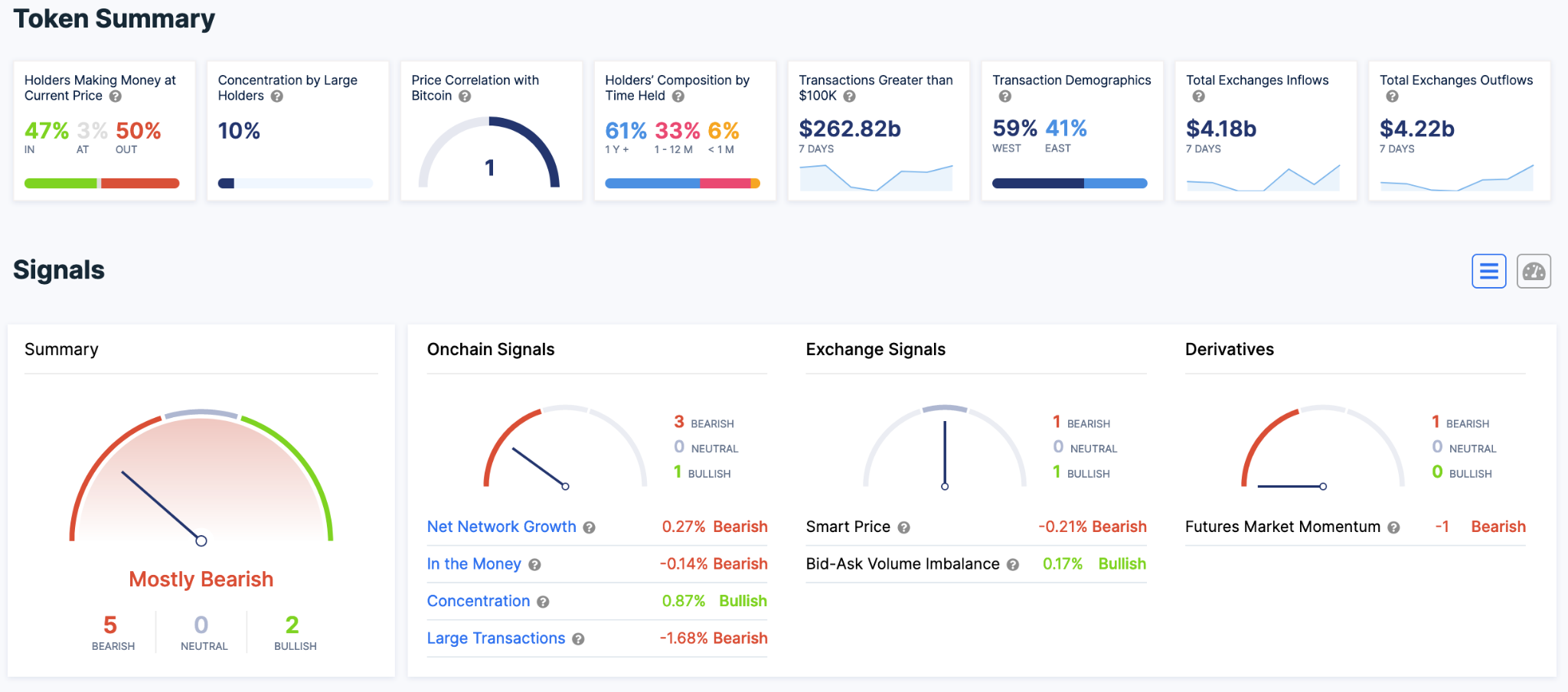

Metrics

10 effective coins of the week

Assessment combines altcoin price performance relative to bitcoin and social performance.

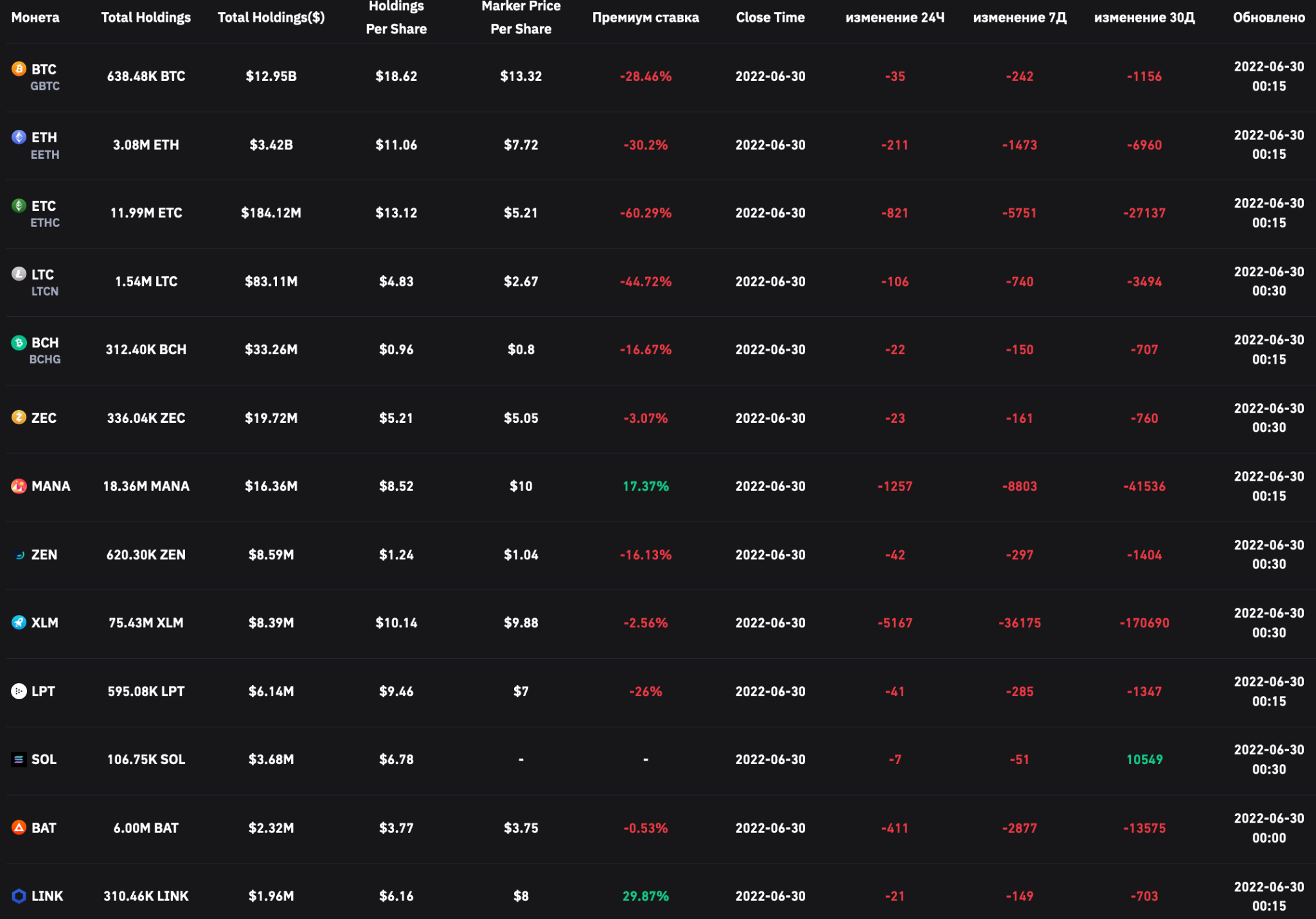

Grayscale fund portfolio dynamics

Bitcoin metrics

- Stock to flow

This model views Bitcoin as a commodity comparable to those like gold, silver, or platinum. These commodities are known as "stored value commodities" because they retain their value over time due to their relative scarcity.

For commodities of value, such as gold, platinum, or silver, a high ratio indicates that they are not primarily consumed for industrial purposes. Instead, much of it is held as a cash hedge, resulting in a higher stock-to-flow ratio.

A higher ratio indicates that the commodity is becoming increasingly scarce and therefore more valuable as a store of value.

How to look at the chart?

In the above chart, the price is overlaid on top of the stock-to-flow ratio line. We can see that the price continues to follow bitcoin's stock-to-flow ratio over time. Thus, the theory suggests that we are able to predict where the price might go by observing the projected stock-to-flow ratio line, which can be calculated because we know the approximate timeline for bitcoin production in the future.

The colored dots on the price line of this chart show the number of days until the next bitcoin halving event. It's an event during which the reward for mining new blocks is halved, meaning miners get 50% less bitcoins for checking transactions.

- BTC OnChain

Despite the panic, the number of Bitcoin addresses with a balance of more than 0.01 BTC has reached 10 million.

Funding Rates

Positive funding rates imply that speculators are bullish, and long-traders pay funds to short-traders.

Negative funding rates mean that speculators are bearish, and short-traders pay funds to long-traders.

P.S. Funding rates (0.01%) - black, this is a neutral situation. Funding rates (below 0.01%) - green, this is a bullish situation. Funding rates (above 0.01%) - red, it is a bearish situation. The stronger the bearish or bullish sentiment, the darker the color.

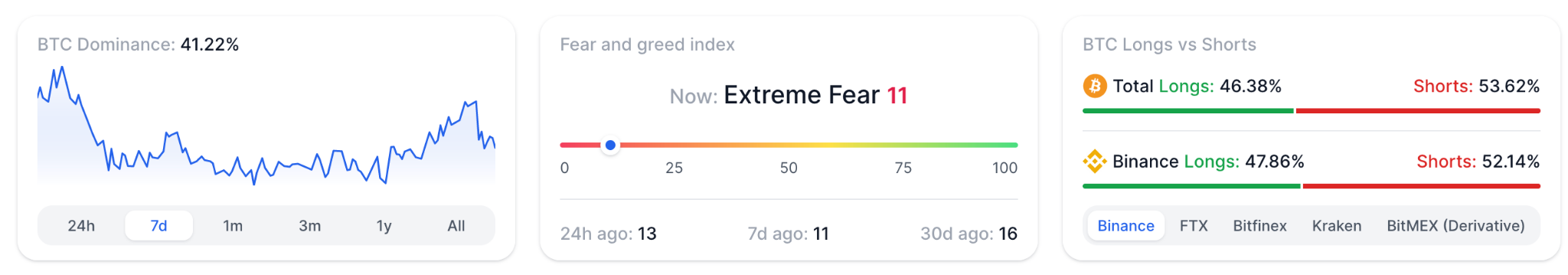

Off chain data